Analysis for October 29th, 2014

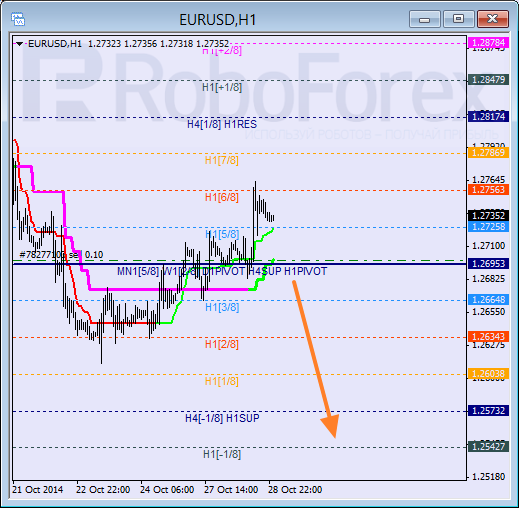

EURUSD, “Euro vs US Dollar”

Eurodollar is still consolidating. Despite an attempt of the price to stay above the 0/8 level, Super Trends are still influenced by “bearish cross”. I’m planning to increase my position as soon as the pair breaks the 0/8 level downwards.

At the H1 chart, the current ascending correction has faced resistance from the 6/8 level. Considering that earlier the pair rebounded from the 2/8 level, there is a strong possibility that the market may resume falling.

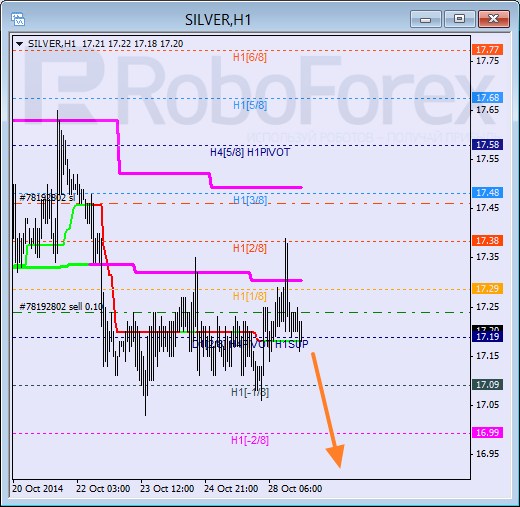

XAGUSD, “Silver vs US Dollar”

In case of Silver, the current descending movement is still supported by Super Trends. Right now, the market is moving in the middle of the chart, which may indicate, at least, a short-term decline towards the 3/8 level. If later the price breaks this level, the market may continue falling.

As we can see at the H1 chart, the market is making another attempt to stay below the 0/8 level; Super Trends are still influenced by “bearish cross”. Possibly, the price may break the -2/8 level quite soon. In this case, the lines at the chart will be redrawn.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Solana price dumps 21% on week as round three of FTX estate sale of SOL commences

Solana price is down almost 5% in the past 24 hours and over 20% in the last seven days. The dump comes as the broader crypto market contracts with Bitcoin price leading the pack as it slides below the $58,000 threshold to test the Bull Market Support Band Indicator.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.