Tensions in the Ukraine have escalated again last week as NATO claims to have satellite images showing that Russian soldiers entering the Ukrainian border joining the rebel forces. The Ukrainian government stated that a full-scale war is on the horizon whilst EU member-states are discussing another round of sanctions on Russia.

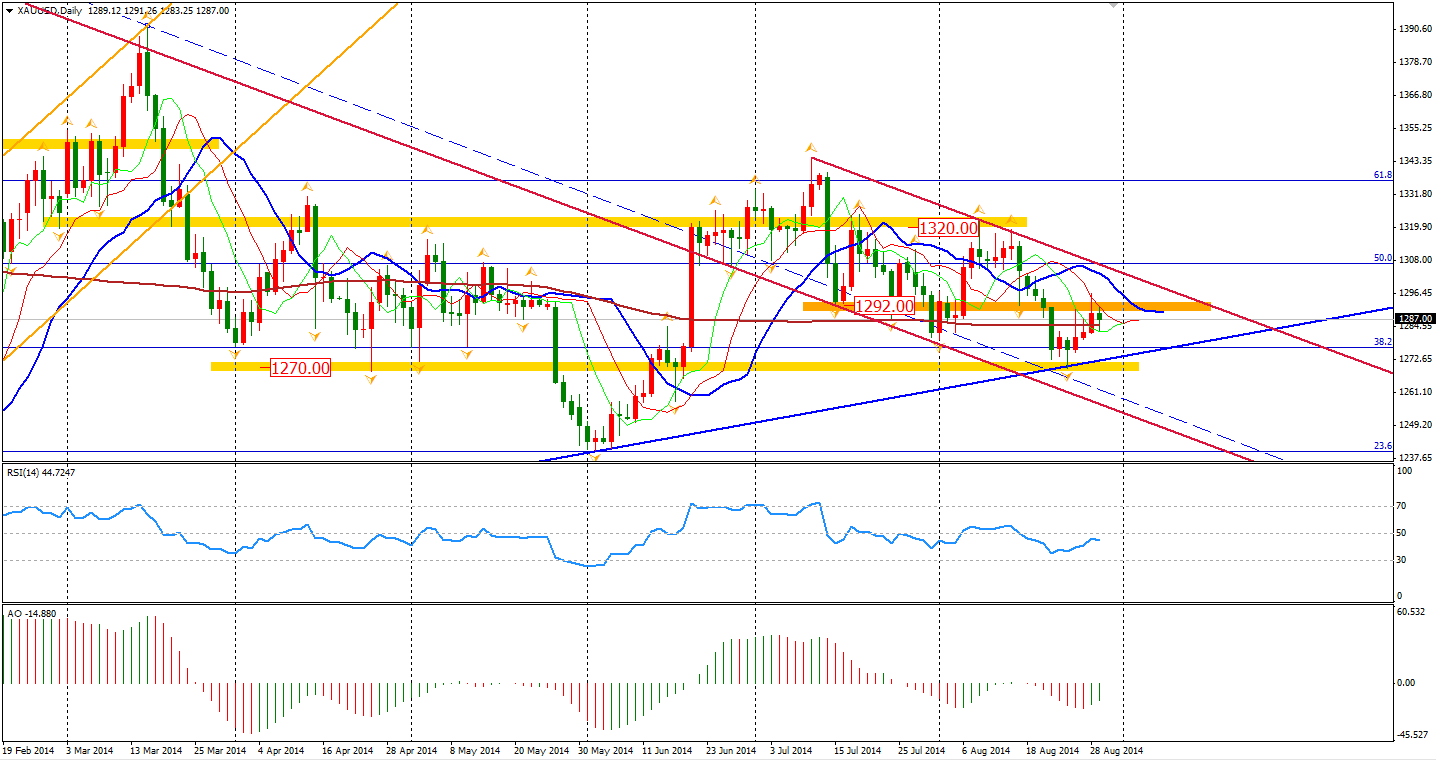

Personally, I don’t think Russia will add heat to the situation this week as they can’t truly benefit from a real war. A large-scale war against the Western world would certainly be an unwise choice for the Kremlin. It appears that they are simply using the situation to bargain for a better deal. The movement of Gold seems to reflect how other traders are also of this thinking. Gold failed to stand beyond the important level $1292 on Friday but managed to stay upon the 200-day Moving Average. It may drop to $1270 support again soon.

