Morning Recap:

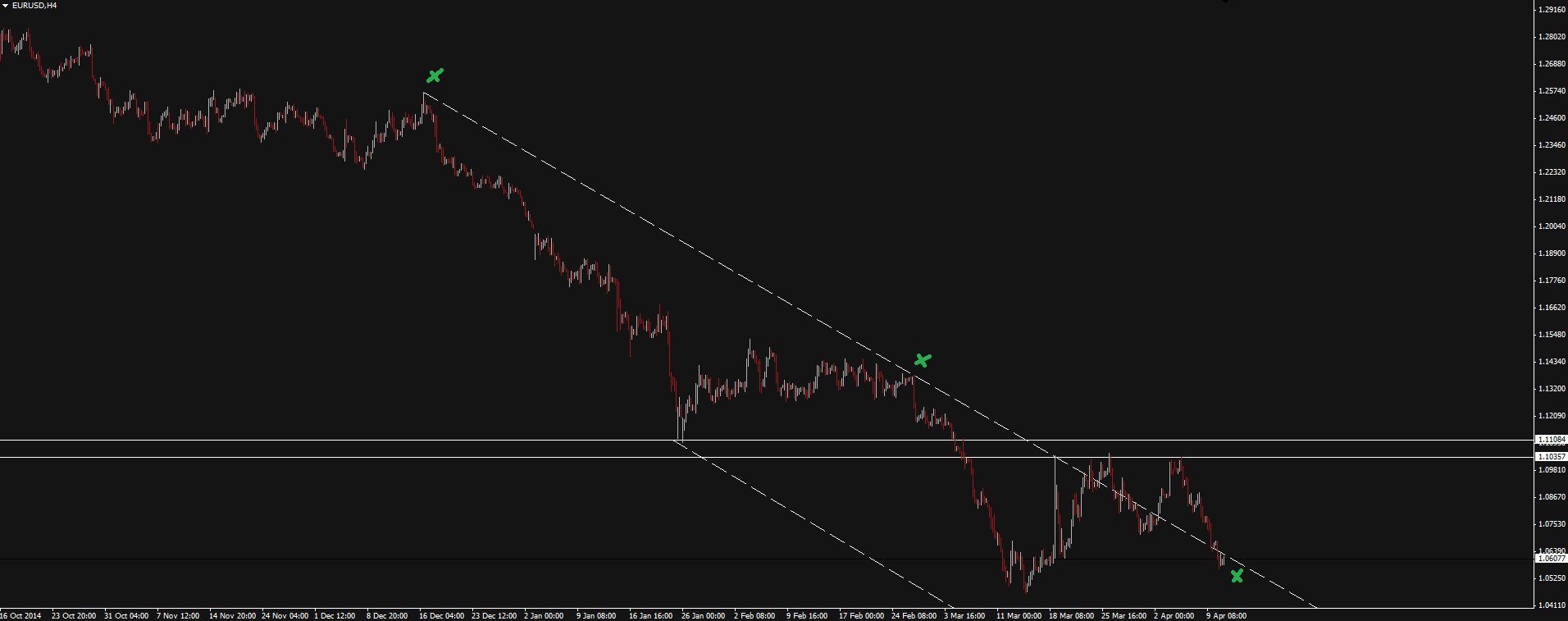

The Euro and British Pound were again the biggest losers on Friday night with the Euro getting smashed for the 5th straight session to close at a 3 week low. With the Eurozone still struggling through QE and the British in the middle of an uncertain election race, the bears are firmly in control across both EUR/USD and GBP/USD.

The Aussie and Kiwi dollars have both held up better than their counterparts from the Northern Hemisphere, but both are at the bottom of ranges and all tucking back into descending channels (as you can see on the EUR/USD chart below), meaning we could be looking at further downside across the board this week.

Click on chart to see a larger view.

Quote of the Day:

I don’t like talking politics in any of these reports, but I couldn’t help myself when I read this quote from Australian Treasurer Joe Hockey. If you aren’t familiar with Joe Hockey, picture a confident, outgoing man who is never afraid to speak his mind.

When asked a question around the tactics of major iron ore miners Rio Tinto and BHP Billiton of ramping up production in a falling market to drive out domestic and international rivals, his reply was swift:

“I’m reluctant to tell people how to run their companies. Not that it stops them from telling us how to run the country.”

Ha!

On the Calendar Today:

We start the week on a quiet note today, with the only major release being Trade Balance data coming out of China. As is the case a lot of the time with Chinese data, the release is set as tentative so keep an eye on Twitter for further release news, especially if you’re trading the Aussie.

