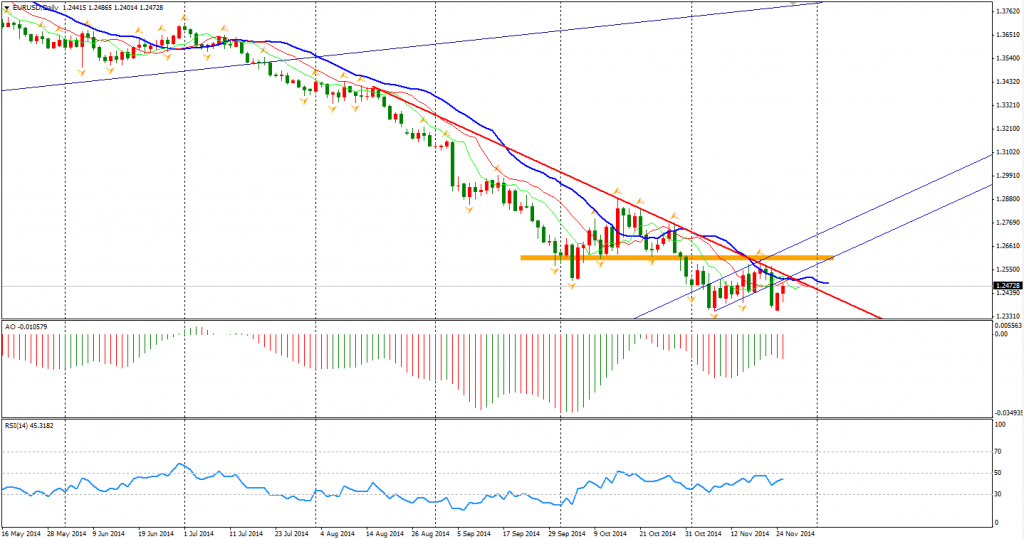

The Euro Dollar took the chance to recover half of its loss last Friday. It has rebounded over 100 pips from its month low and the critical support level of 1.2360, but the bearish trend has far from being changed.

The US Dollar wavered on US economic data last night. Better-than-expected GDP growth once helped the Dollar make gains but the data afterwards pared the Dollar and assisted the Euro and Sterling bounce to their day’s highs. Even with downbeat housing prices and consumer confidence, it doesn’t seem that the uptrend will change for the Dollar.

