Morning View:

EUR/USD came off it’s highs overnight, dropping sharply as the European Central Bank’s Benoit Coeure said that they could step up their purchases of Eurozone government bonds. The idea here is that the bank can front load it’s purchases now to avoid the seasonal issues that arise in the following months.

Coeure went on to suggest that the ECB may push interest rates further below zero when setting stimulatory monetary policy. But with Mario Draghi constantly standing by his view that ECB interest rates could not go much beyond the zero level, this all sounds like a bit of good old fashioned jawboning to me.

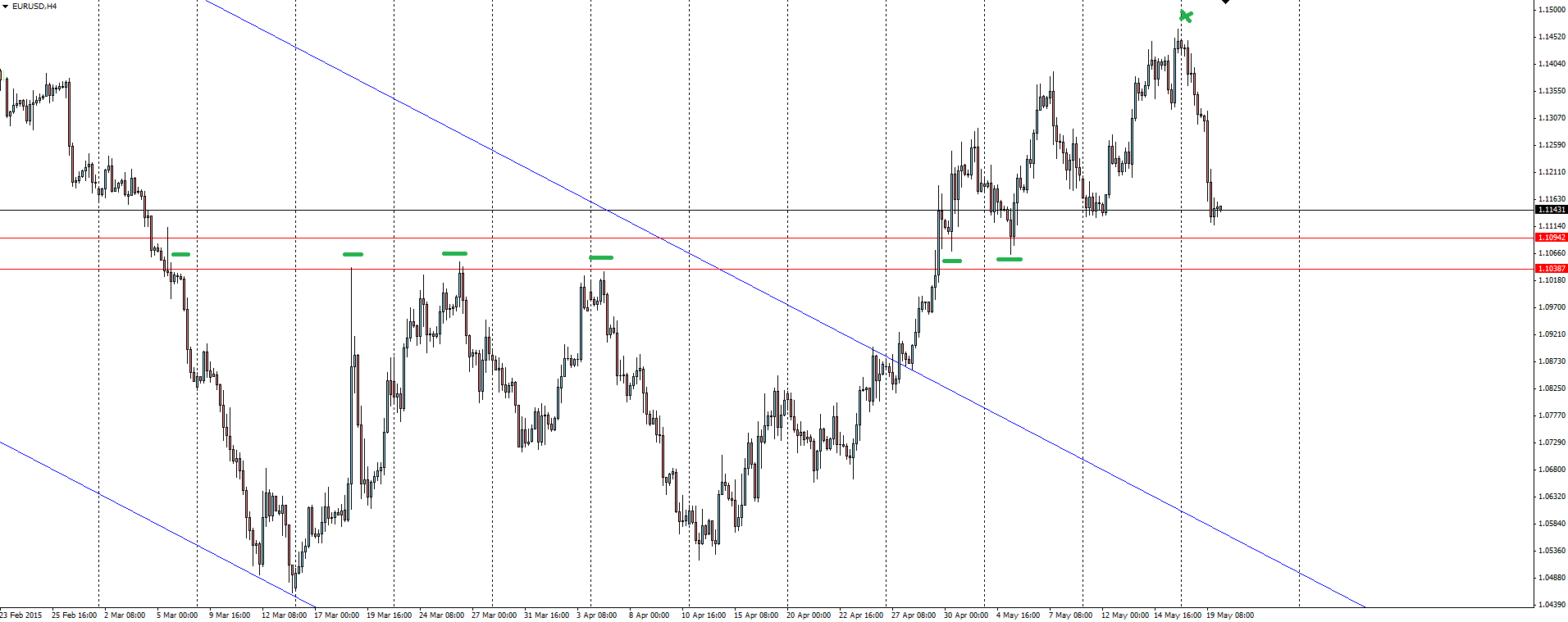

EUR/USD 4 Hourly:

Click on chart to see a larger view.

With EUR/USD rallying nearly 1000 pips off it’s lows, this isn’t ideal for the ECB who would like to see the pair lower in order to stimulate inflation and help export demand growth.

