Analysis for July 22nd, 2014

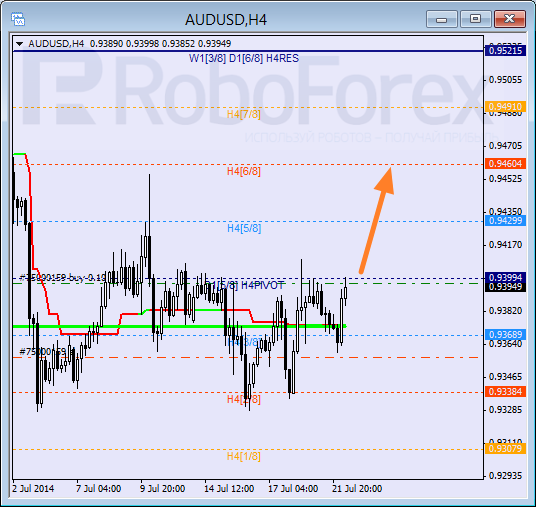

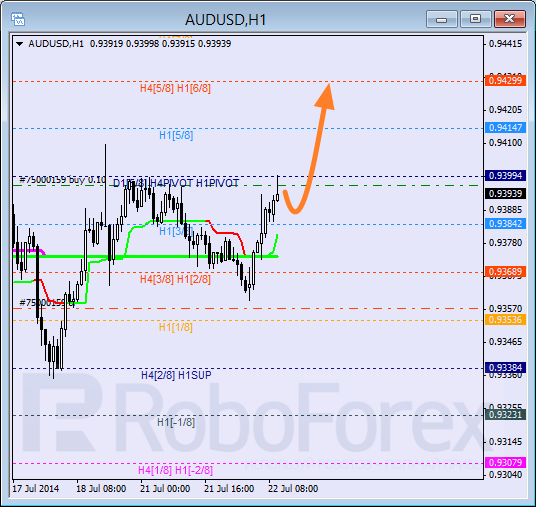

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is moving above Super Trends, therefore, there is no point in keeping my sell order. O closed it and opened new buy order with stop loss placed at local low. Closest target is at the 6/8 level, but if it is broken, next target will be at the 8/8 one.

Pair is moving in the middle of H1 chart; after consolidating, Super Trends started moving upwards. Possibly, price may reach new high during the day.

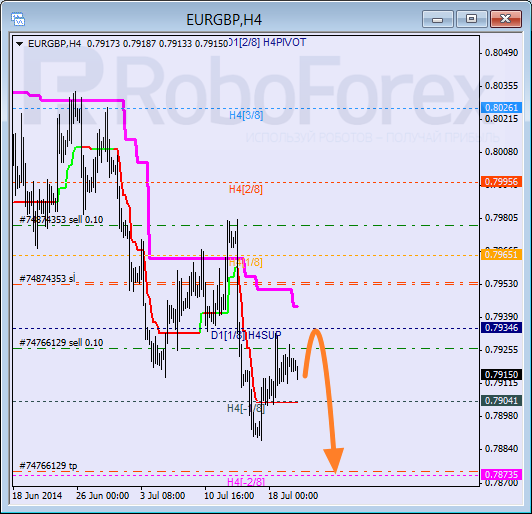

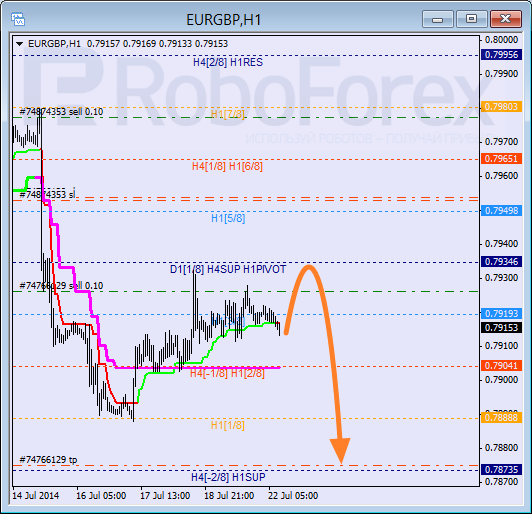

EUR GBP, “Euro vs Great Britain Pound”

Pair is still moving inside “oversold zone”. Probably, during the day price may test the 0/8 level. If price rebounds from it, target will be at the -2/8 level, where I placed take profit on my sell orders.

At H1 chart, price is about to test the 4/8 level. If it rebounds from this level and stays below Super Trends, I’m planning to increase my short position with target at the 0/8 level, which may be reach during the next several days.

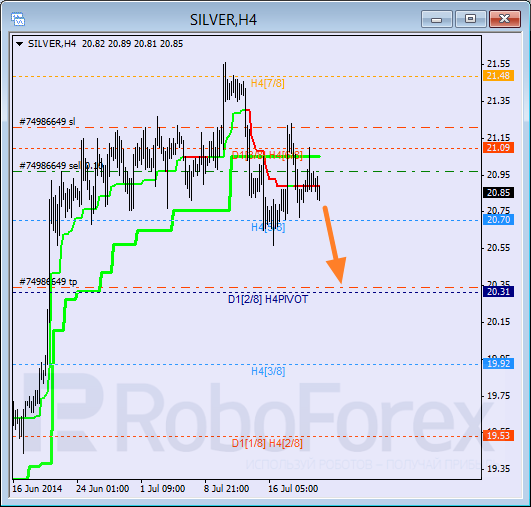

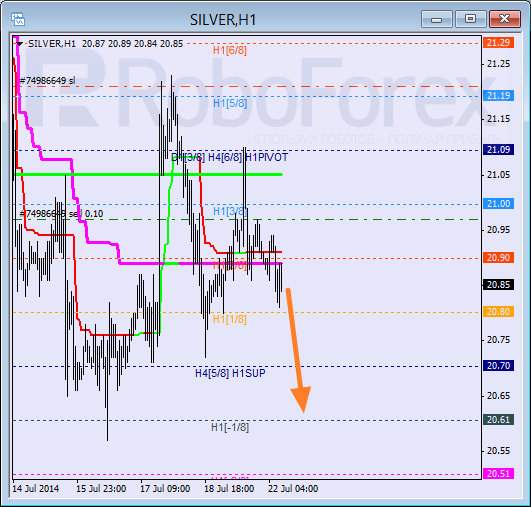

XAG USD, “Silver vs US Dollar”

Yesterday, sellers successfully tested Super Trends, which earlier formed “bearish cross”. I’m keeping one sell order, closest target is at the 4/8 level. If this level is broken later, market will continue falling down.

As we can see at H1 chart, bears are supported by the 4/8 level and daily Super Trend. Possibly, during the day sellers may try to break the 0/8 level and enter “oversold zone”.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.