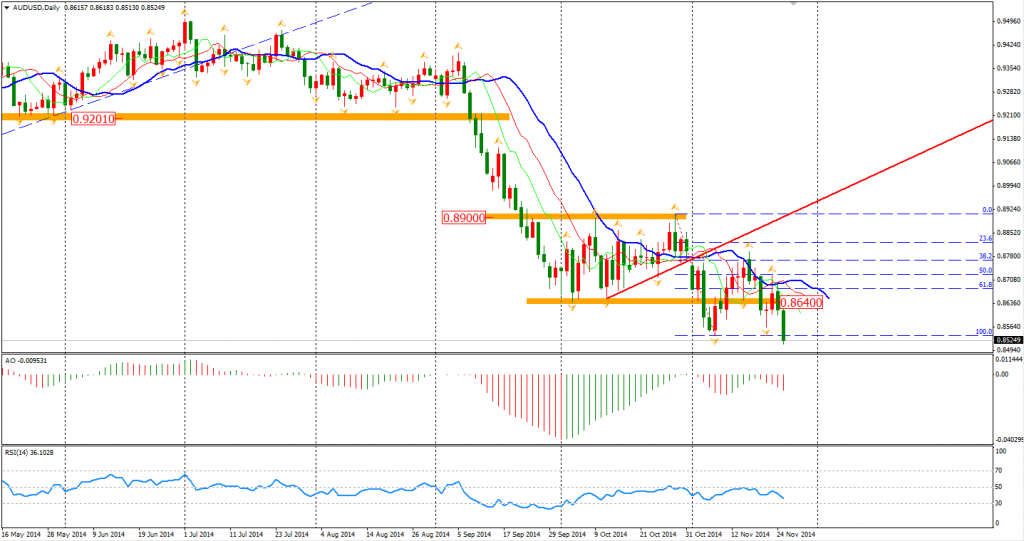

The bearishness of commodities and commodity currencies is not over yet. Even after the Chinese central bank started to implement monetary easing, we are yet to see a shift. The Aussie was the weakest major yesterday against Dollar, suppressed further by RBA official’s speech. It hit a new recent low of 0.8514 along with Iron ore who also renewed its low.

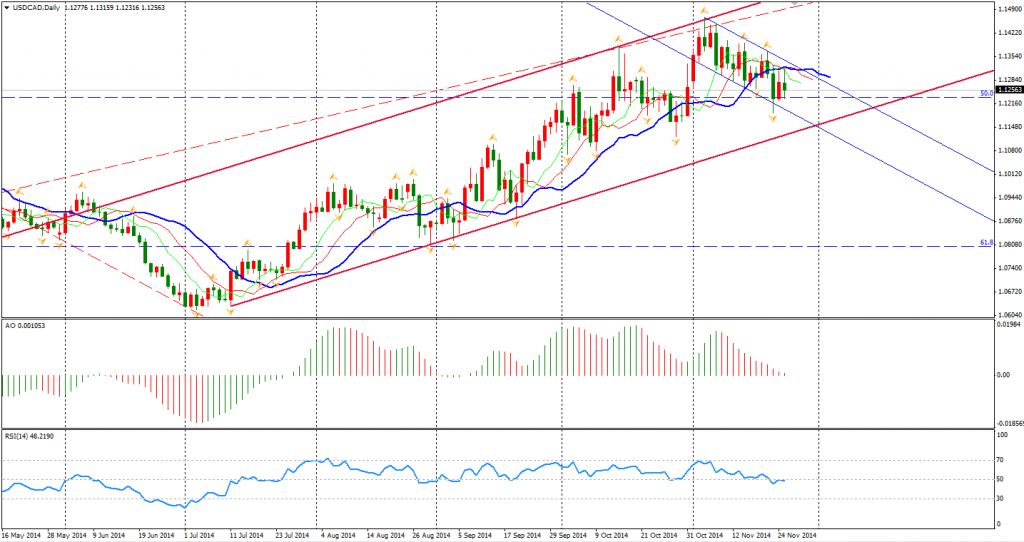

The Canadian Dollar performed stronger recently as the slump of oil prices eased. USDCAD now is moving in a narrow downward channel and may find support from the lower boundary of mid-run bullish channel near 1.1160.

The Yen rebounded from its low as this round of depreciation seems to be over, against the backdrop of the heated domestic discussion on whether QQE and a cheaper Yen will revive Japan’s economy. The RSI and AO indicator show reversal signs in USDJPY daily chart. Bulls can leave this pair for a while and wait for a lower level for entry.

Most Asian stock markets maintain their rise. The Shanghai Composite surged by 1.37% and refreshed 3-year high again to 2567. The ASX 200 also lost 0.5% to 5335 as mining companies dampened. In the European stock markets, the UK FTSE was up 0.02%, the German DAX rose 0.77% and the French CAC Index gained 0.32%. The US market inched lower. The S&P 500 lost 0.11% to 2067. The Dow closed flat at 17815, and the Nasdaq Composite Index rose 0.07% to 4758.

On the data front, the second estimate of UK GDP will be released at 20:30 AEDST. US durable goods orders and unemployment claims will be released at 0:30 AEDST.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD clings to small gains above 1.2550

Following Friday's volatile action, GBP/USD edges highs and trades in the green above 1.2550. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold price rebounds on downbeat NFP data, eyes on Fedspeak

Gold price (XAU/USD) snaps the two-day losing streak during the European session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Fed.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.