In the latest FOMC statement released earlier this morning, the board sent a signal to the public that the Federal Reserve would take delicate steps towards raising the benchmark interest rate in 2015. The phrase “considerable time” which describes how long the near-zero rate will be held now has been changed to “patient”. Ms Yellen’s speech, the chairwoman stated that the possibility of a rate hike in the next two FOMC meetings is very low, but almost every member expects that the normalization of monetary policies will happen in 2015. Some of them think that the timing may be mid-2015 considering that the current inflation remains at low level.

The Dollar index surged above the 89 level after Yellen’s speech as Fed confirmed to be moving forward to policy normalization while other major economics are still sticking to unconventional easing. The retreat of US Dollar now has finished and reversal signs have been left in the majors’ daily charts.

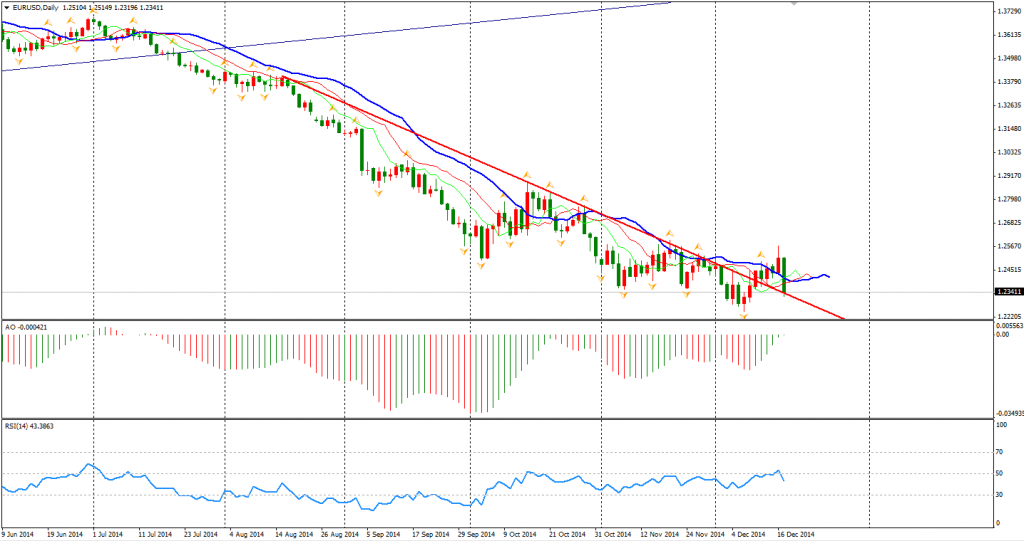

Euro fell to 1.2340 against Dollar, erasing the gains of last five trading days. RSI dropped back below 50.

