Analysis for February 27th, 2015

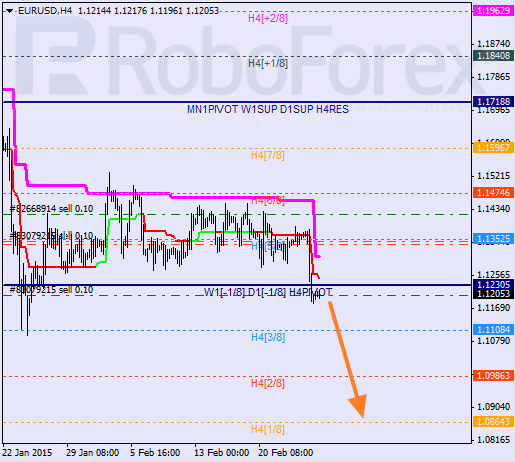

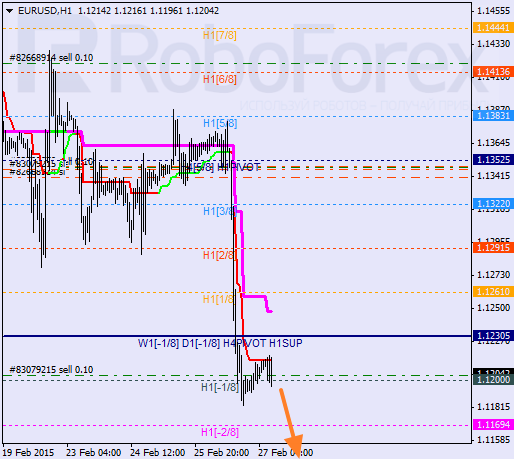

EUR USD, “Euro vs US Dollar”

Euro has left its month-long consolidation channel by making a fast descending movement. The price has broken the 4/8 level, and if later bears are able to stay below the 3/8 level, the market may continue falling towards the 1/8 one.

As we can see at the H1 chart, after breaking the 0/8 level, the pair is trying to stay inside “oversold zone”. During a local correction, I opened an additional sell order. In the future, the price may break the -2/8 level. In this case, the lines at the chart will be redrawn.

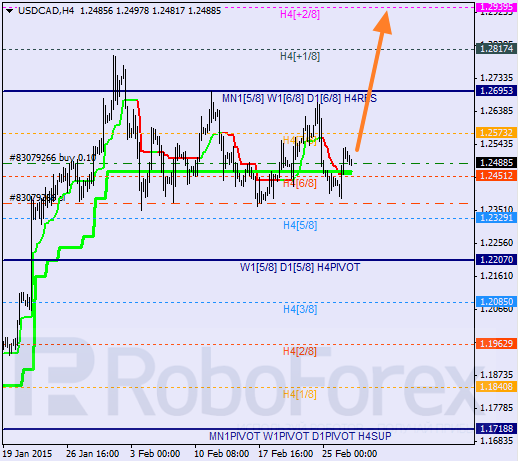

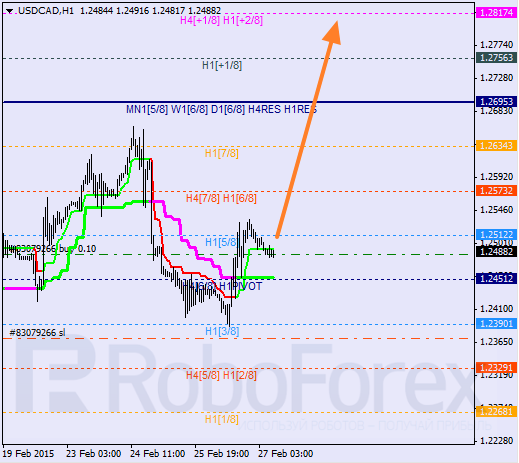

USD CAD, “US Dollar vs Canadian Dollar”

Canadian Dollar has rebounded from the 6/8 level several times, which means that the market may start another ascending movement. Probably, Super Trends may form “bullish cross” during the next several hours.

At the H1 chart, the price is moving in the middle. If the pair is able to stay above the 5/8 level during the day, it may continue growing towards the 8/8 one or even higher.

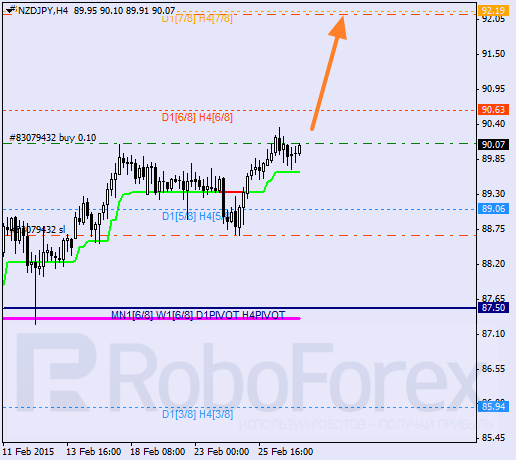

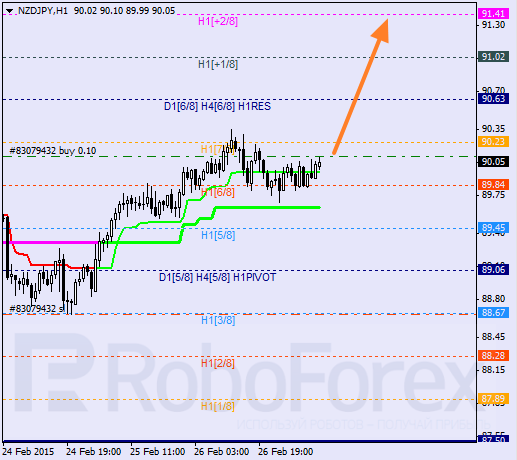

NZD JPY, “New Zealand Dollar vs Japanese Yen”

The pair s trying to rebounds from the H4 Super Trend. Earlier, the price was able to stay above the 5/8 level and continued growing towards the 8/8 one. Possibly, the market may reach a new local high during the day.

As we can see at the H1 chart, after rebounding from the 7/8 level, the pair was supported by the 6/8 level. Moreover, the price has rebounded from this level several times, which means that it may start a new ascending movement towards the 8/8 level.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.