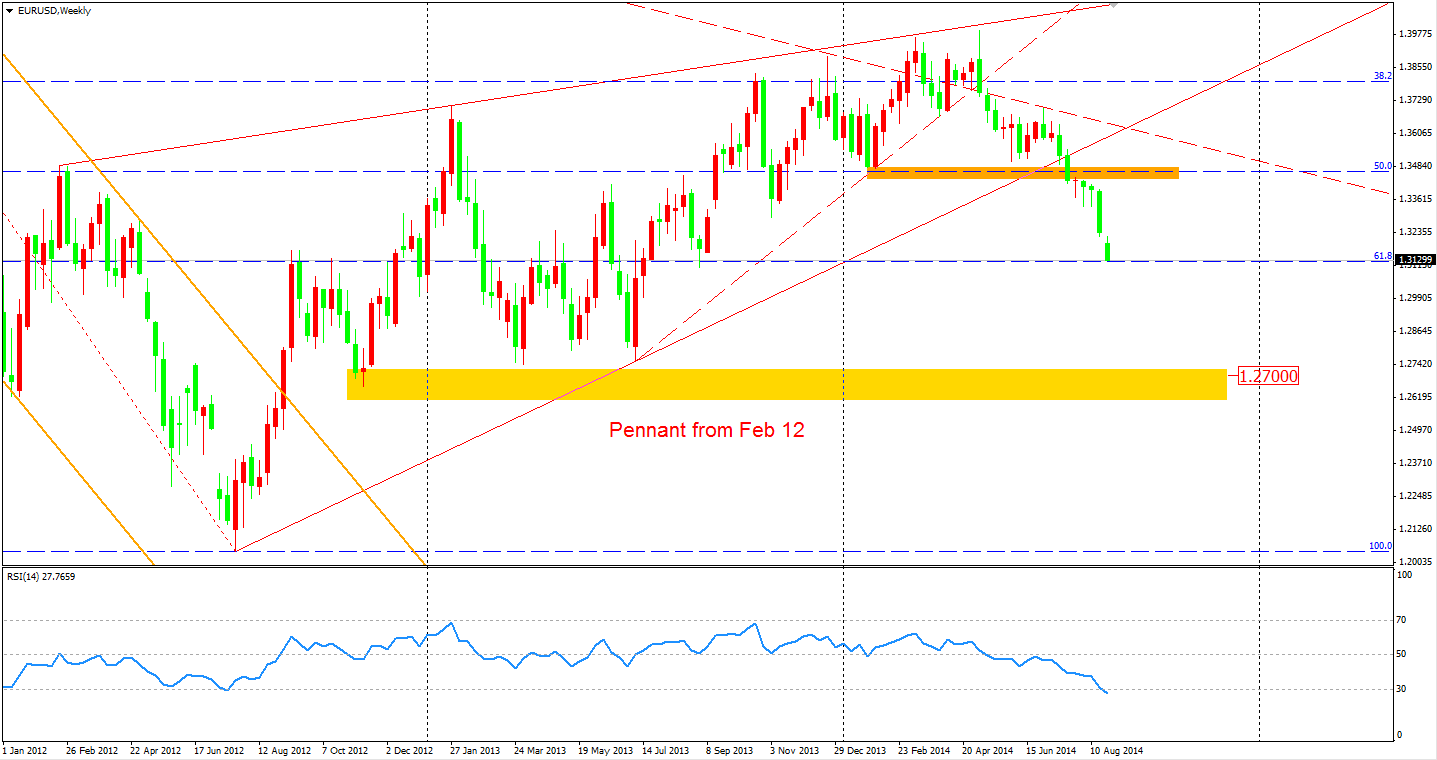

An important item in this month’s calendar key events is the next ECB meeting happening on Thursday. A more dovish statement is expected and Governor Draghi may disclose more details about QE or ABS purchasing program. However, actions may not be implemented in this meeting, as the ECB may be waiting for confirmation of a decreasing inflation rate and may need more time to observe the effects from June’s rate cut. The Euro closed at a new low for the year at 1.3132.

China’s market led the rise for the Asias stock markets on Friday. The Shanghai Composite surged near 1% up to 2217. The Nikkei Stock Average lost 0.23%. The Australian ASX 200 was up 0.03% to 5626. In European stock markets, the UK FTSE rose 0.20%, the German DAX gained 0.08% and the French CAC Index lifted 0.34%.

U.S. stocks kept the rising with the NASDAQ Composite Index hitting its highest level since March 2000. The Hi-tech stocks Index was down 0.50% to 4580. The S&P 500 rose 0.33% to 2003 – another new record high. The Dow gained 0.11% to 17098.

On the data front, China official Manufacturing PMI will be released at 11:00 AEST and HSBC Manufacturing PMI will be at 30 minutes after. In the early European session, traders will look at UK Manufacturing PMI at 18:30 AEST. Today is the U.S. Labour day, so lower trading volume can expected around midnight.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold rebounds to $2,320 as US yields edge lower

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.