The Canadian currency was quick to give back the gains from last week as the price of oil tumbled below $30 during the European session. Comments from the Organization of the Petroleum Exporting Countries (OPEC) seeking to stabilize the energy market alongside Russia were unsuccessful. Russian sources have been quoted as saying due to the nation’s oil production set up Russian oil is profitable at current levels. Those comments and the fact that Iraq announced record levels of production and Saudi Arabia’s investment to remain unchanged once again made oversupply concerns depreciated the price of crude.

The USD/CAD had finished last week at 1.4130 after a rebound in oil prices and good Canadian economic indicators. This week the loonie was quick to give back some of the gains as the pair trades at 1.4269.

The USD/CAD was one of the most volatile pairs on Monday. It appreciated 1.046 percent in the last 24 hours with the majority of the direction to the upside following the oil production comments from OPEC and non-OPEC members.

The Canadian delegation from Davos returns after making a positive impact on the world stage, but with plenty of questions on what it intends to do to boost the economy. The budget to be unveiled March is heavily awaited as the conventional monetary policy tool kit is quite limited and there is a need for fiscal stimulus before dipping into unconventional policies such as quantitative easing (QE). The Canadian economy is facing the brunt of the fall of commodity prices and is seeking to diversify as soon as possible. The weak loonie has been a boon for some industries such as tourism and film which can adapt quickly, but has taken manufacturing longer to recover and it remains to be seen if it can do so at all, after ironically the strong loonie made factories shutdown to be relocated to other nations seeking cost advantages.

The Canadian economic calendar is sparse this week with the monthly gross domestic product on Friday, January 30 the main highlight. The forecasts call for a 0.3 precent increment in November. Canadian retail sales for the same period surprised to the upside last week so there is optimism about the November data given the boost to retailers. The price of oil had not deteriorated as much as it did in the first weeks of 2016 which also will show up in the final GDP number released at the end of the week.

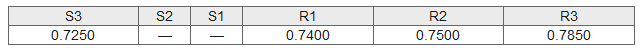

USD/CAD Technical

USD/CAD events to watch this week:

Wednesday, January 27

10:30am USD Crude Oil Inventories

2:00pm USD FOMC Statement

2:00pm USD Federal Funds Rate

3:00pm NZD Official Cash Rate

3:00pm NZD RBNZ Rate Statement

4:45pm NZD Trade Balance

Thursday, January 28

4:30am GBP Prelim GDP q/q

8:30am USD Core Durable Goods Orders m/m

8:30am USD Unemployment Claims

Tentative JPY Monetary Policy Statement

Friday, January 29

12:00am JPY BOJ Outlook Report

Tentative JPY BOJ Press Conference

8:30am CAD GDP m/m

8:30am USD Advance GDP q/q

*All times EST

-------

Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.