Independence Day:

“Look at us. Everybody’s trying to get out of Washington, and we’re the only schmucks trying to get in.”

With it being the 4th of July in the US and with all the turmoil around Greece, today’s cover photo just seemed right. I’m sure someone with better Photoshop skills than myself can put the UFO above the Greek Parthenon and send it back to us on Twitter or Facebook!

On the back of last night’s Thursday Non-Farm Payroll miss, the odds of a Fed rate hike in September seem to be drifting. NFP came in at 223K v the 231K expected. This slight miss in itself didn’t put a whole lot of pressure on the USD, but last months’ 280K was revised down to 254K which added to the data dependent uncertainty and saw a USD sell off across the board.

If you remembered yesterday’s Asian Session Morning blog, we took a look at USD/JPY heading into NFP and talked about the levels that we had to manage our risk around on either side of the market.

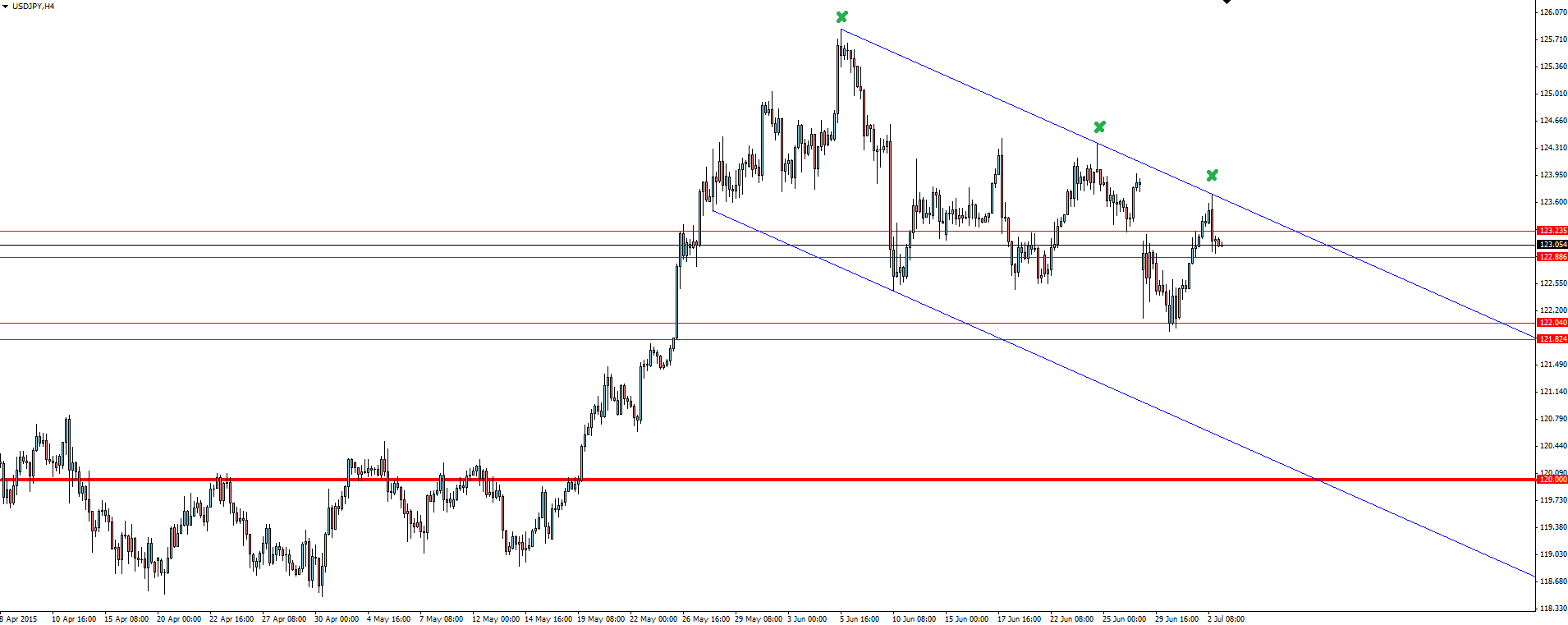

USD/JPY 4 Hourly:

Click on chart to see a larger view.

