Analysis for October 7th, 2015

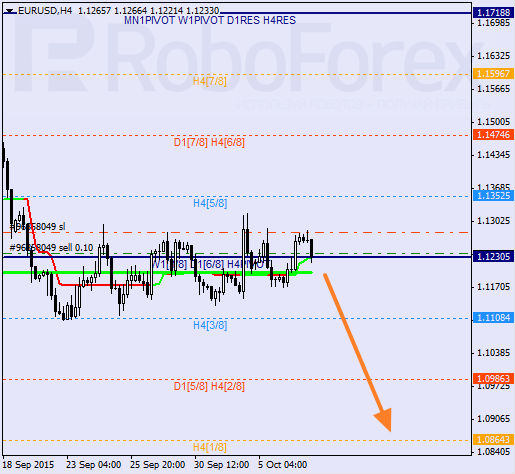

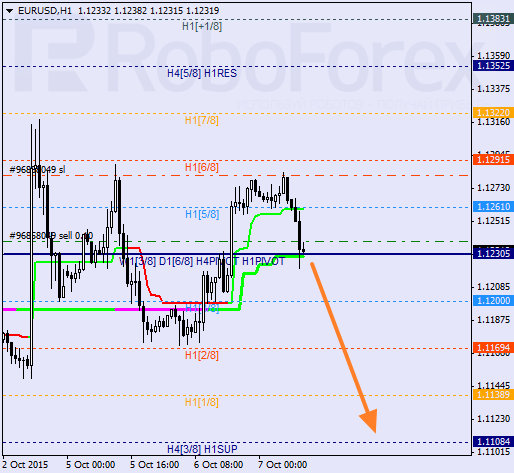

EURUSD, “Euro vs US Dollar”

Eurodollar is still consolidating. As soon as the price is able to stay under Super Trends, it will resume moving downwards. If later the pair breaks the 3/8 level and stays below it, the market will continue moving downwards to reach the 1/8 level or even the 0/8 one.

At the H1 chart, the pair also is moving in the middle. Possibly, Super Trends may form “bearish cross” during the day. I’m planning to open another sell order after the price breaks the 3/8 level and stays below it.

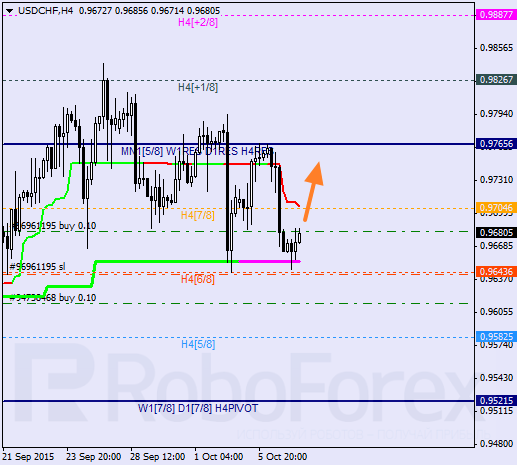

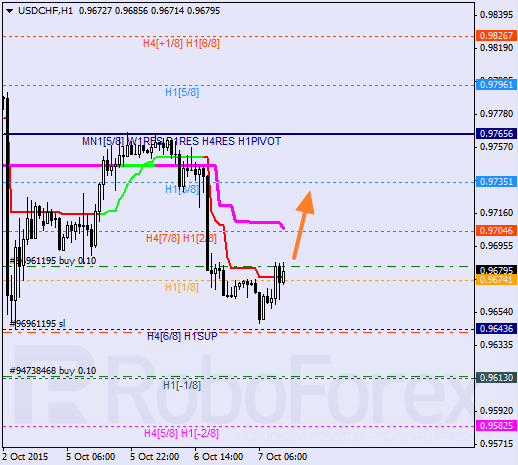

USDCHF, “US Dollar vs Swiss Franc”

Franc has rebounded from the daily Super Trend twice. In addition to that, the price has been supported by the 6/8 level, which means that it may resume moving upwards. I’m planning to increase my position after the price stays above Super Trends.

At the H1 chart, the pair is trying to rebound from the 0/8 level. If Super Trends form “bullish cross” in the nearest future, the market may resume growing. It’s highly likely, that the price may try to breaks the 4/8 level.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.