Analysis for March 22nd, 2016

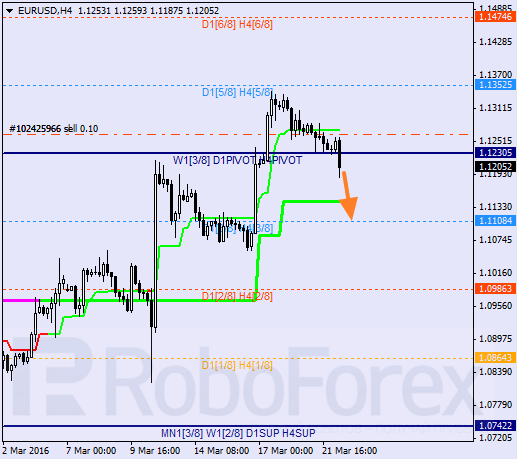

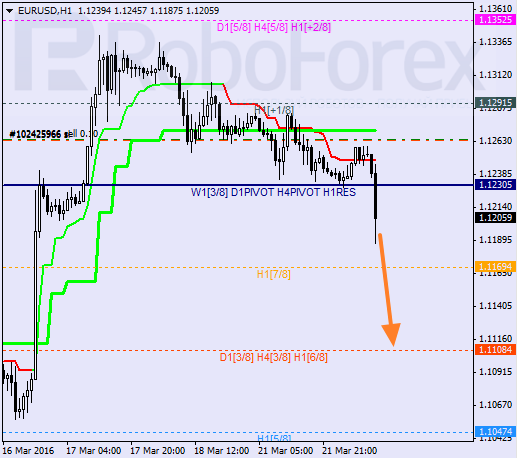

EURUSD, “Euro vs US Dollar”

Eurodollar has broken the 4/8 level and right now is trying to stay under it. Earlier, the price was able to stay below the H4 Super Trend. It's highly likely that on Tuesday the pair will continue its decline towards the 2/8 level.

At the H1 chart, Eurodollar has broken the 8/8 level and left “overbought zone”. Earlier, Super Trends formed “bearish cross”. It’s highly likely that in the nearest future the market will continue falling towards the 6/8 level.

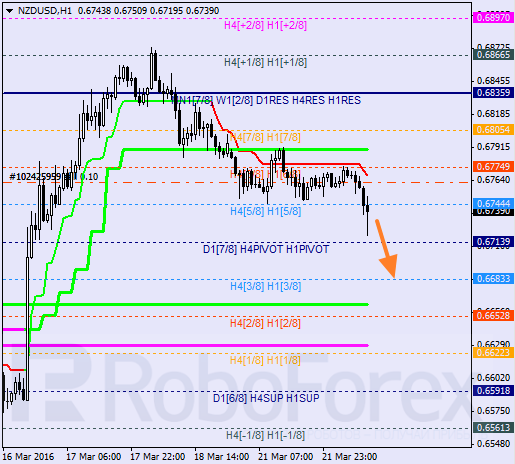

NZDUSD, “New Zealand Dollar vs US Dollar”

New Zealand Dollar hasn’t been able to stay above the 8/8 level; right now, the price is moving under the H4 Super Trend and trying to stay below the 5/8 level. It’s highly likely that in the nearest future the market may move towards the daily Super Trend. If the pair beaks it, bears will return to the market.

At the H1 chart, the price is moving in the middle. Earlier, Super Trends formed “bearish cross”. It’s highly likely that on Tuesday the pair may break the 4/8 level and continue falling towards the 3/8 one.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 during the early Monday. The softer US Dollar provides some support to the major pair. Traders await the HCOB Purchasing Managers’ Index (PMI) data from Germany and the Eurozone, along with the Eurozone PPI.

GBP/USD rises to near 1.2550 due to dovish sentiment surrounding Fed

GBP/USD continues its winning streak for the fourth consecutive day, trading around 1.2550 during the Asian trading hours on Monday. The appreciation of the pair could be attributed to the recalibrated expectations for the Fed's interest rate cuts in 2024 following the release of lower-than-expected US jobs data.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.