FOMC Minutes:

Along with the expected, neutral ‘data dependent’ rhetoric throughout the statement, the Fed also clearly signalled that they believe the US economy is stronger than what the first quarter data indicates and that they are still on track to raise interest rates by the end of this calendar year.

Many participants, however, thought it unlikely that the data available in June would provide sufficient confirmation that the conditions for raising the target range for the federal funds rate had been satisfied, al-though they generally did not rule out this possibility.

Most participants felt that the timing of the first increase in the target range for the federal funds rate would appropriately be determined on a meeting-by-meeting basis and would depend on the evolution of economic conditions and the outlook.

This has reassured the market, and USD bulls that the Fed isn’t getting cold feet when it comes to tightening and that they are still on track most probably for a September hike.

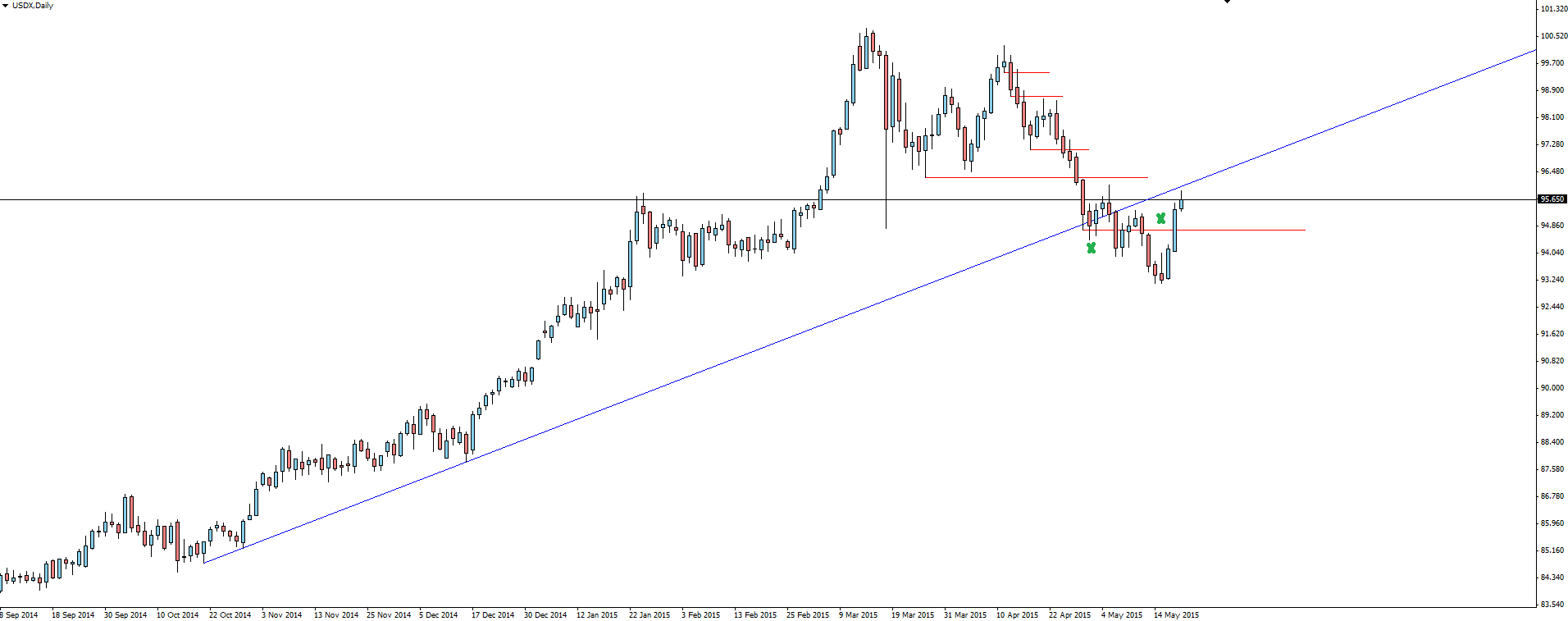

USDX Daily:

Click on chart to see a larger view.

On the USDX chart that we have been watching, you can see that price has finally regained a level of previously broken support and on the back of this Fed retoric, we’re on track to regain that trend line and push up once again to the highs.

———-

On the Calendar Today:

Chinese Flash Manufacturing data the big mover on the calendar in Asia this morning.

Just keep in mind that the markets are still digesting the FOMC minutes around today’s releases.

