Greek officials have announced that they have reached consensus with the Eurogroup. In exchange for the continued funding of Greece for another few months, a list of demanded reforms has been drafted. The leaders are still working on the solution of the bailout program extension, but the result seems to be promising and recent polls shows that the domestic support ratio of Syriza-led government does not fall significantly even after they gave up on almost every promise they had pledged to voting Greek public.

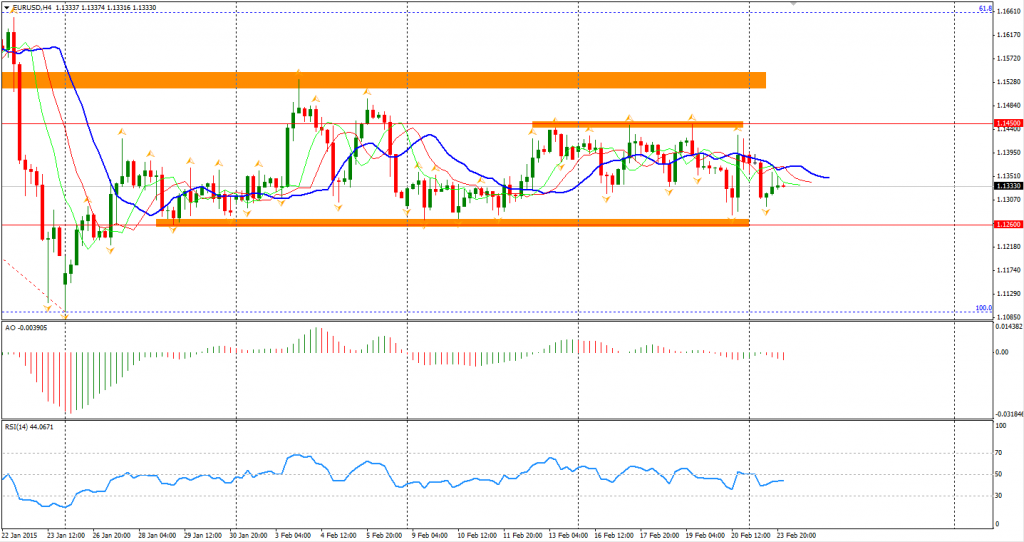

The Euro fell from highs of near 1.1380 to 1.1295 and was trading near 1.1335 earlier this morning. The sideway continues within the range between 1.1260 and 1.1450.

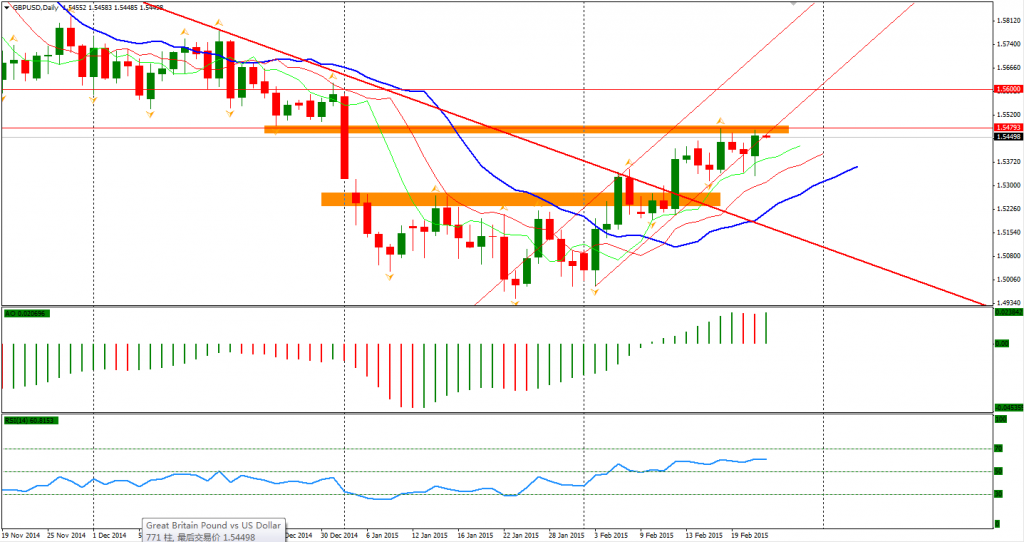

Sterling experienced a relative strong rebound against the Dollar yesterday. It rose from the day low of 1.5333 to the 18th February high of 1.5480 during the European session. The 1.5480 resistance seems close to breaching. If so, the 1.56 level above will be the next target for bulls.

Fed chairwoman Yellen will make a testimony on the Semi-annual Monetary Policy Report before the Senate Banking Committee today. I feel I have to alert the traders who are still betting on a higher US Dollar that the reversal risk is increasing. Firstly, Yellen always tends to be dovish on monetary policy. Although it is almost a certainty that Fed may raise interest rate during the year, a dovish statement will still affect the market heavily. Another sign is that the bull positions on the USD has been at the historical high for so long and yet the rise of USD has ceased for a while, all implying a major reversal is in the works. Traders should be prepared for this situation.

Turning now to the stock markets, the Nikkei Stock Average gained 0.73% to 18467, refreshing the highest level in 15 years. Australian ASX 200 rebounded 0.45% to 5908. In European markets, the UK FTSE was down 0.1%, the German DAX climbed 0.73% and the French CAC Index gained 0.65%. US stock indices remained mostly unchanged. The S&P 500 closed 0.03% lower at 2110. The Dow lost 0.13% to 18117, and the Nasdaq Composite Index rose 0.1% to 4961.

On the data front, UK Inflation Report Hearings will be released at 21:00 AEDST. After midnight, ECB President Draghi will speak at 1:00 AEDST and Fed Chairwoman Yellen will follow at 2:00 AEDST.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.