Elsewhere:

Last night also saw the German ZEW survey show that business confidence has fallen to its lowest level since December 2014, while the US saw housing data surprise to the upside, with Housing Starts in April surging to a 7 year high.

———-

On the Calendar Today:

Quiet one on the data front during Asia but it all leads us into the FOMC Minutes early tomorrow morning.

Wednesday:

JPY Prelim GDP

AUD Westpac Consumer Sentiment

GBP MPC Official Bank Rate Votes

CAD Wholesale Sales

USD FOMC Meeting Minutes

———-

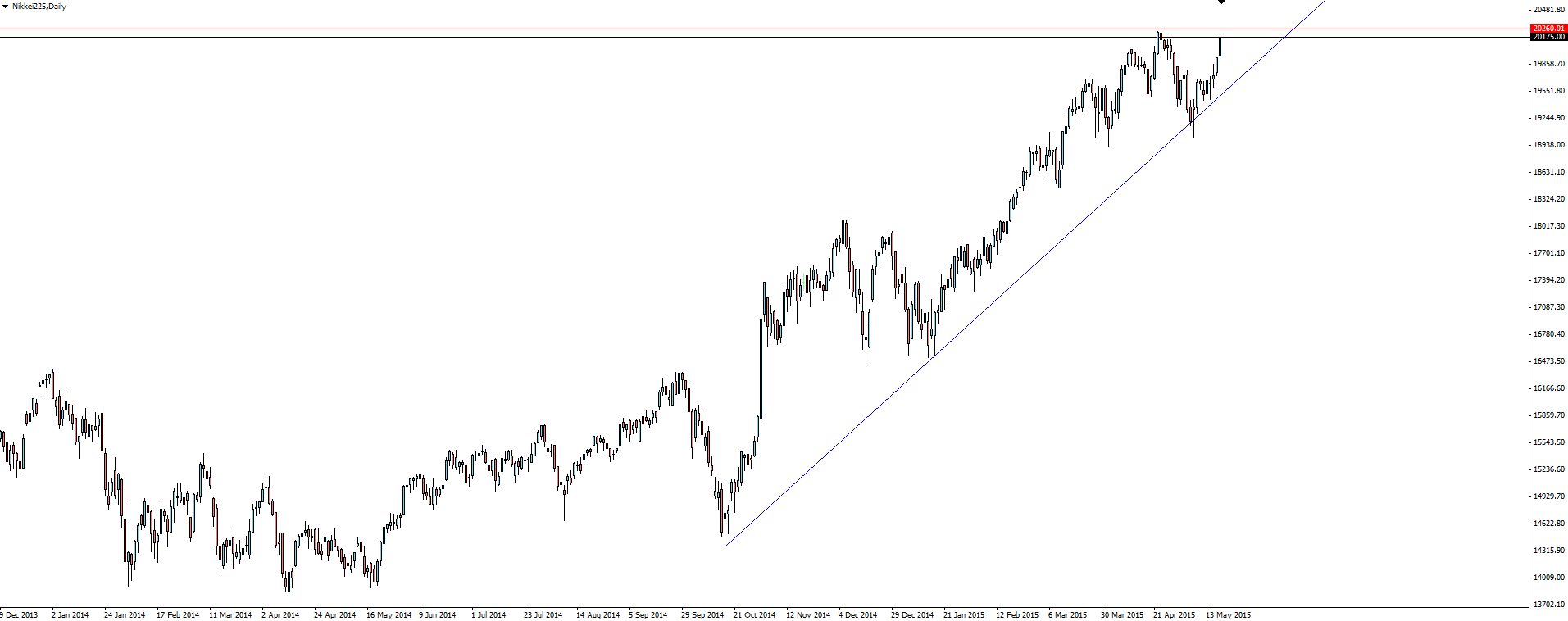

Chart of the Day:

The Nikkei hit a 3 week high this morning and looks set to surge through it’s recent swing high.

NIKKEI Daily:

Click on chart to see a larger view.

Look at that long wicked candle on trend line support and then the way that price rallied hard off the level straight up to it’s swing high. This is the key level, but it looks pretty damn strong to me!

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.