The euro has started the trading week with losses, as the pair trades at the 1.1060 in the European session. On the release front, German and Eurozone Manufacturing PMIs missed their estimates. In the US, there is only one event on the schedule, Manufacturing PMI. On Tuesday, there are two key releases – German Ifo Business Climate and US CB Consumer Confidence.

German PPI, which measure inflation in the manufacturing sector, looked dismal in January, with a decline of 0.7%. This was shy of the estimate of -0.3%. So it comes as no surprise that German Flash Manufacturing PMI also missed expectations, with a reading of 50.2 points, barely above the 50-line, which separates contraction and expansion. Eurozone Flash Manufacturing PMI was a bit better at 51.0 points, but also missed the estimate. Eurozone’s manufacturing sector has been hit hard by the Chinese slowdown, as the Asian giant is the Eurozone’s second largest trading partner. These weak readings are making it increasingly difficult for the ECB to remain on the sidelines as the Eurozone economy continues to struggle. Will Mario Draghi and Co. make a move at the March policy meeting? Possible monetary moves include adopting negative interest rates (a step recently taken by the BoJ) as well as increasing the current quantitative easing scheme, which currently involves purchasing assets at 60 billion euros/mth. Either of these moves would likely shake up the currency markets and weaken the euro.

The Federal Reserve sent out a cautious message in last week’s minutes, which reiterated the central bank’s concern that turmoil in global markets could have negative repercussions for the US economy. Policymakers sent out a broad hint that a rate hike is unlikely in March, as they discussed “altering their earlier views of the appropriate path for the target range for the federal funds rate”. This could have a negative impact on the US dollar, as investors may look elsewhere to park funds if US rates are not moving higher anytime soon. Federal Reserve chair Janet Yellen said last week that the Fed still planned to raise rates later in 2016, but FOMC member James Bullard argued that there was room to delay any rate moves, given global financial turmoil and weak US inflation. Still, a growing number of market players are skeptical that the Fed will make any moves before next year. Back in the heady days of December, the Fed hinted at a series of rate hikes during 2016, but the turmoil in the financial markets and the downturn in the US economy in 2016 have quickly dampened expectations of a rate move.

Monday (Feb. 22)

3:00 French Flash Manufacturing PMI. Estimate 49.9 points. Actual 50.3 points

3:00 French Flash Services PMI. Estimate 50.4 points. Actual 49.8 points

3:30 German Flash Manufacturing PMI. Estimate 52.1 points. Actual 50.2 points

3:30 German Flash Services PMI. Estimate 54.8 points. Actual 55.1 points

4:00 Eurozone Flash Manufacturing PMI. Estimate 52.1 points. Actual 51.0 points

4:00 Eurozone Flash Services PMI. Estimate 53.4 points. Actual 53.0 points

9:45 US Flash Manufacturing PMI. Estimate 52.3 points

Upcoming Key Events

Tuesday (Feb. 23)

4:00 German Ifo Business Climate. Estimate

107.00 10:00 US CB Consumer Confidence. Estimate 97.4 points

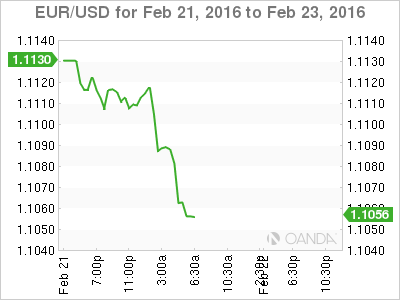

Open: 1.1122 Low: 1.1055 High: 1.1123 Close: 1.1063

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0847 | 1.0941 | 1.1087 | 1.1172 | 1.1278 | 1.1349 |

EUR/USD was flat in the Asian session and has posted losses in European trade

There is weak resistance at 1.1172

1.1087 is providing support

Current range: 1.1087 to 1.1172

Further levels in both directions:

Below: 1.1087, 1.0941 and 1.0847

Above: 1.1172, 1.1278, 1.1349 and 1.1495

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.