Analysis for March 4th, 2015

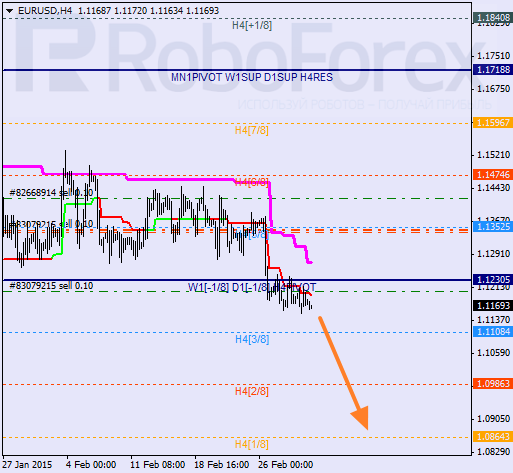

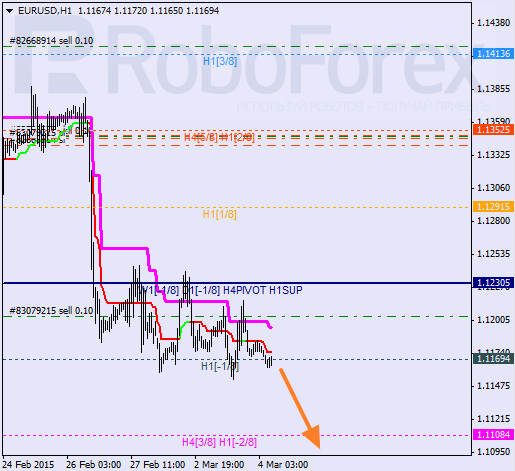

EURUSD, “Euro vs US Dollar”

Euro is moving near its local lows. The price has broken the 4/8 level and stayed below it, and if later bears are able to stay below the 3/8 level, the market may continue falling towards the 1/8 one.

As we can see at the H1 chart, after breaking the 0/8 level, the pair is moving inside “oversold zone”. Earlier during a local correction, I opened an additional sell order. In the future, the price may break the -2/8 level. In this case, the lines at the chart will be redrawn.

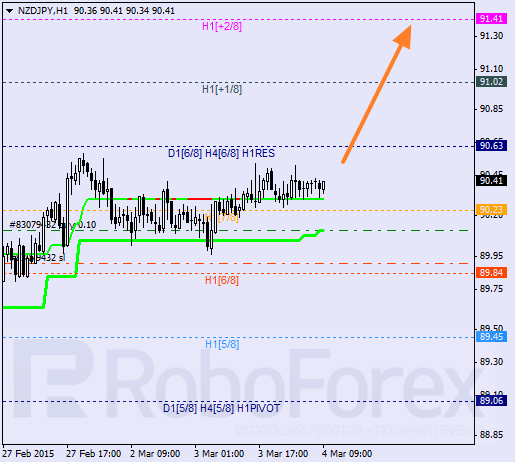

NZDJPY, “New Zealand Dollar vs Japanese Yen”

The pair has rebounded from the H4 Super Trend. Earlier, the price was able to stay above the 5/8 level and continued growing towards the 8/8 one. however, in order to decrease risks, I’ve placed the take profit at the 7/8 level. Possibly, the market may reach a new local high during the day.

As we can see at the H1 chart, after breaking the 7/8 level, the pair has been supported by the H1 Super Trend. Moreover, the price has rebounded from it several times, which means that it may start a new ascending movement to break the 8/8 level.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

Australian Dollar maintains ground amid subdued US Dollar, US Nonfarm Payrolls awaited

The Australian Dollar rises on hawkish sentiment surrounding the RBA prolonging higher interest rates. Australia’s central bank is expected to maintain its current rate at 4.35% until the end of September. US Nonfarm Payrolls is expected to print a reading of 243K for April, compared to 303K prior.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold bears take action on mixed signals from US economy

Gold price fell more than 2% for the second consecutive week, erased a small portion of its losses but finally came under renewed bearish pressure. The near-term technical outlook points to a loss of bullish momentum as the market focus shifts to Fedspeak.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.