Australian Inflation:

Yesterday saw the release of the official inflation figures out of Australia, with the higher than expected number adding to reasons that the RBA could look to again hold rates in May. For a Governor that to me sounds like he is apprehensive to cut rates again, this might just have tipped his hand.

I read an interesting piece yesterday from trader @RemixTrades on Twitter, which basically sums up my thinking:

“You do one interest rate cut and then keep saying that you may cut again – just enough to keep markets on the edge. This way, you keep the currency in check and the markets tame while you actually don’t do anything else.”

Stevens has kept the currency in check by dangling enough of a rate cut carrot to the markets. Along with (most importantly) the external factors such as USD strength, a lot of the currency depreciation work has been done for him.

Keep the idea of a cut on the table and let the market work for you!

BoE Votes.

Last night we also got the latest Bank of England minutes, with all 9 MPC members voting in favour of the current refinancing rate. The amount of QE was also unanimously agreed upon at £375 billion.

GBP/USD rallied strongly on the release, pushing up into the resistance zone that we had spoken about in the Technical Analysis section of the Vantage FX News Centre. I take a look at the chart and some ways to tackle this change in the Chart of the Day section below.

On the Calendar Today:

Chinese Manufacturing data is the big release on the calendar during the Asian session today. With the Aussie recieving a huge boost on the back of yesterday’s inflation number maybe forcing the RBA’s hand on a hold, it will be interesting to see what happens if this number is also a beat.

A whole string of European PMI’s to be released later in the night. Which ones of these actually move the market is a bit of a lottery so stay alert to the release times, especially if you’re trading the Euro.

Thursday:

CNY HSBC Flash Manufacturing PMI

EUR French Flash Manufacturing PMI

EUR German Flash Manufacturing PMI

GBP Retail Sales

USD Unemployment Claims

Chart of the Day:

A couple of charts again today, keeping with the GBP theme.

GBP/USD Daily:

Click on chart to see a larger view.

With the BoE’s hawkish stance, price has pushed up into the zone we were looking for sellers to step in. However, the fact that it rallied hard into the level on momentum is not something that I want to be stepping in front of and fading just yet.

Here is an alternate scenario which is now on the table after the news. I am still however apprehensive to be buying Cable while price is still capped by the descending channel, not to mention the theme of still relentless USD strength.

Turned into a bit of a wait and see.

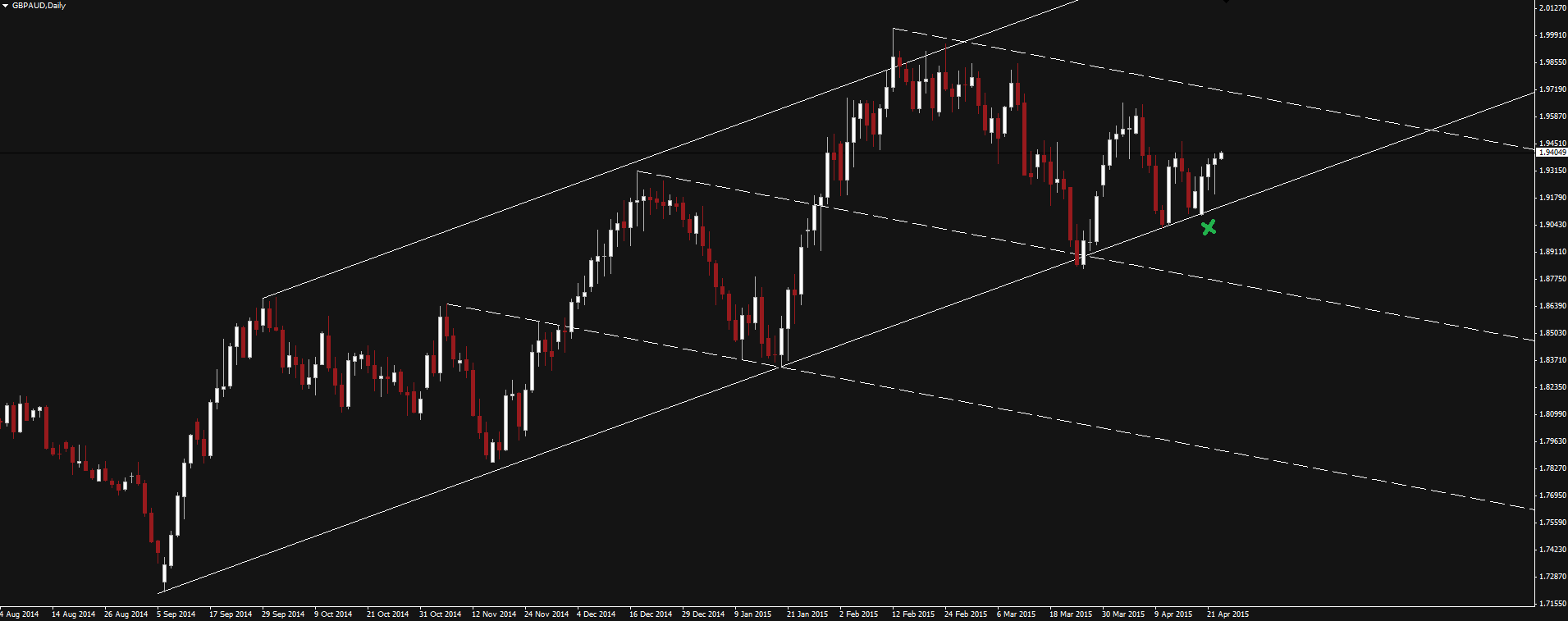

GBP/AUD Daily:

Click on chart to see a larger view.

With both the BoE and RBA speaking about moving rates in opposite directions, we better take a look at the GBP/AUD chart. This pair is not as stable as its Cable brother and whips around a lot more. If you are trading this pair, make sure you’re justifying your size and stops accordingly.

Price is moving between levels in it’s bullish channel and last week we got another healthy bounce off support. Now it is looking as though the level has held off the back of the BoE, are new highs are on the cards?

Technically, if that channel snaps to the downside then it’s going to drop hard. But support has held until it hasn’t and right now on the back of both GBP and AUD news earlier in the week, the play is for new highs.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

AUD/USD drops below 0.6600 after RBA policy announcements

AUD/USD stays under bearish pressure and trades deep in negative territory slightly below 0.6600. The RBA left the policy settings unchanged as expected but Governor Bullock said that there was no necessity to further tighten the policy.

Gold price turns red amid the renewed US dollar demand

Gold price trades in negative territory on Tuesday amid the renewed USD demand. A downbeat US jobs data for April prompted speculation of potential rate cuts by the Fed in the coming months.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.