Analysis for April 3rd, 2014

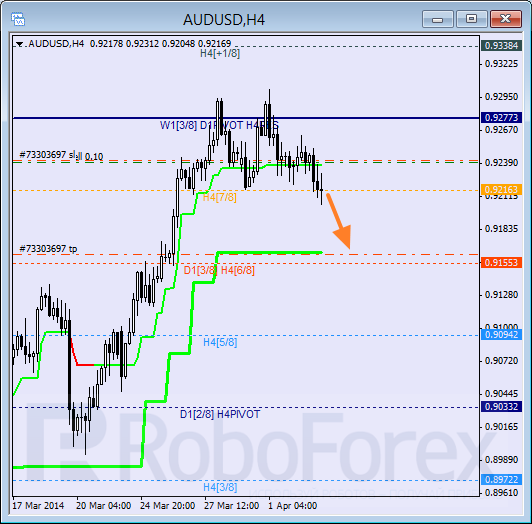

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar rebounded from the 8/8 level twice. Later, price was able to stay below H4 Super Trend and I decided to move the stop on my sell order into the black. In the near term, market is expected to fall down towards the 6/8 level and daily Super Trend.

At H1 chart, Super Trends formed “bearish cross”. If price is able to stay below the 6/8 level, market will continue falling down towards the 4/8 one. If bears break this level as well, pair will move much lower.

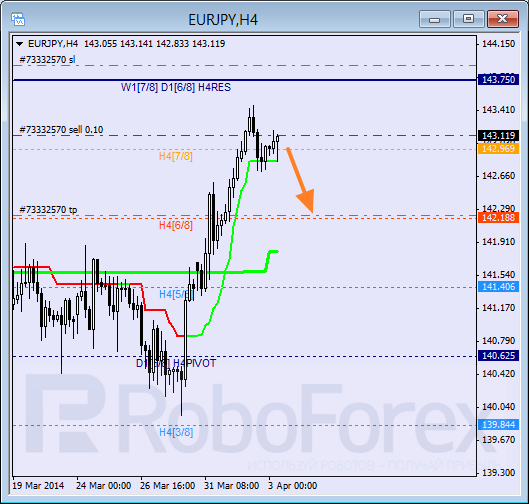

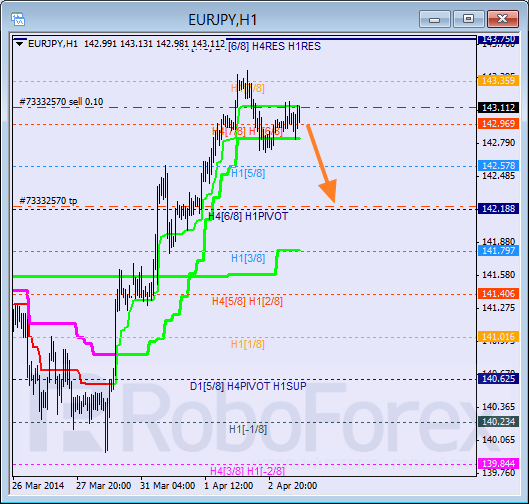

EUR JPY, “Euro vs Japanese Yen”

Fast ascending movement was stopped at the 7/8 level. Possibly, pair is starting new correction, that’s why I closed my buy order and opened a sell one. Closest target for bears is at the 6/8 level: if pair rebounds from it, market may start new ascending movement.

At H1 chart, price rebounded from the 7/8 level and right now is moving between Super Trends, which are still inside “green zone”. Possibly, pair may reach the 4/8 level until the end of this week.

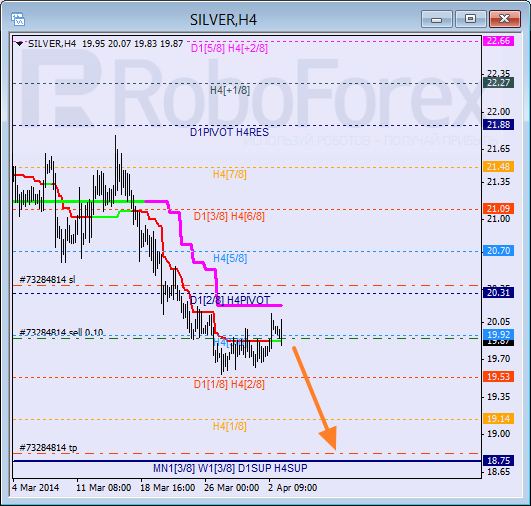

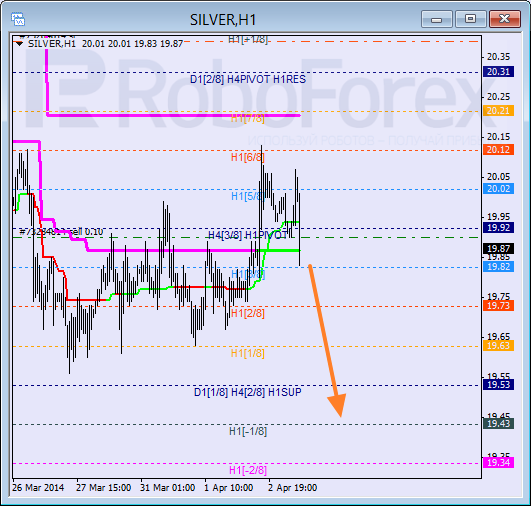

XAG USD, “Silver vs US Dollar”

Silver is still consolidating; bears are trying to keep price below the 3/8 level. If they succeed, market will continue falling down towards the 0/8 level.

At H1 chart we can see, that despite “bearish cross” formed by Super Trends, Silver is already moving below them. In the near term, price may break the 0/8 level. Later instrument is expected to break the ‑2/8 level. In this case, lines at the chart will be redrawn.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.