Being the last trading of September, we can comfortably look back and see who how strongly the US Dollar has been performing this last month against the other majors as a whole. Back in early September, I wrote in the column ‘The era of the US Dollar has truly come’, about how the market was reassuring as leaving little doubt to the return to trend. The golden advice of trading where “a trend is a friend” stays true. While we see no signs of reversal on the Dollar yet, the best strategy now would still be to follow the trend.

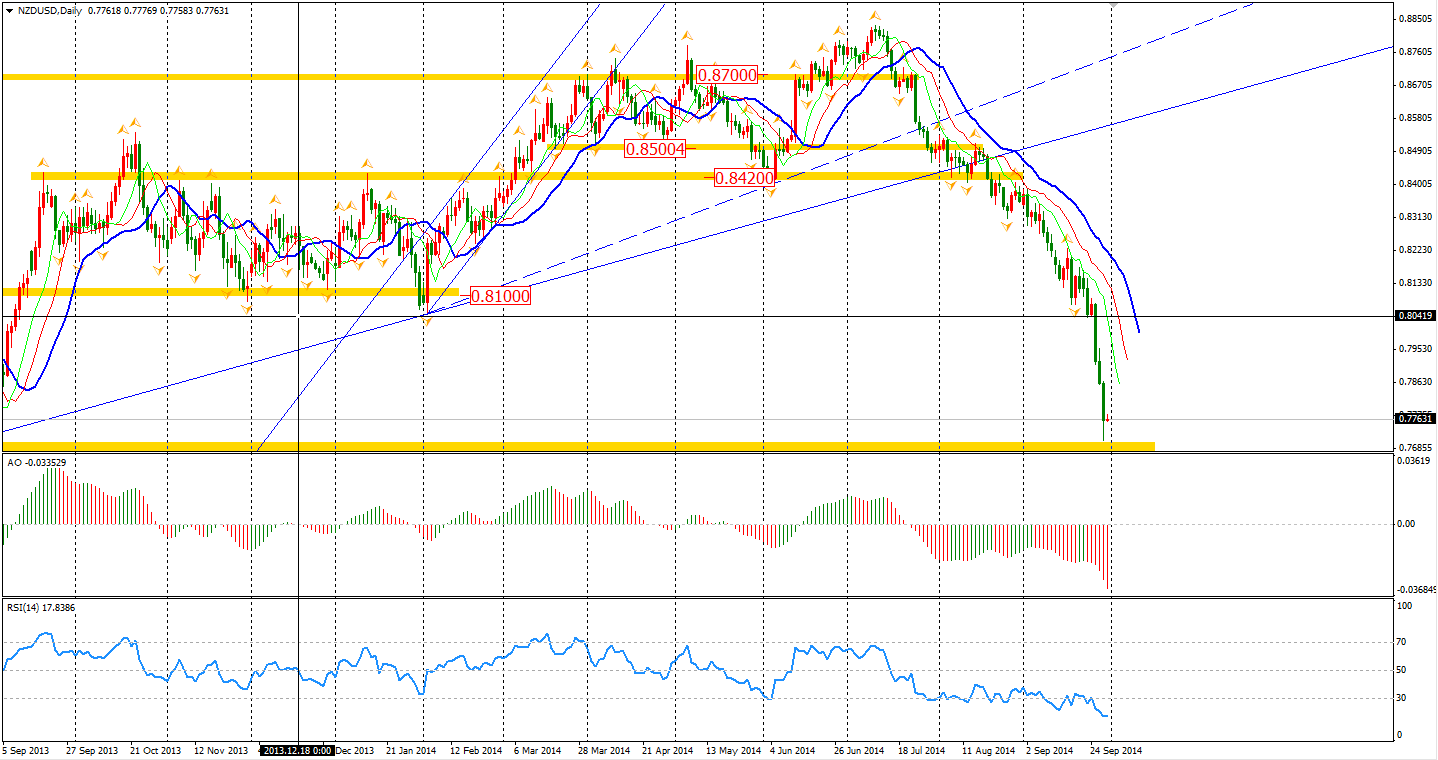

The New Zealand Dollar was the weakest major currency yesterday, falling 1.3% against the US Dollar. In the Asian Monday morning session, the RBNZ disclosed that the central bank had intervened in the forex market in August selling a net of NZ$521 million – the highest amount in seven years. The Kiwi/Dollar dropped to a day low of 0.7709 after the news. The RBNZ thinks the fair level should be 0.65 yet it seems like the fall won’t be over in the middle run.