Monday:

CNY Trade Balance

Chart of the Day:

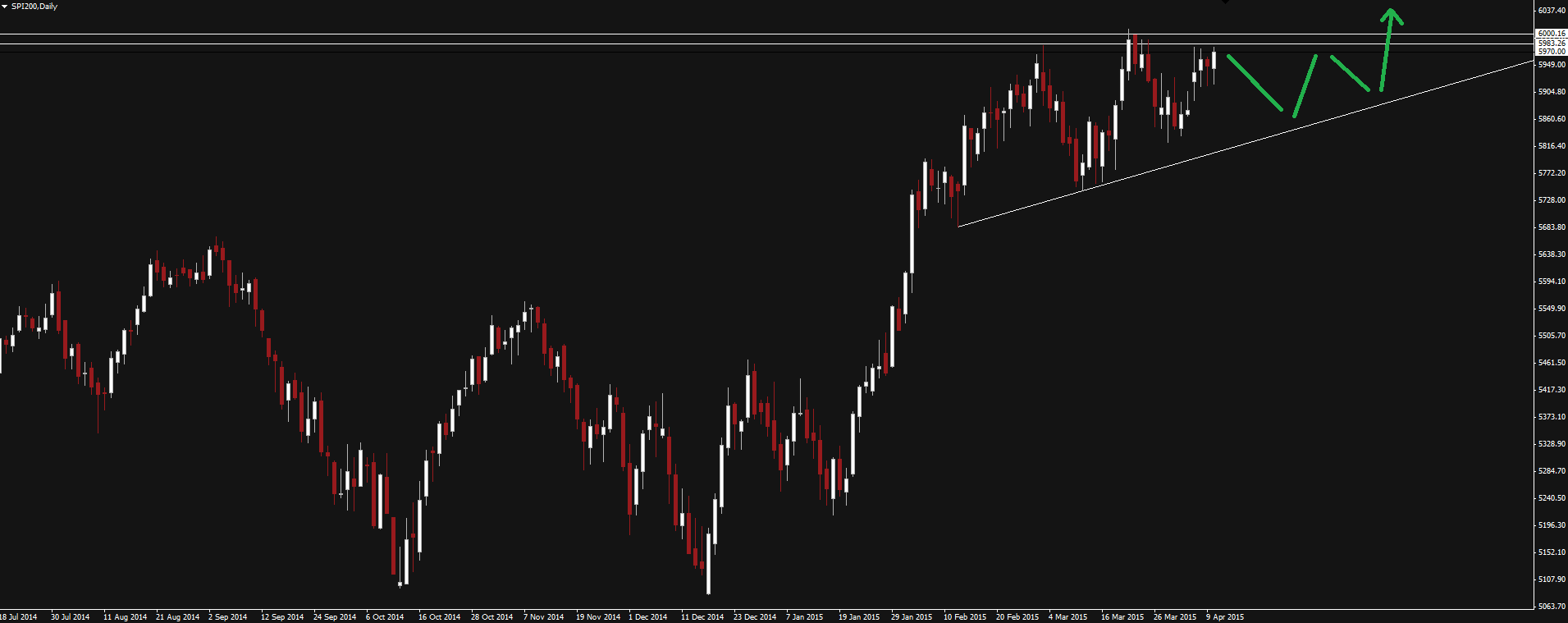

Something a little different to start the week with the Australian SPI200 market at the front of local trader’s minds as price approaches a major psychological. The SPI goes into this week just over 30 points short of the magic 6000 mark.

SPI200 Daily:

Click on chart to see a larger view.

Markets tested the level a few weeks back pushing through intra-day, but were unable to close and sellers stepped in. The SPI has then made another higher low to form a bit of an ascending triangle that looks very bullish.

Any weaker than expected Australian data that points of an already almost certain interest rate cut and subsequent cheap money, should be the catalyst for a push through the 6000 level.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 during the early Monday. The softer US Dollar provides some support to the major pair. Traders await the HCOB Purchasing Managers’ Index (PMI) data from Germany and the Eurozone, along with the Eurozone PPI.

GBP/USD rises to near 1.2550 due to dovish sentiment surrounding Fed

GBP/USD continues its winning streak for the fourth consecutive day, trading around 1.2550 during the Asian trading hours on Monday. The appreciation of the pair could be attributed to the recalibrated expectations for the Fed's interest rate cuts in 2024 following the release of lower-than-expected US jobs data.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.