Analysis for September 17th, 2014

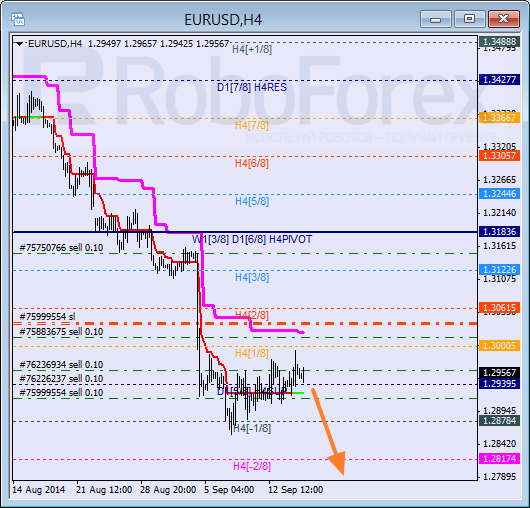

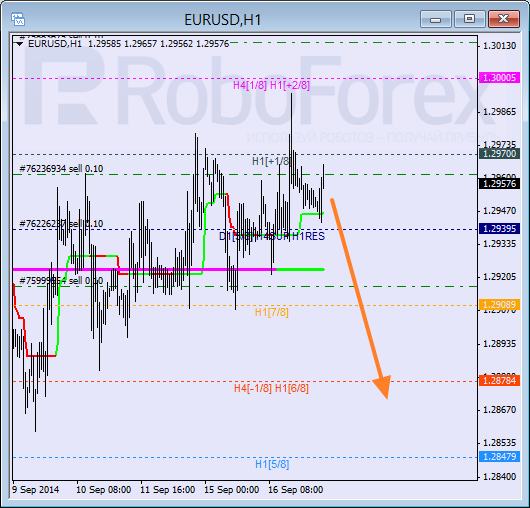

EUR USD, “Euro vs US Dollar”

Eurodollar is still consolidating. The price is trying to stay above the 0/8 level, which means that the current correction may continue. On the other hand, until the price breaks the 1/8 level, the main priority is continuation of a bearish trend.

At the H1 chart, the price is moving inside “overbought zone”. Considering that after making an unsuccessful attempt to break the +2/8 level, the price was able to stay below the +1/8 one, there is still a possibility that the downtrend may resume. I’m planning to increase my short position as soon as the market breaks Super Trends.

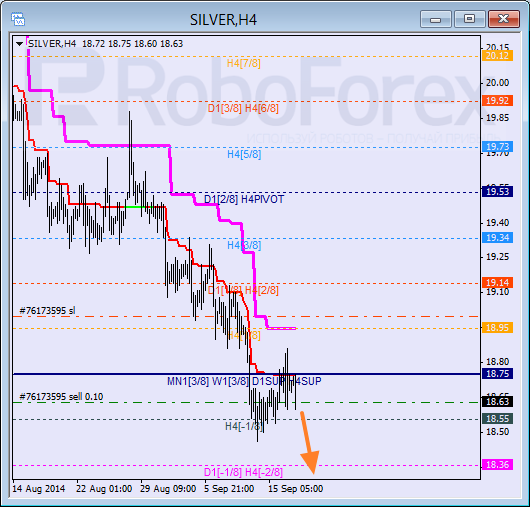

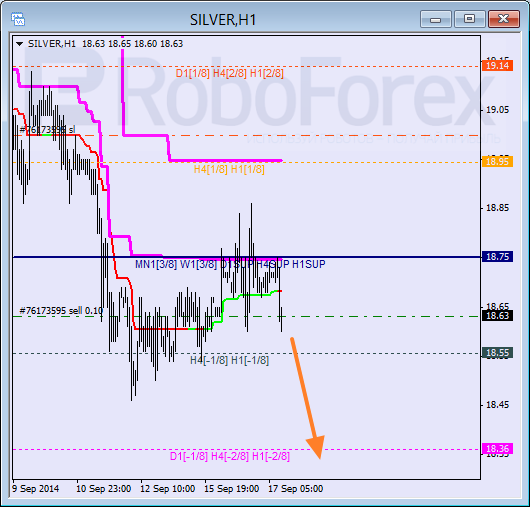

XAG USD, “Silver vs US Dollar”

After being supported by the 0/8 level and the H4 Super Trend, Silver is trying to start falling again. The first target for bears is at the -2/8 level. If later the market breaks it, the lines at the chart will be redrawn.

At the H1 chart, the price continues moving inside “oversold zone”; Super Trends are still influenced by “bearish cross”. I’m planning to move my stop to breakeven as soon as the price breaks the minimum.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

USD/JPY crashes toward 156.00, Japanese intervention in play?

Having briefly recaptured 160.00, USD/JPY came under intense selling and sank toward 156.00 on what seems like a Japanese FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD rallies toward 0.6600 on risk flows, hawkish RBA expectations

AUD/USD extends gains toward 0.6600 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.