Just like how carry trade strategies would fail as volatility returns, will the global stock market bull trend stop as the economy slows down and higher risk is making some investors withdraw their investments?

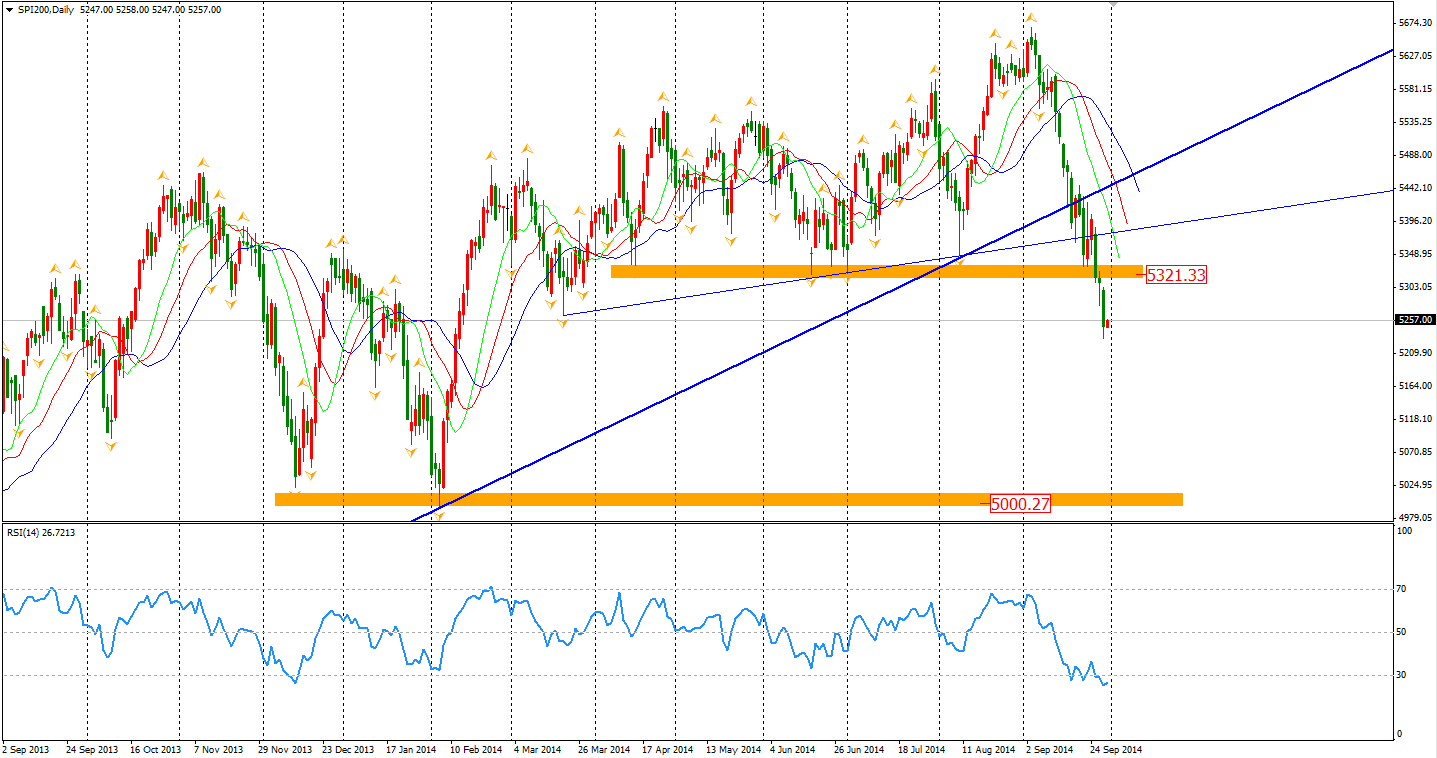

The Australian ASX 200 slumped by 0.93% to 5264. The index has already broken the bullish trendline formed since mid-2012 and also the support near 5320. From a technical view, it is heading towards the year’s low 5000 integer level.