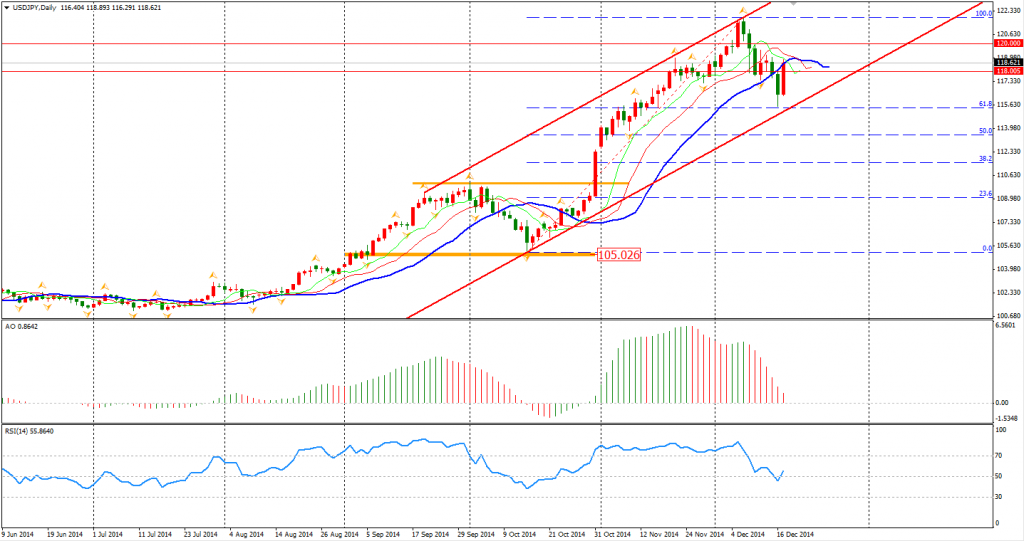

Similar situation happened with Dollar Yen as it reversed all its loss from the last two days’ falling. The bullish channel remains perfect, showing the Dollar Yen may keep rising in the middle run.

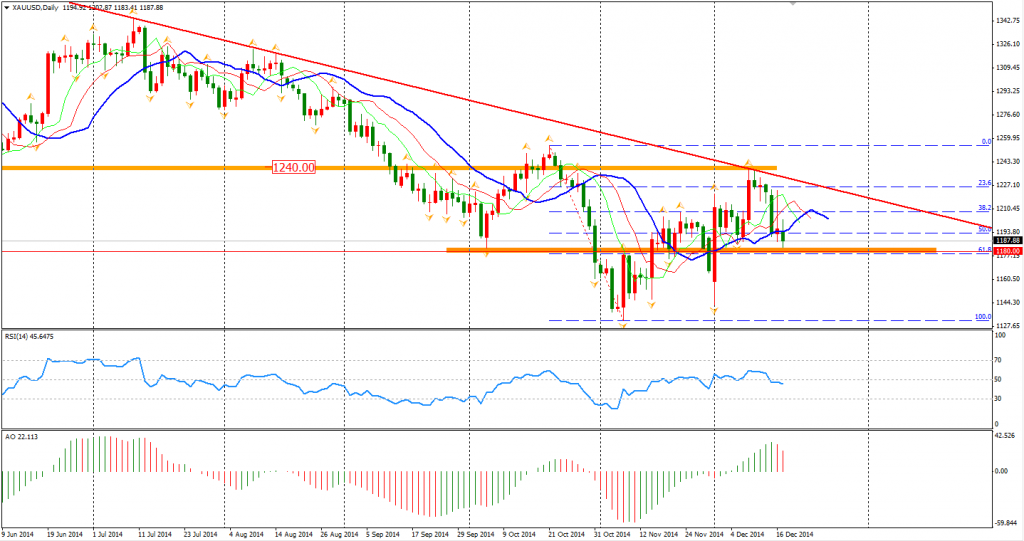

Gold price fell to $1189 and tested the $1180 support during the day. Indicators like alligator, AO and RSI now have turned bearish, implying that $1180 may not support the price for long.

Back to the stock markets, the Shanghai Composite surged 1.31% to 3060. ASX 200 bounced 0.18% to 5167. The Nikkei Stock Average was up 0.38%. The European markets closed as mixed, the UK FTSE rebounded 0.1%, the German DAX fell 0.2% and the French CAC Index gained 0.46%. US market rallied as Federal Reserve retained its pledge to keep interest rates low. The S&P 500 closed 2% higher at 2012. The Dow surged 1.69% to 17357, and the Nasdaq Composite Index rocketed 2.12% to 4644.

On the data front, German IFO Business Climate will be released at 20:00 AEDST. UK Retail Sales will be at 20:30 AEDST. US weekly Unemployment Claims and Philly Fed Manufacturing Index will be out at midnight.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold price struggles for a firm intraday direction, hover above $2,300

Gold price fails to lure buyers amid a fresh leg up in the US bond yields, modest USD uptick. A positive risk tone also contributes to capping the upside for the safe-haven precious metal. Traders, however, might prefer to wait for the US NFP report before placing aggressive bets.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.