The FX market calmed down before the FOMC meeting, which will be held tomorrow morning Australian time. The USD index is moving around 100 as bets on stronger USD were only partially closed. The main forecast is still expecting Fed will delete ‘patience’ in the statement and pave the way for rate hike at June. However, the major risk now is Fed’s concern on the aspect that strong Dollar will pare the US economic recovery as recent data is not that satisfactory, except for the job market. In that case, we will see a major retreat of the Dollar, and the bulls shall realize that risk.

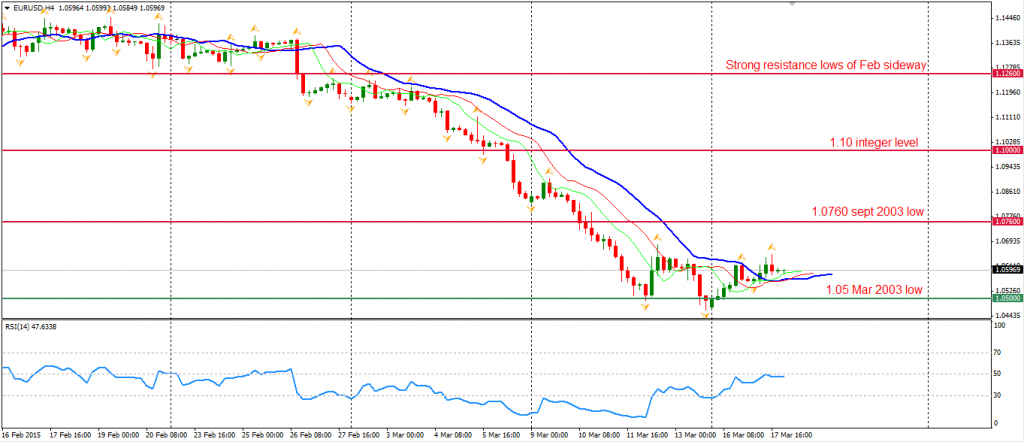

Euro Dollar rebounded to 1.0650 among the profit-taking orders, but still closed below 1.06 at this early morning. The pair will probably remain sideways in a limited range before the FOMC statement. 1.0760 and 1.05 are the critical levels of EURUSD.

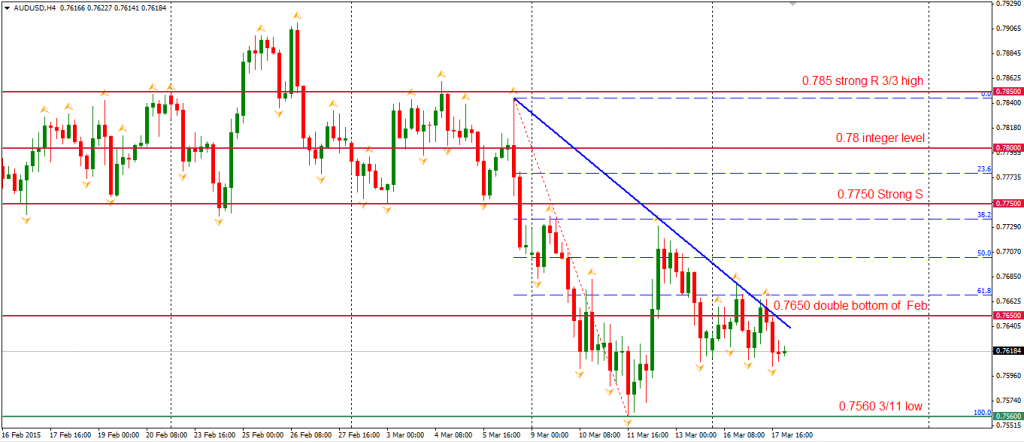

Aussie Dollar remained at its weakness and followed the bearish trendline formed since 0.7850. 0.76 will be the temporary support for this currency pair in the Asian trading hours.

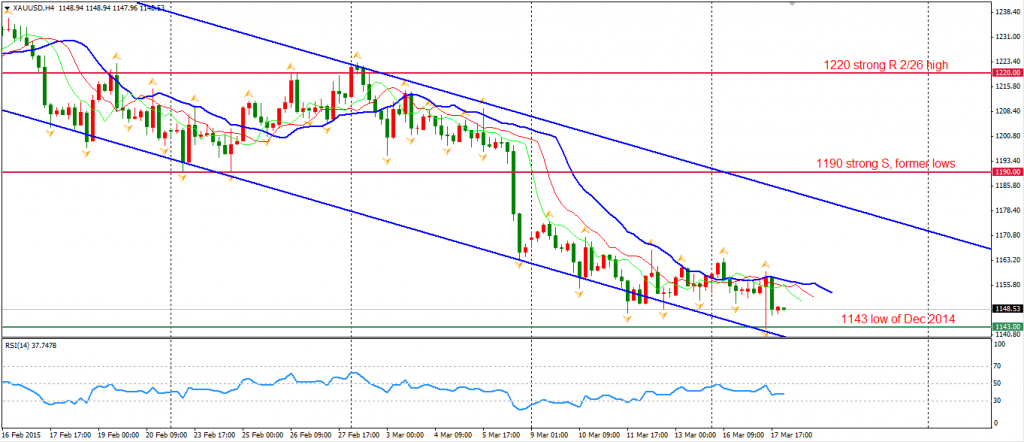

Gold prices slumped to $1142 per ounce shortly after a 3000-lot short order raged the market. The bulls reversed the whole loss later but finally gave up the $1160. The prices closed at around $1150. Although US dollar has showed some extent of weakness, gold prices were not supported by this effect. The bullishness of global stock markets is the main reason suppressing the gold. The yellow metals keep within the bearish channel and see no sign of buying orders to support the gold prices.

Back to stock markets, Shanghai Composite surged 1.55% to 3503, refreshed 7 years high. The Nikkei Stock Average gained 1% as well. Australian ASX 200 rebounded 0.77% to 5842. In European markets, the UK FTSE climbed 0.49%, the German DAX retreated 1.54% and the French CAC Index also lost 0.64%. The US stock indices were mixed before the FOMC meeting. The S&P 500 closed 0.35% lower at 2074. The Dow fell 0.71% to 17849, and the Nasdaq Composite Index climbed 0.16% to 4937.

On the data front, Bank of England will release its March meeting minutes at 20:30 pm AEDST along with the job market data. Fed will release their March monetary policy, which will attract all the focus at 5 am tomorrow morning AEDST.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.