Thursday:

AUD MI Inflation Expectations

CNY HSBC Flash Manufacturing PMI

EUR Flash Manufacturing PMI

EUR German Flash Manufacturing PMI

GBP Retail Sales

EUR ECB Monetary Policy Meeting Accounts

USD Unemployment Claims

USD Existing Home Sales

USD Philly Fed Manufacturing Index

———-

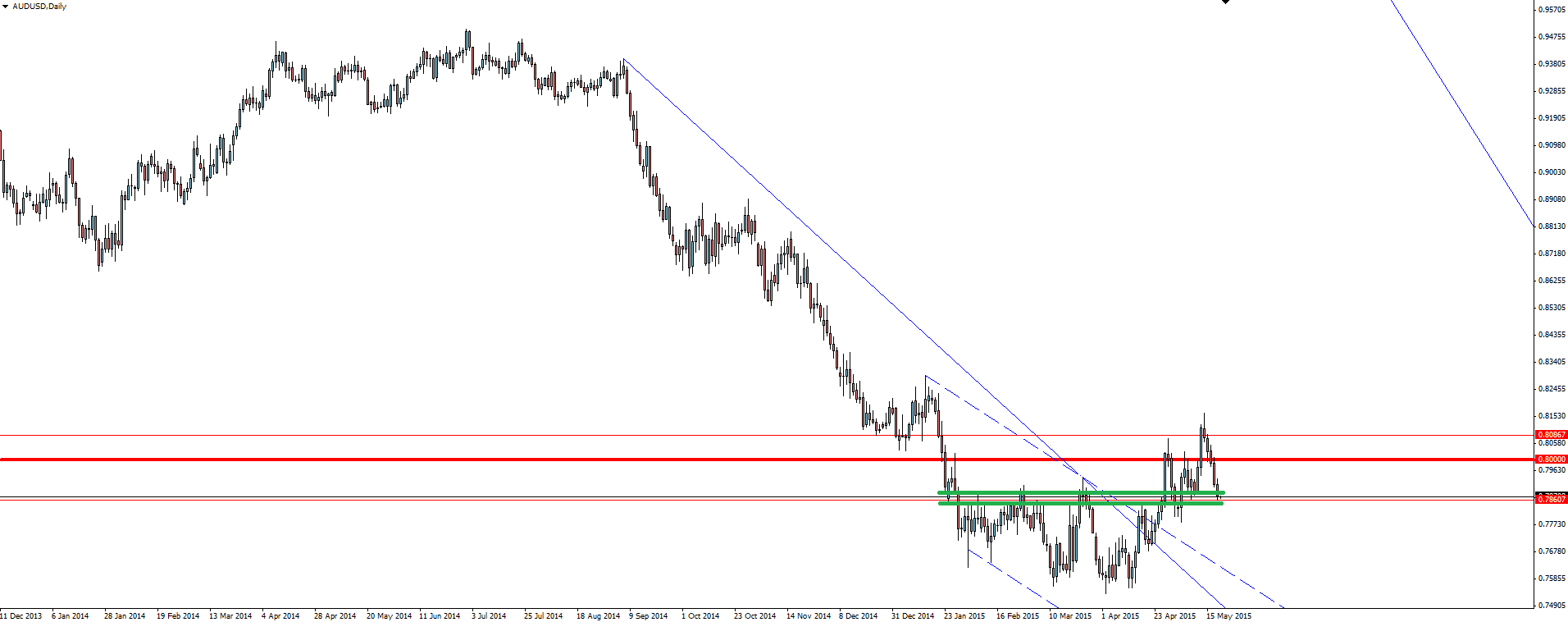

Chart of the Day:

With the FOMC Minutes last night not altering the theme of USD strength, we take a look at where AUD/USD is sitting.

AUD/USD Daily:

Click on chart to see a larger view.

With AUD/USD poking above the 80c level to knock out any weak shorts, we’ve sold off vertically from here. Price now has come back to it’s most recent swing low on the lower time frame charts and into the green supply zone I have marked where we could expect some action.

AUD/USD Hourly:

Click on chart to see a larger view.

On a lower time frame hourly chart, the way price has come off it’s highs quite aggressively is highlighted by the channel the pair is moving inside.

Combining these two views, we are potentially sitting at higher time frame support and the way price acts around it’s hourly channel edges will be watched to refine any trade entries.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.