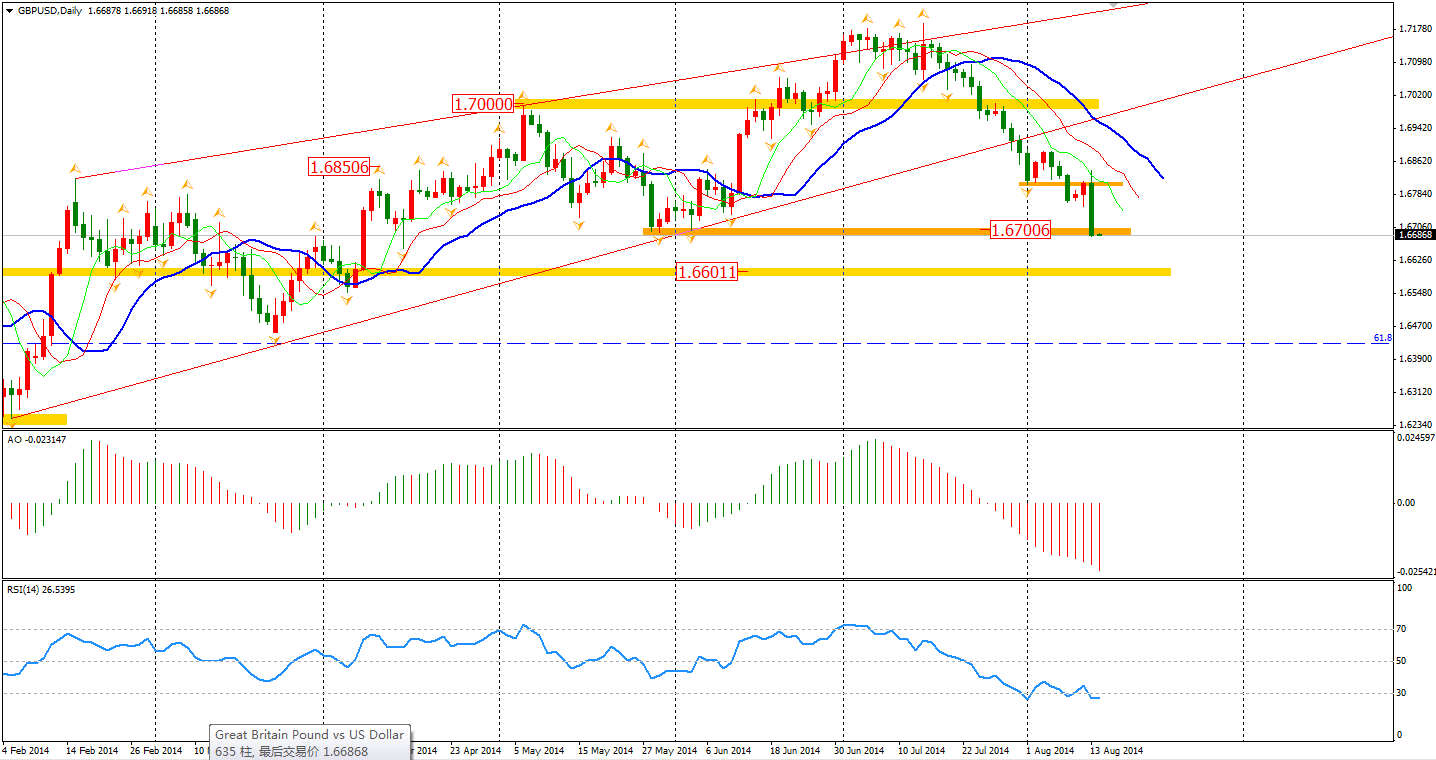

The Sterling plummeted to 1.67 against Dollar last night, after the BOE Governor Carney’s dovish speech. Carney implied that the plain wage growth would delay the timing for rate rising. The next bears’ target will be March’s low at the 1.66 integer level as the space for falling Sterling has been opened since it broke the uptrend channel. It is likely that the current level at 1.67 will soon break through. A noteworthy aside though, the UK unemployment rate fell to 3% in July, confirming the robust recovery of the economy. Can the UK experience a solid growth without inflation pressure?

