Analysis for July 17th, 2014

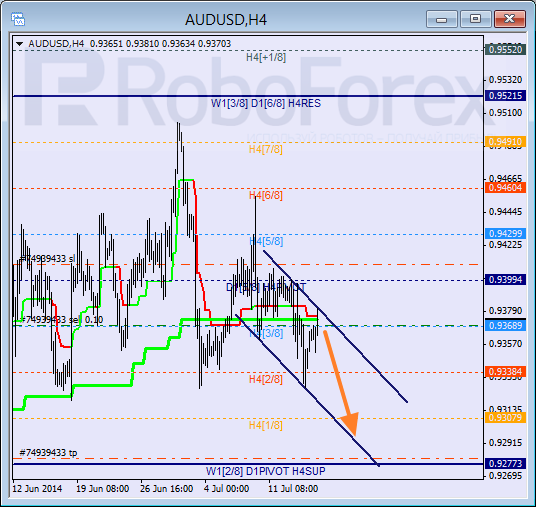

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar correction has been stopped by Super Trends. Moreover, price is moving in the descending channel, trying to rebound from its upper border. I have only one sell order, however, when Super Trends will form “bearish cross” I am planning to add more.

Price’s first attempt to break the 0/8 level failed and it started new correction. If bears break the 2/8 level, price may start descending movement to the “oversold zone”.

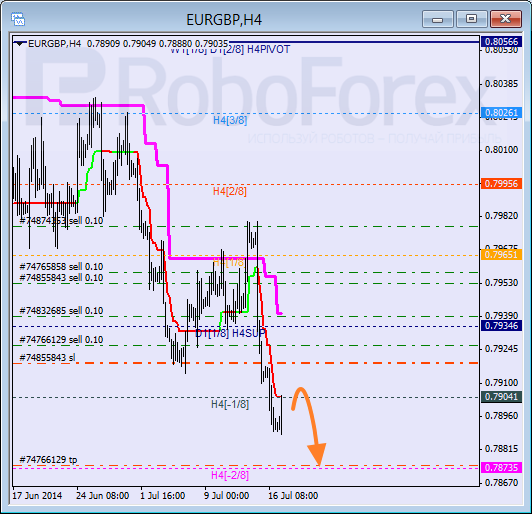

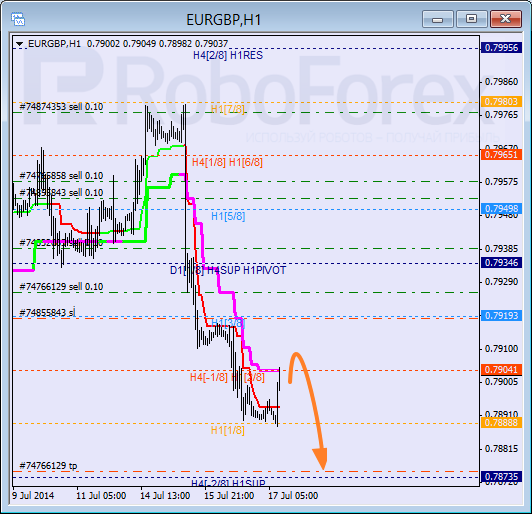

EUR GBP, “Euro vs Great Britain Pound”

Price is still being corrected inside “oversold zone”. If price rebounds from the -1/8 level, then the breakout of the -2/8 level may be within several hours. Probably, by the end of the trading week the lines in the chart will be redrawn.

Price’s first attempt to break the 1/8 level failed. Price is moving below Super Trends. Stop losses are at the local maximum, if price rebounds from daily Super Trend, price may reach the 0/8 level very soon.

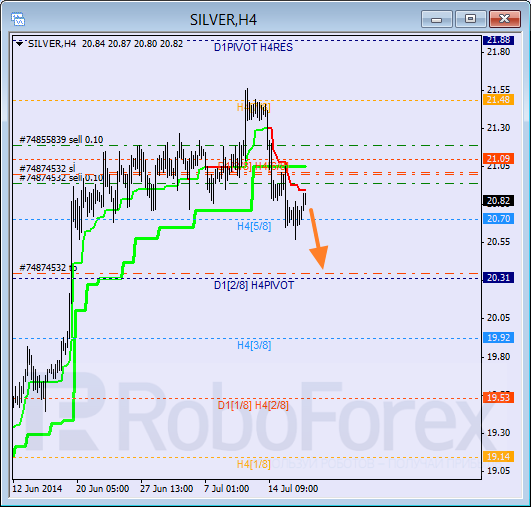

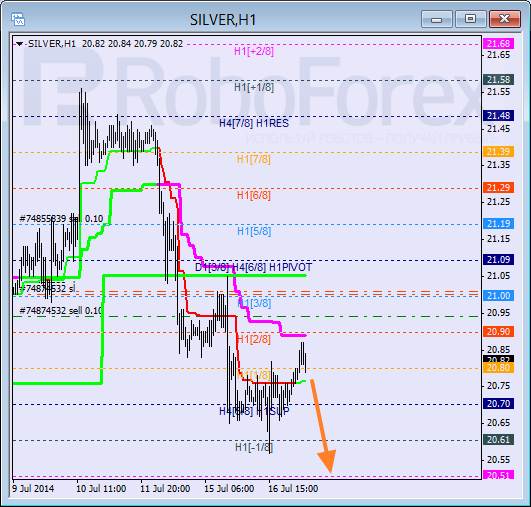

XAG USD, “Silver vs US Dollar”

Silver is being corrected below Super Trends that have formed “bearish cross”. In the nearest future, if bears break the 4/8 level, price may start descending movement.

Bear’s first attempt to break the -1/8 level failed. If during the day price rebounds from the 2/8 level and Super Trend, I will increase my short position with the view to the breakout of the -2/8 level and chart lines redrawing.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 during the early Monday. The softer US Dollar provides some support to the major pair. Traders await the HCOB Purchasing Managers’ Index (PMI) data from Germany and the Eurozone, along with the Eurozone PPI.

GBP/USD rises to near 1.2550 due to dovish sentiment surrounding Fed

GBP/USD continues its winning streak for the fourth consecutive day, trading around 1.2550 during the Asian trading hours on Monday. The appreciation of the pair could be attributed to the recalibrated expectations for the Fed's interest rate cuts in 2024 following the release of lower-than-expected US jobs data.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.