Analysis for June 23rd, 2015

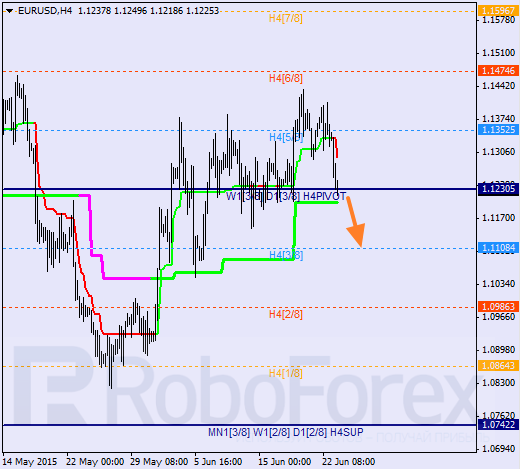

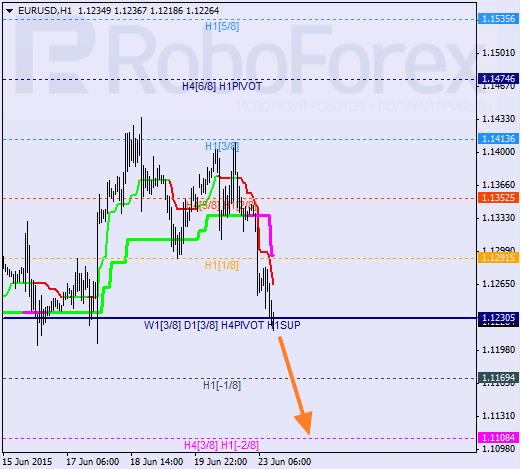

EUR USD, “Euro vs US Dollar”

At the H4 chart, Eurodollar is moving in the middle again. Probably, in the nearest future the price may test the 3/8 level. If the market breaks this level and stays below it, the pair may continue falling towards the 0/8 one.

As we can see at the H1 chart, the price is trying to stay below the 0/8 level. Earlier Super Trends formed “bearish cross”. if later the pair breaks the -2/8 level, the lines at the chart will be redrawn.

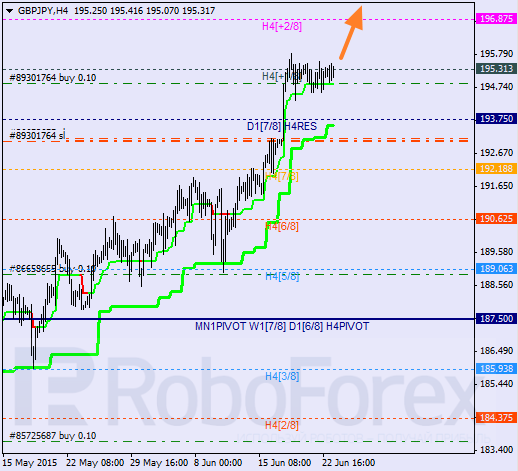

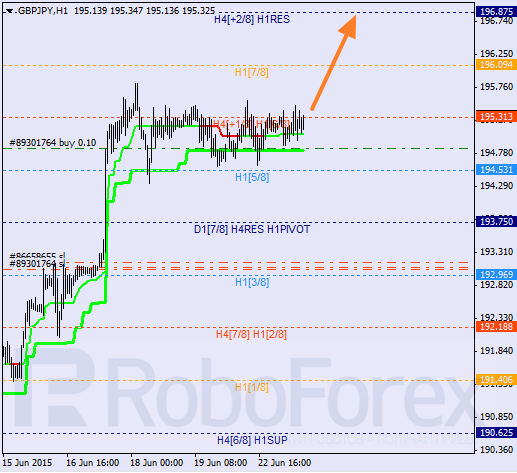

GBP JPY, “Great Britain Pound vs Japanese Yen”

The pair is consolidating inside “overbought zone”; bulls are supported by the H4 Super Trend. If later the pair breaks the +2/8 level, the lines at the chart will be redrawn.

At the H1 chart, the pair is being corrected between the 6/8 and 5/8 levels. Super Trends provide support. The closest target for bulls is at the 8/8 level. After reaching it, the market may start a bearish pullback.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.