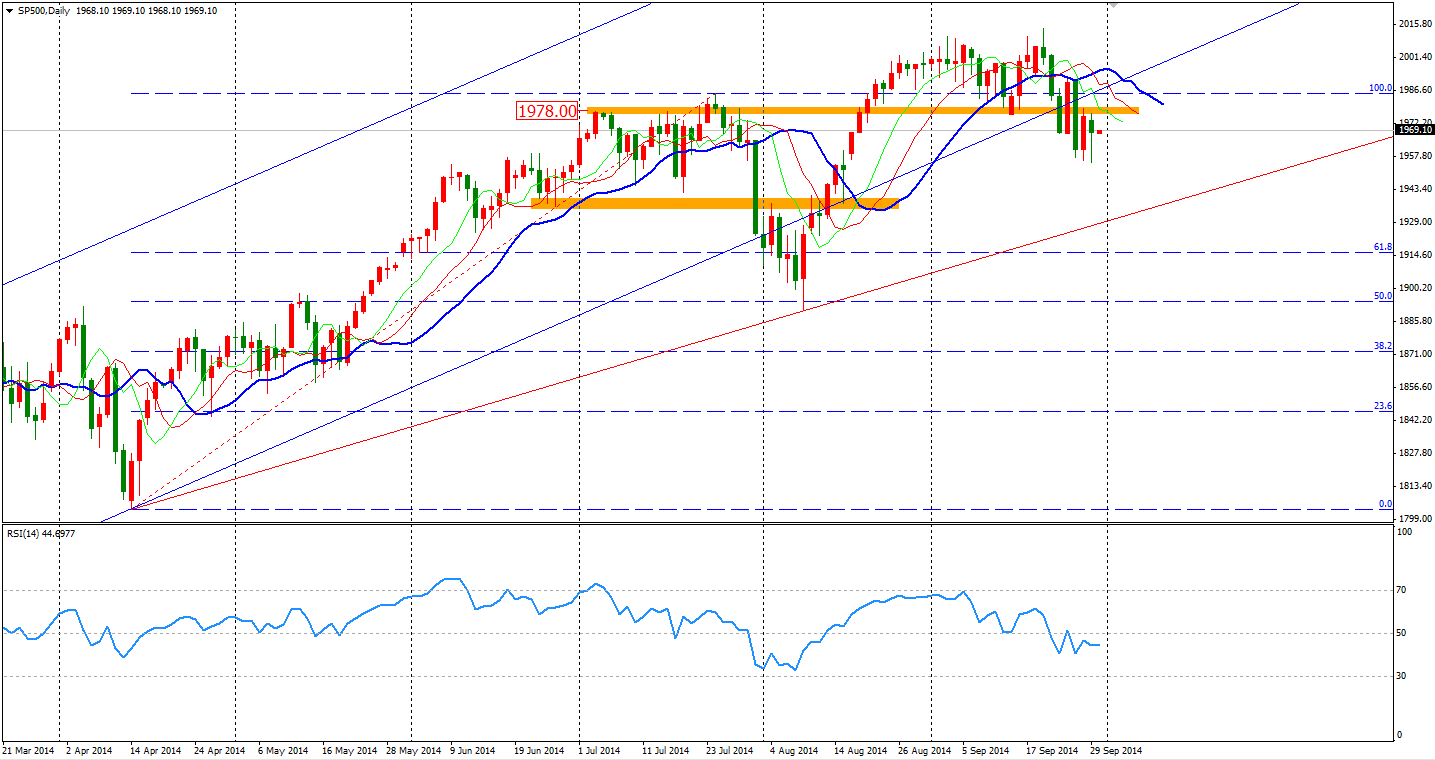

In other Asian stock markets, the Shanghai Composite moved by 0.43% up to 2357. The Nikkei Stock Average rebounded by 0.5%. In European stock markets, the UK FTSE was down 0.04%, the German DAX lost 0.71% and the French CAC Index fell 0.83%. U.S. stocks continued the weakness. The S&P 500 lost 0.25% to 1978. The Dow edged down 0.25% to 17071, while the Nasdaq Composite Index dropped 0.14% to 4506.

We also saw a reverse sign for the S&P 500 as it failed to rise back to the area beyond the 1978 level. A bottom top pattern has revealed itself in the daily chart.

For the data front, the UK Current Account and Unemployment Rate will be closely watched at 18:30. The Eurozone CPI and Unemployment Rate will be 30 minutes after this. At the beginning of US trading hours, the Canada GDP and US CB Consumer Confidence will be released.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.