As you can see, price crept up to trend line resistance before selling off it hard on the NFP miss. This was a good result because shorting into resistance you would have made a nice 50 pips while if you were long, you could have easily taken a break-even.

———-

On the Calendar Today:

With NFP out of the way, the US on holidays and the Greek referendum to be decided over the weekend, today’s data shouldn’t be too game changing. A day like today isn’t one to get chopped out of trades on short term news spikes.

Once again, I want to just stress that with the uncertainty of what the Greek referendum result will be, I wouldn’t be holding any notable positions over the weekend. We just don’t know what markets are going to do.

Friday:

AUD Retail Sales

CNY HSBC Services PMI

GBP Services PMI

USD Bank Holiday

———-

Chart of the Day:

As the NFP spike fallout settles down, GBP/USD sits in a nice actionable zone.

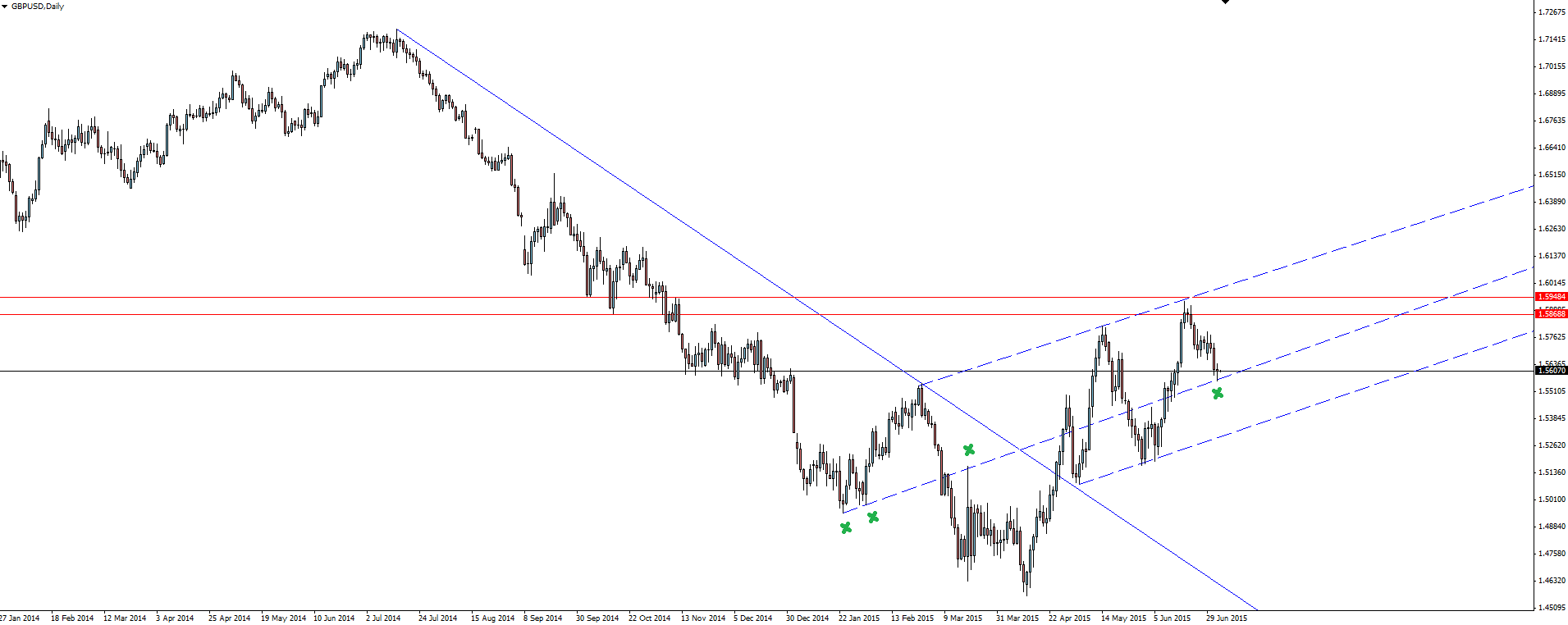

GBP/USD Daily:

Click on chart to see a larger view.

