Analysis for May 5th, 2015

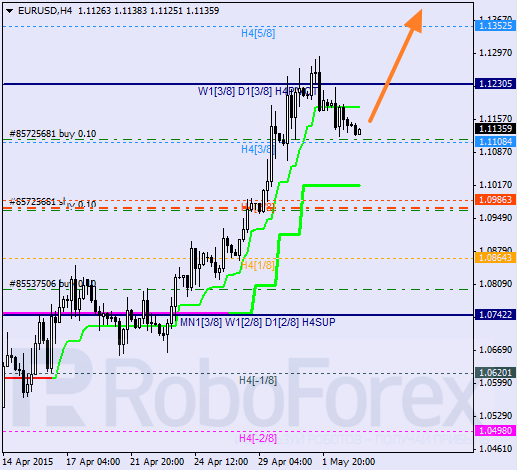

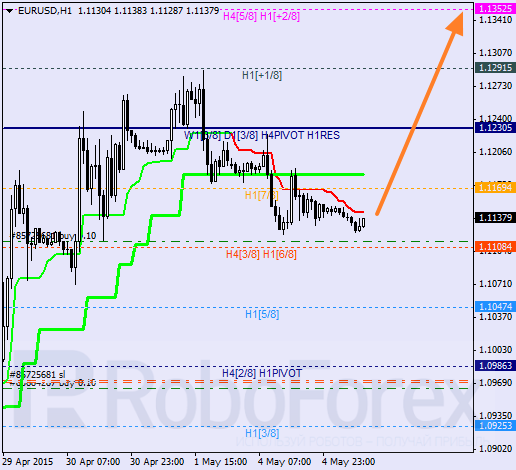

EURUSD, “Euro vs US Dollar”

Eurodollar is still being corrected between Super Trends. If the pair rebounds from the 3/8 level, the uptrend may continue. If later the price is able to stay above the 5/8 level, the next target for buyers will be at the 8/8 one.

As we can see at the H1 chart, the current correction resulted in “bearish cross” formed by Super Trends. However, the price is supported by the 6/8 level, which means that it may resume growing. I’m planning to increase my long position as soon as the market breaks the 8/8 level and stays above it.

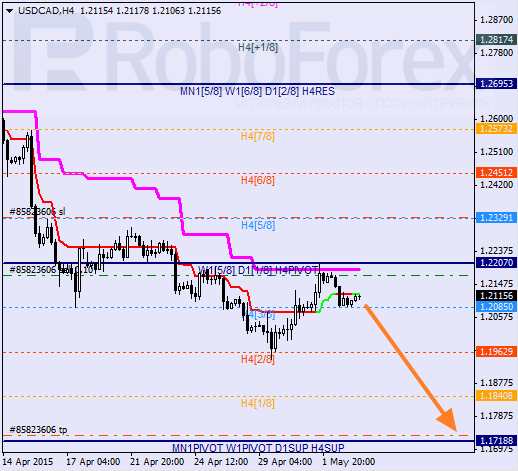

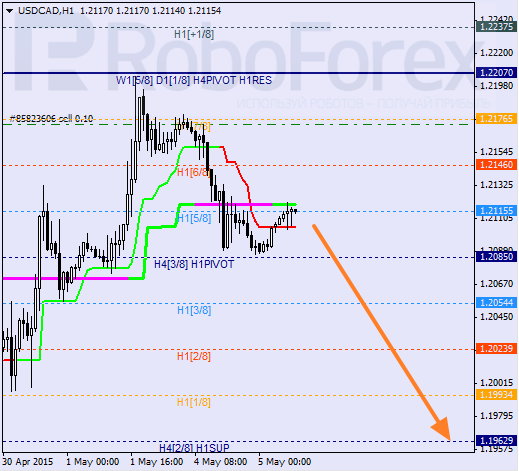

USDCAD, “US Dollar vs Canadian Dollar”

Canadian Dollar has rebounded from the daily Super Trend and the 4/8 level. If later the price is able to stay below the 3/8 level, the next target for bears will be at the 0/8 one. After reaching it, the market may start a larger correction.

As we can see at the H1 chart, the price has rebounded from the 8/8 level and Super Trends have formed “bullish cross”. Probably, the pair may break yesterday’s low during the day. If the market is able to stay below the 3/8 level, it may continue falling towards the 0/8 one, which is the closest target.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.