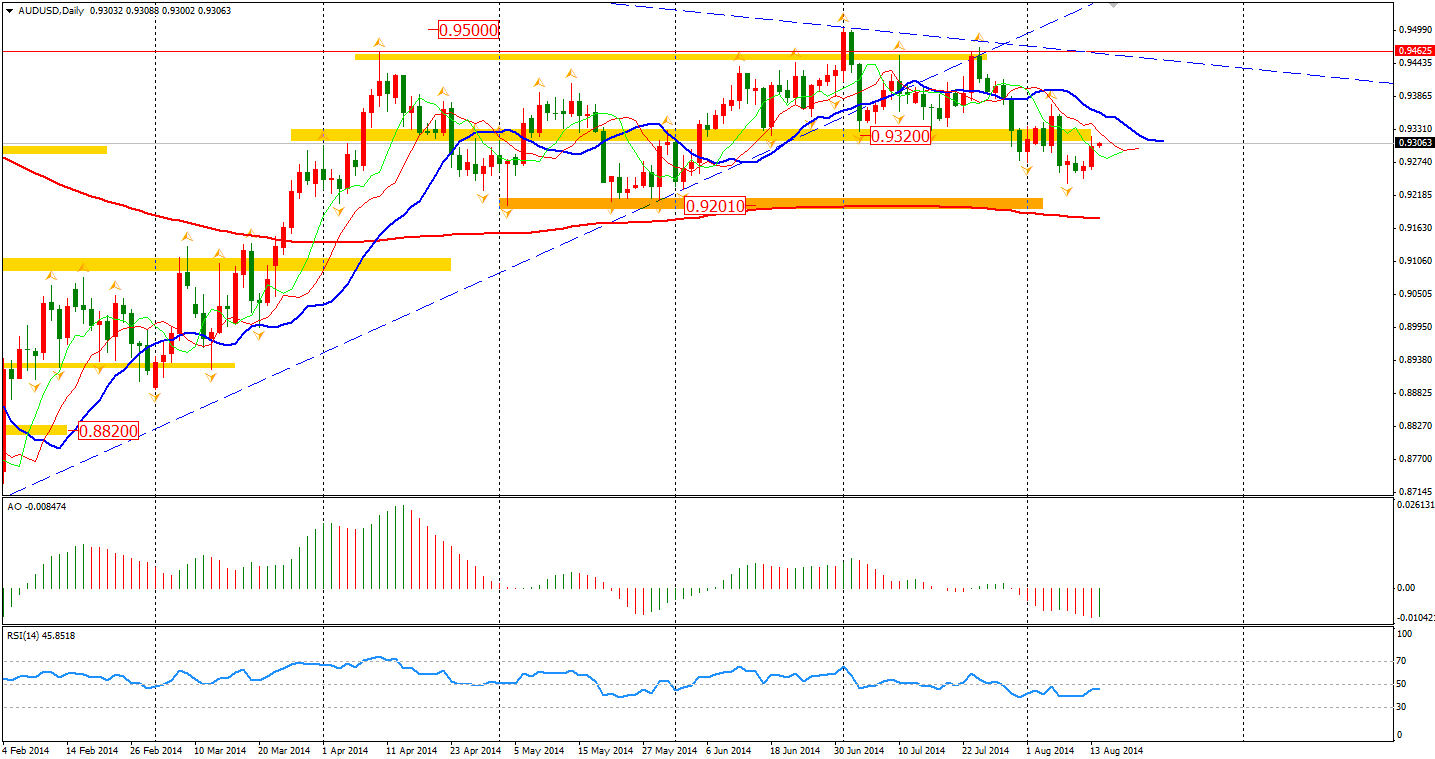

U.S. Retail Sales released a no growth result in July, disappointing investors as expectations were set at 0.2% growth. This is the lowest pace in the recent 6 months. The USD was under pressure after the data. Aussie led the rebound of commodity currencies against Dollar. It rose back beyond the 0.93 level. However, don’t forget the fact that 0.9320 is the neckline of head-and-shoulders pattern which we have mentioned a couple times. The near term outlook of Aussie is still permissible.

