NFP Good Friday:

With Good Friday not actually a federal holiday in the US, today sees the March NFP jobs report released as scheduled.

Although it may feel strange for some of us logging into our trading platforms on a public holiday, it is actually not that uncommon for NFP to fall on Good Friday. The last time we got a Good Friday NFP number was in 2012 with 10 others before that dating back 35 years!

The expected NFP print sits at 247,000 and as I mentioned in yesterday’s morning view, the risk is for a weaker number. On the back of this risk, the USD slipped against most major currencies with traders taking profits heading into the number.

Click on chart to see a larger view.

I’ve been speaking about looking at opportunities to get into trades heading into the number, and these profit taking rallies can be seen as this opportunity if you are bullish USD. Historically, there isn’t too much to fear from low holiday liquidity affecting how the number trades as it’s released, but in the lead up during Asia and London I definitely recommend using some caution. Could get some spiky price action.

UK Election Uncertainty:

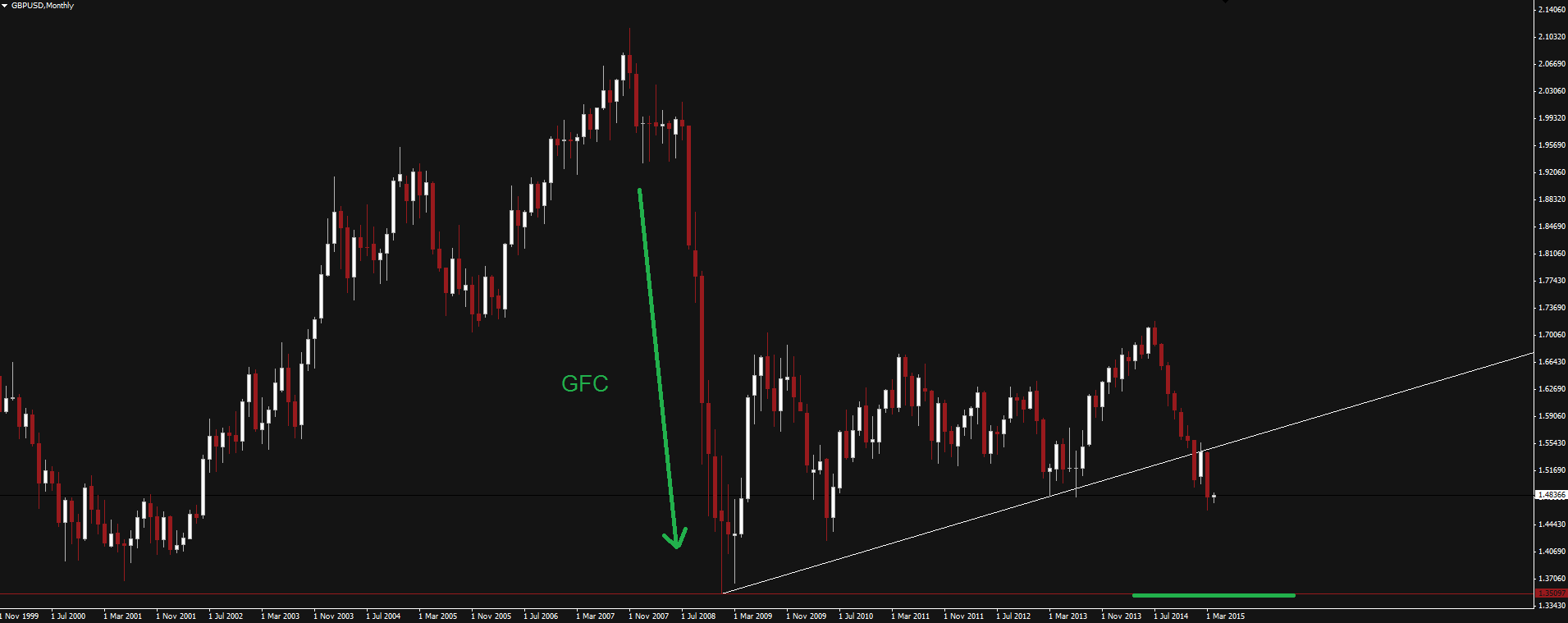

The run in to the UK elections are in full swing and the risk of a hung parliament is real. Markets can’t deal with uncertainty and this will put further pressure on GBP/USD with a history of dysfunctional coalitions falling apart.

On the matter of a possible hung parliament, I even came across a headline that read: “This could be the UK’s Lehman’s moment” which to me is just a little bit exaggerated… Yes it’s interesting that in the current economic climate, GBP/USD price could take a look at testing it’s GFC swing lows on the Monthly chart, but that’s definitely not the right way of wording it.

Click on chart to see a larger view.

So long as there is uncertainty, we are looking at further falls in GBP/USD.

On the Calendar Today:

Most major centres are on holiday for Good Friday, but put a big red circle around NFP come the US session.

Friday:

AUD Bank Holiday

CHF Bank Holiday

EUR German Bank Holiday

GBP Bank Holiday

CAD Bank Holiday

USD Non-Farm Employment Change

USD Unemployment Rate

Chart of the Day:

AUD/NZD 4 hour:

Click on chart to see a larger view.

The AUD/NZD set a fresh all time low overnight, dropping below 1.0100 which was touched back in 1996. That big fat red line at parity on the chart above is getting mighty close isn’t it! It’s such a big one that I just can’t see the market not trying to push it down to at least have a go at testing the level.

So often this happens with huge psychological levels like this and heading into the RBA decision next week where a cut is expected, I like the idea of selling into any rallies.

Recommended Content

Editors’ Picks

AUD/USD holds positive ground above 0.6500 on weaker US Dollar

The AUD/USD pair extends recovery around 0.6525 during the early Asian session on Thursday. The Federal Reserve held its interest rates steady at 5.25–5.50% at its meeting on Wednesday, citing a “lack of further progress” in getting inflation back down to its 2% target.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Solana price dumps 21% on week as round three of FTX estate sale of SOL commences

Solana price is down almost 5% in the past 24 hours and over 20% in the last seven days. The dump comes as the broader crypto market contracts with Bitcoin price leading the pack as it slides below the $58,000 threshold to test the Bull Market Support Band Indicator.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.