NFP Does Enough:

Although Friday’s Nonfaarm Payrolls number missed expectations, it wasn’t enough to put a dampener on expectations of an interest rate hike from the Federal Reserve as early as September.

“USD Non-Farm Employment Change (215K v 222K expected)”

With the Unemployment Rate also holding at the lowest level in 7 years, optimism was quickly restored after the initial negative reaction caused by traders and algos reacting to the headline number.

“USD Unemployment Rate 5.3% v 5.3% expected)”

With the costs of borrowing money to potentially invest in stocks looking like going up, Wall Street initially sold off the SP500, causing it to close at its lowest level in a month.

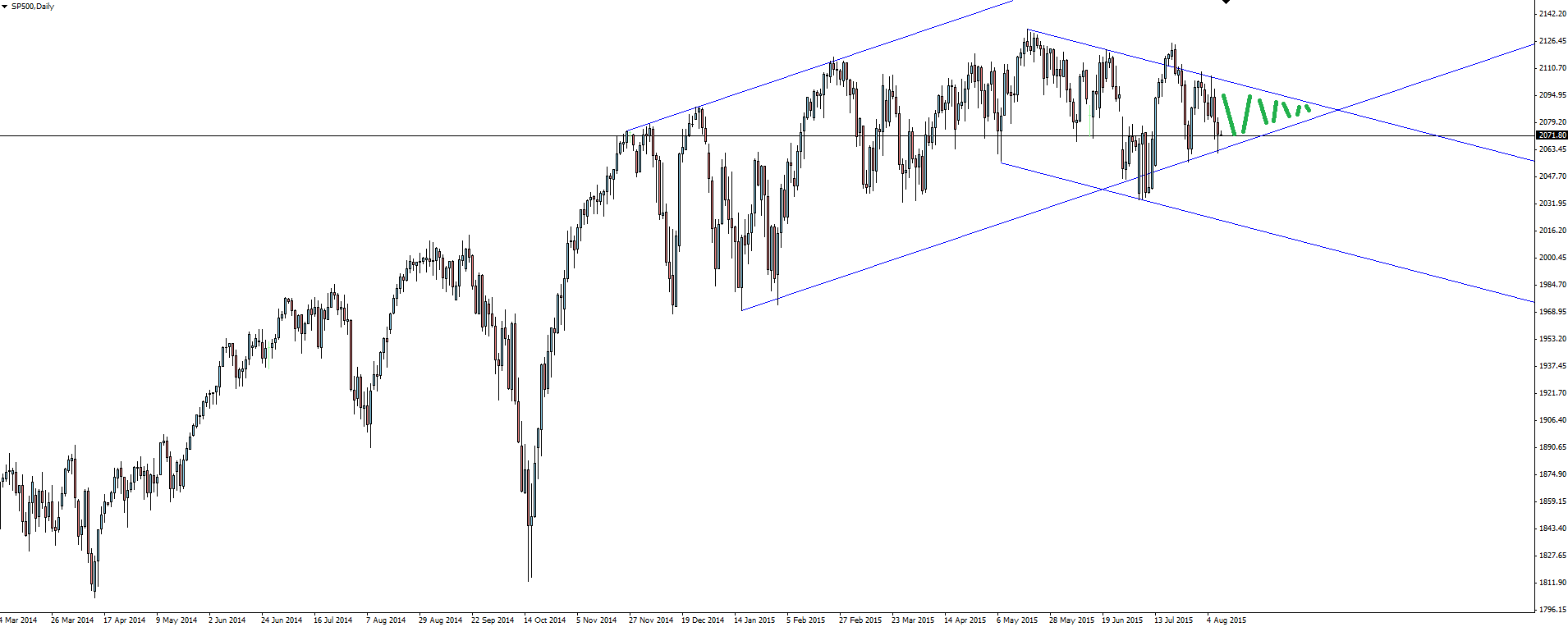

SP500 Daily:

Click on chart to see a larger view.

I wouldn’t get too carried away with this move just yet because as you can see from the chart above, price is still heavily range bound, trapped by a flag pattern inside a longer term bullish channel.

Stock market bulls aren’t finished with just yet!

Chinese Woes:

“CNY Trade Balance (43.0B v 53.4B expected)”

“CNY CPI y/y (1.6% v 1.5% expected)”

The weekend saw Chinese Trade data suffer on the back of a fall in exports. With Chinese economic growth still a major sticking point in terms of confidence in Commodity Currencies such as the Aussie Dollar, this number will do nothing to change that perception as we head into a new week.

