Without further ado and without surprise, the largest scale monetary stimulus in human history is ending. The Fed has decided to stop its asset purchasing program which has swelled its balance sheet by $1.66 trillion. The board of committee believe that the “labour market conditions improved somewhat further, with solid job gains and a lower unemployment rate” disregarding earlier language that referred to a “significant underutilization” of labour resources. Even though the Fed is trying to minimize the effects of QE quitting on the market, even pledging that they will not raise the interest rate until inflation is back to 2%, the Dollar surged across the board and US stocks fell after the release.

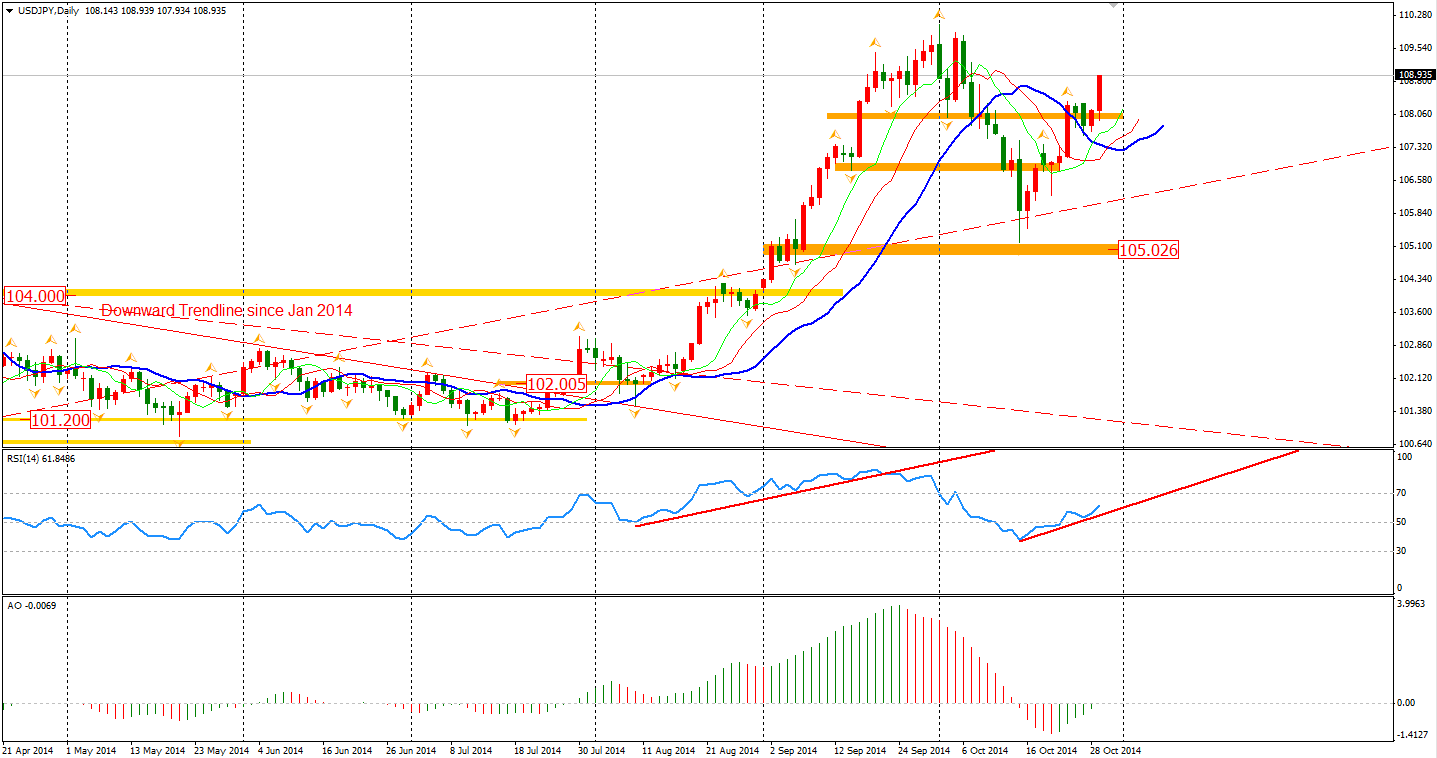

Most major pairs fell by over 100 pips against the Dollar erasing all gains of the last two days when the market was speculating on the possibility of a dovish FOMC statement. Dollar Yen rose by 0.7% nearing the 109 Yen level. A new resurgence appears to be on the way and the former high of 110 will be challenged soon.