The middle line is the interesting on here, with this being the 4th touch of a previously broken and chopped trend line. So often these sorts of lines ‘re-active’ further down the line, even if they have been broken numerous times and are therefore still significant to keep on your chart.

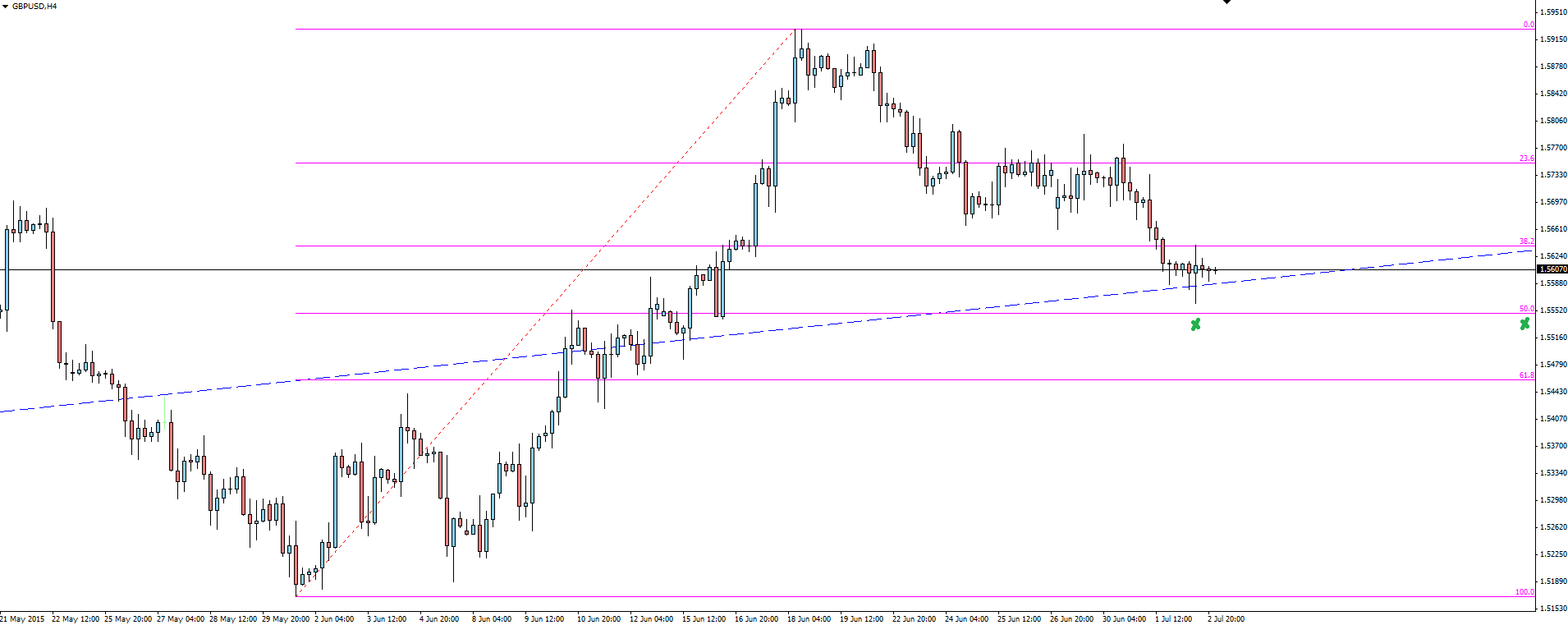

GBP/USD 4 Hourly:

Click on chart to see a larger view.

This level just happens to be the 50% fib support level as well. As I’ve said before, I’m not the biggest Fibonacci guy, but in this case it does give us some nice horizontal levels in which to place our stops around if we are trading to the long side.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.