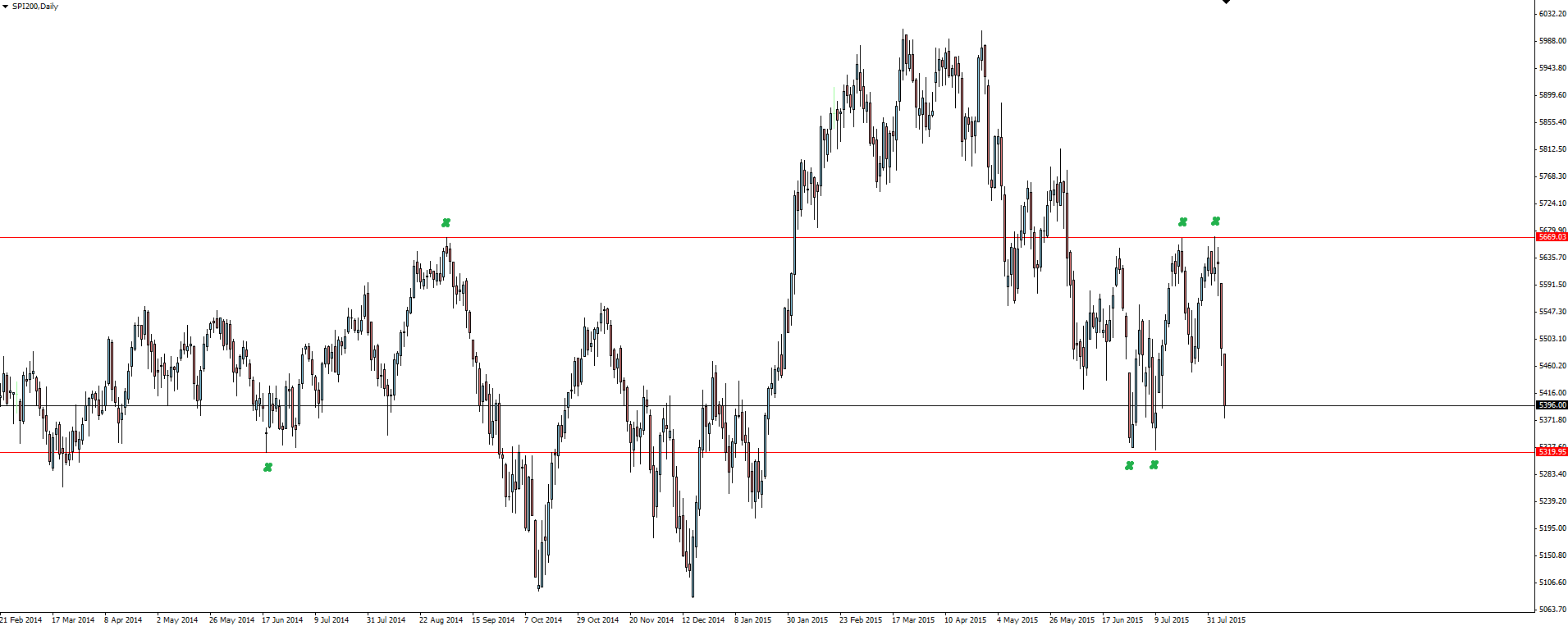

SPI200 Daily:

Click on chart to see a larger view.

Sticking with the Stock Market theme to begin the week, the Australian SPI200 has fallen a lot sharper than it’s Wall Street counterpart and with both the US and China coming off, not much is expected for the local market today.

As you can see from the above chart, price has also been kind to traders who fade major levels, with the SPI tightly range bound and respecting levels to the pip.

———-

On the Calendar Monday:

A quiet Asian Session to begin a fresh week with the tier 1 Chinese Trade Balance and Inflation data we spoke about above both having been released over the weekend.

Later in the evening we see a couple of FOMC members speaking at the Federal Reserve Bank of Atlanta’s conference. Lockhart is due to deliver opening remarks alongside Fischer before the former speaks again with an added Q&A session that has the potential to move markets.

USD FOMC Member Fischer Speaks

USD FOMC Member Lockhart Speaks

USD FOMC Member Lockhart Speaks Again

———-

Chart of the Day:

With the Commodities Trading section of the Vantage FX website receiving a fresh new look, we take a look at Oil as price enters an important tradable zone.

OIL Daily:

Click on chart to see a larger view.

After a short lived relief rally, Oil resumed its bearish trend, just as quickly falling back to its lows where price currently sits.

An argument could easily be made that this current zone is a buy until it actually breaks but for the more conservative traders that prefer to go with the trend, selling any sort of momentum or a re-test of broken support could well be the smarter play.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.