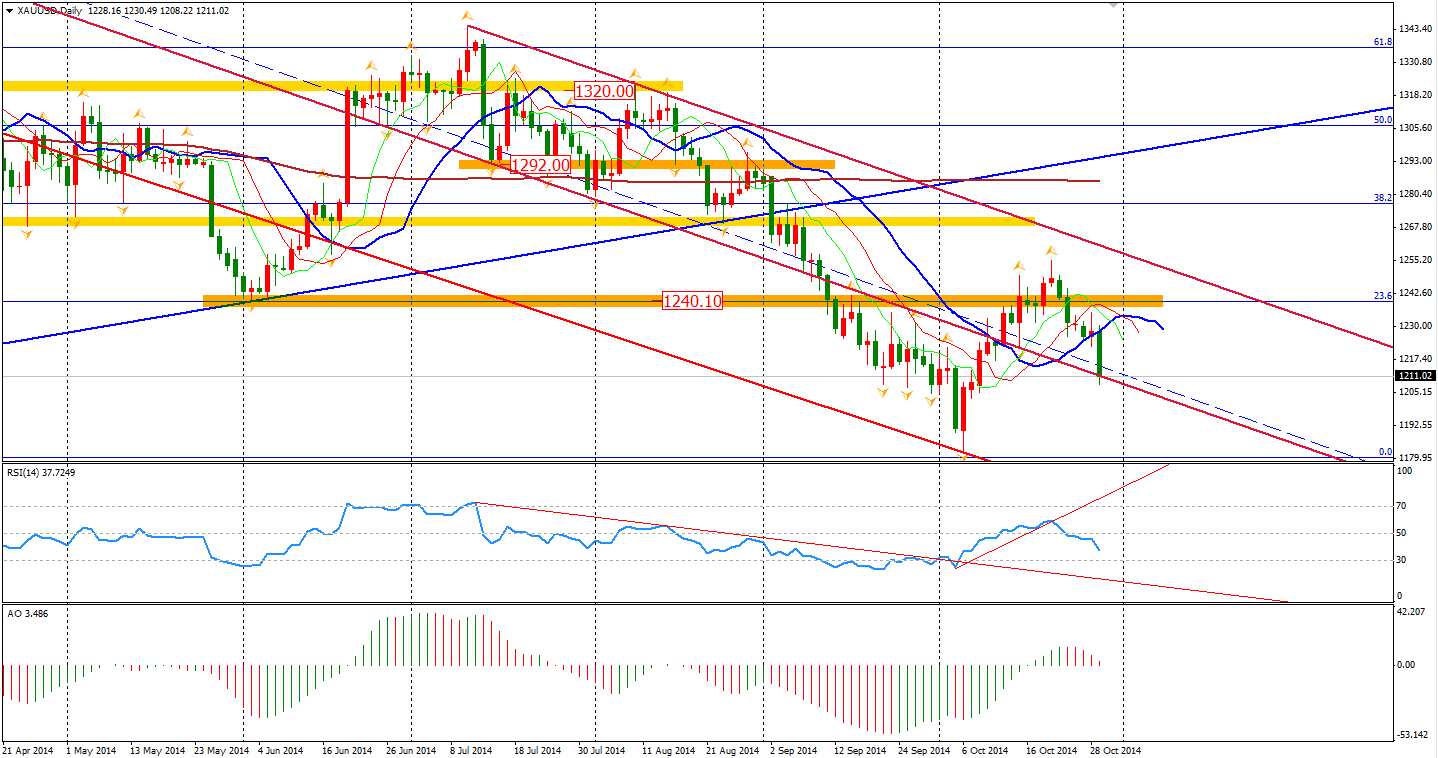

The Gold price plummeted once by 1.6% to $1208 per ounce this morning as the non-interest-return assets lost its attraction. The price now is temporarily supported by the middle line of the bearish channel.

Asian stock markets rose yesterday led by the Chinese market. The Shanghai Composite rocketed by 1.5% to 2373 as the Hong Kong authority said the preparation of Shanghai-HK market link has been complete. ASX 200 lost 0.09% to 5448. The Nikkei Stock Average also rose 1.46% to 15553. In European stock markets, the UK FTSE was up 0.81%, the German DAX edged up by 0.16% and the French CAC Index closed flat. The US market once fell on the statement but recovered most of the loss later. The S&P 500 slid 0.14% to 1982. The Dow slid 0.18% to 16974, while the Nasdaq Composite Index lost 0.33% to 4549.

On the data front, German CPI and Unemployment Change will be released today. US Advance GDP and Unemployment Claims will be out at 23:30 AEST and Yellen’s speech will begin at midnight.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.