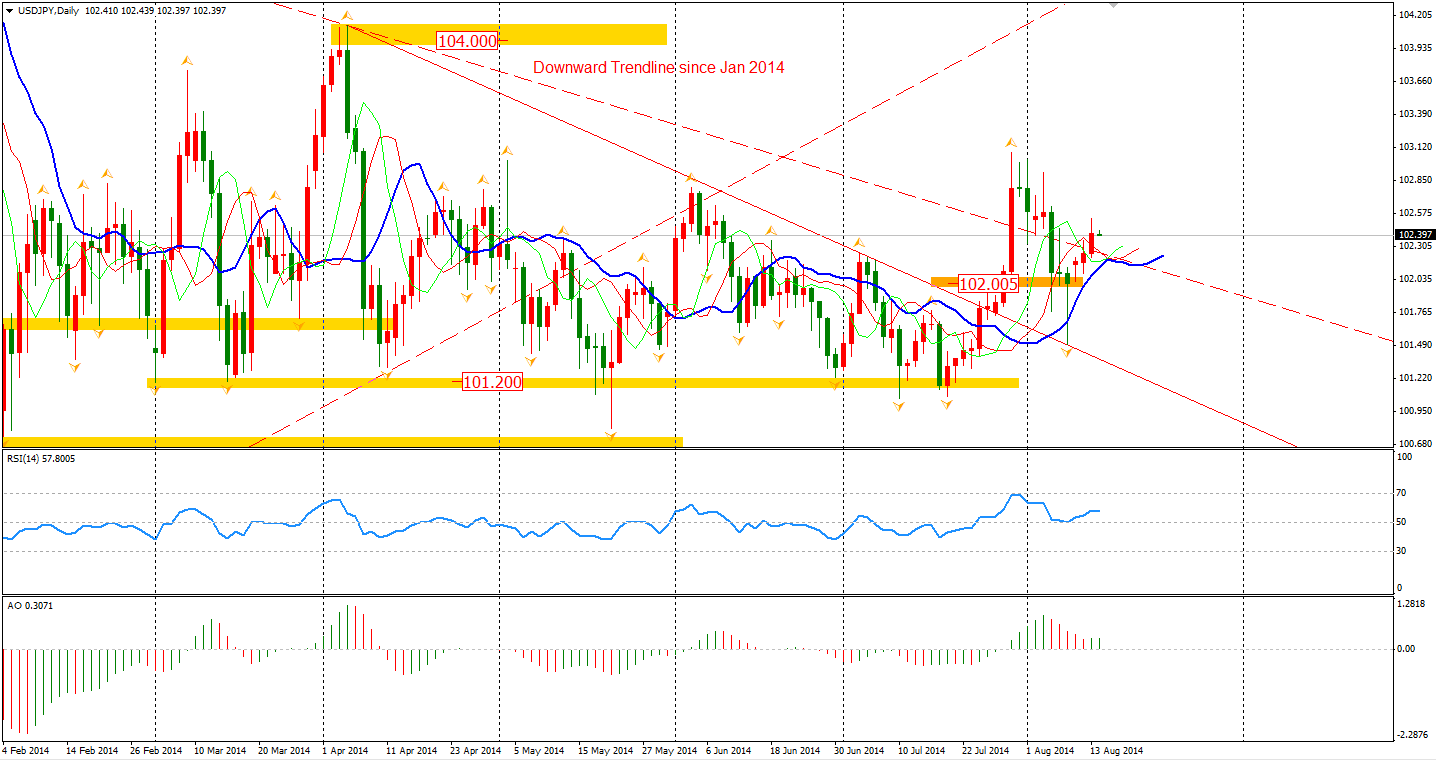

Japan’s Q2 economy contracted by 6.8% as expected. Yen kept its slow depreciation against major currencies as investors are still cautious of the sudden rising of the Yen in reaction to the warfare in Middle East.

Asian stock markets finished with mixed results yesterday. The Nikkei Stock Average rose 0.35% despite the large contraction of the Japanese Q2 GDP. The Shanghai Composite edged 0.06% higher to 2223. The Australian ASX 200 retreated 0.28% to 5514. In European stock markets, the FTSE gained 0.37%, the German DAX surged 1.43%, and the French CAC Index advanced 0.78%. U.S. stocks closed higher as downbeat retails sales lowered rate raising expectation. The Dows closed rose 0.55% to 16652. The S&P 500 gained 0.67% to 1947, and the Nasdaq Composite Index was up 1.02% to 4434.

On the data front, light releases in the Asian period, but French and Germany Q2 GDP will be out at the beginning of European session, followed by Eurozone data. Also, the weekly US Unemployment is at 22:30 pm.

MXT Global Pty Ltd ACN 157 768 566 AFSL 428901. Trading derivatives and forex carries a high level of risk to your capital and should only be traded with money you can afford to lose. Ensure you read our FSG, PDS and Terms & Conditions, and seek independent advice, to fully understand the risks, before deciding to enter into any transactions with MXT Global. The general information on this website is not directed at residents in any country or jurisdiction where such distribution or use would contravene local law or regulation.

Company disclaimer for reports:

#The views and content above are Anthony Wu's own and do not reflect the views of MXT Global.

The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, analyses, prices or other information is provided as general market commentary and not as investment advice.

MXT Global does not warrant the completeness, accuracy or timeliness of the information supplied, and shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content.

No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.#

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY holds rebound near 156.00 after probable Japan's intervention-led crash

USD/JPY consolidates the rebound near 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price struggles for a firm intraday direction, hover above $2,300

Gold price fails to lure buyers amid a fresh leg up in the US bond yields, modest USD uptick. A positive risk tone also contributes to capping the upside for the safe-haven precious metal. Traders, however, might prefer to wait for the US NFP report before placing aggressive bets.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.