The USD advanced 0.353 versus the CAD in the last 24 hours.

The USD/CAD touched multi-year highs (1.4316) as the price of oil continues to tumble as supply is far outstripping demand around the globe. The loonie was last at the 70 cent level in 2003. The currency showed some resilience after the crisis of 2008, but that was aided by firm energy prices. The slowdown in emerging market demand for crude coupled with the increased production levels with the introduction of new technology and the controversial pumping war drove the price of West Texas to below $30 earlier today.

The Canadian dollar is a commodity currency with crude oil exports making up 13 percent of Canadian exports. The loonie has fallen 40 percent since January 2013. The economic irony is that the strong CAD after the crisis eroded all the price advantages of Canada’s manufacturing base, which is now forced to rebuild in an adverse scenario as global growth is slowing down. The Canadian economy depends on the recovery of its largest trading partner to mitigate the losses of its energy exports, but as the U.S. economy shows no sign of fast recovery the Bank of Canada might be forced to cut interest rates in January.

The U.S. crude oil inventories will be published the Energy Information Administration on Wednesday, January 13 at 10:30 am and given the volatility in energy prices and the heavy correlation with the CAD investors need to be aware of the change in crude stockpiles.

The Bank of Canada released its Business Outlook survey yesterday. The softness from the resource sector is spreading as commented by Governor Stephen Poloz. Business sentiment remains pessimistic and could be worse as the survey was before the latest rout in oil prices.

Canadian Finance Minister Bill Morneau echoed the sentiment regarding the increasing headwinds to the economy if commodity prices remain soft. After winning the elections last year there was a lot of hope in the new government and Mr. Morneau is still confident the Liberal government’s plans to increase infrastructure spending and tax cuts will boost growth. The Canadian budget is expected to be announced in March.

Merrill Lynch expected the BOC to make waves next week with a rate cut. Laurentian Bank call it a “coin flip” as the case for a rate cut keeps rising as fast as the price of oil is falling. The Canadian central bank surprised markets last year with 2 proactive rate cuts after it accurately forecasted the fall of oil prices and its effect on the economy. This time around the central bank is facing a different scenario as the main questions now are: What is the Fed going to do and how long with energy producers maintain pumping levels? In both cases there is little the BOC can do even with a proactive stand.

There will be little in the way of indicators to guide the decision of the central bank as only the Housing starts and the selling price of new homes will be on the agenda this week. The Bank of Canada will announce its rate decision on Wednesday, January 20. The problem with being ahead of the Fed’s Federal Open Market Committee (FOMC) is that it means going in blind to the potential market disrupting decisions of the biggest central bank in the world. There are also no expected changes to the American benchmark rate despite the hawkish rhetoric from some Fed members. Interest rate divergence has given the edge to the USD for the last two years, with very little to show for it as the Bank of Canada has eased more than the Fed has tightened, but with the price of oil the BOC is running out of room to cut.

Oil inventories will be announced Wednesday, January 13 at 10:30 am and given the volatility in energy prices and the heavy correlation with the CAD investors need to be aware of the change in crude stockpiles.

USD/CAD 1.4272 H: 1.4316 L: 1.4177

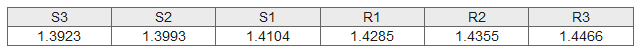

USD/CAD Technical

- Wednesday, January 1310:30am USD Crude Oil Inventories

- Thursday, January 147:00am Bank of England Rate Decision and Minutes

- Friday, Jan 158:30am USD Core Retail Sales

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.