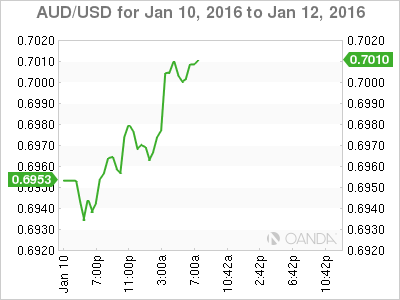

The Australian dollar has posted considerable gains on Monday, as AUD/USD trades at the 0.70 level in the European session. On the release front, it’s a quiet start to the week, with two minor releases on the schedule. Australian ANZ Job Advertisements disappointed with a decline of 0.1%, marking a 5-month law. The lone US release on the calendar is the Labor Markets Condition Index.

The first week of January was a disaster for the Australian dollar, which plunged some 340 points against its US counterpart. The Aussie recorded daily lows every day last week, dropping to lows last seen in late September. The Aussie has been steamrolled early in 2016 as nervous investors have dumped minor currencies like the Australian dollar in favor of the safe-haven US dollar. The plunge was precipitated by disappointing Chinese manufacturing data last week, underscoring weak demand from the world’s number two economy. This is bad news indeed for the Australian economy, as China is Australia’s largest trading partner. Australian Building Approvals, a key release, posted a sharp decline in November, which further weakened the Aussie. Market jitters intensified as tensions rose between Iran and Saudi Arabia and a nuclear device test by North Korea. Adding fuel to the fire, China has devalued the yuan by over 0.5%, triggering another bout of risk-aversion by investors.

In the US, Nonfarm Payrolls surged to 292 thousand, crushing the estimate of 203 thousand. This was the strongest reading in 10 months, and underscores a strong US employment market. The unemployment rate remained unchanged at 5.0%. The Fed will probably not make another move at its policy meeting at the end of January, so soon after the historic rate hike in December. However, many experts are expecting the Fed will raise interest rates in March. Such a move would likely make the US dollar assets more attractive to investors and boost the greenback against its rivals. If the US economy continues to heat up, the Fed is expected to continue to tighten monetary policy over the course of 2016.

Last week, the Federal Reserve released the minutes of its historic December policy meeting, at which it raised rates by 0.25 percent. The minutes were noteworthy in highlighting differences among policymakers as to whether US inflation levels will improve. Indeed, some FOMC members said that their vote in favor of a rate hike was a close call because of concerns that low inflation levels will continue in 2016. What’s next? The Fed has hinted that the December rate is the first of a series of incremental moves in 2016, but inflation levels will play an important role in the timing and size of future rate hikes.

AUD/USD Fundamentals

Monday (Jan. 11)

19:30 Australian ANZ Job Advertisements

10:00 US Labor Market Conditions Index

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.6754 | 0.6848 | 0.6931 | 0.7063 | 0.7100 | 0.7213 |

AUD/USD has posted gains in the Asian and European sessions

There is resistance at 0.7063

0.6931 is providing support

Current range: 0.6931 to 0.7063

Further levels in both directions:

Below: 0.6931, 0.6848 and 0.6754

Above: 0.7063, 0.7100, 0.7213 and 0.7349

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.