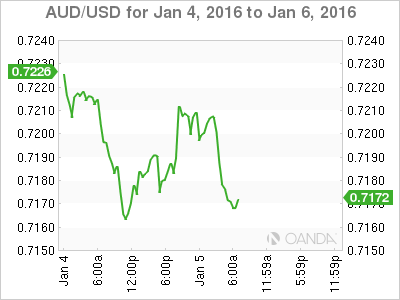

The Australian dollar has posted slight losses on Tuesday, as AUD/USD trades at 0.7170 in the European session. On the release front, the lone US event is Total Vehicle Sales. Australia will release the AIG Services Index.

There hasn’t been much cheer for the Aussie as we start the New Year. AUD/USD dropped over 100 points on Monday, the first trading day of 2016. The sharp drop was largely due to a disappointing reading from Chinese Caixin Manufacturing PMI. The key indicator slipped to 48.2 points in December, short of the forecast of 48.9 points. The index managed to break above the 50-point level only once in 2015, pointing to ongoing contraction in the Chinese manufacturing sector. Meanwhile, Australian Commodity Prices continues to post sharp declines, and slipped 23.3% in December. These figures underscore decreased Chinese demand for Australian exports, which has hurt the Australian economy and weakened the commodity-based Australian dollar. The Australian dollar remains under strong pressure, and with the US dollar looking sharp, it could be a miserable January for the Australian currency.

The US economy showed strong improvement in 2015 and received a vote of confidence from the Federal Reserve, which raised interest rates just before the end of the year. At the same time, certain sectors which have lagged behind the recovery, such as the manufacturing industry. Recent manufacturing releases have missed expectations, and the negative trend continued on Monday. ISM Manufacturing PMI, a key indicator, slipped to 48.2 points, well short of the forecast of 49.1 points. This weak reading is raising concerns, since it marks back-to back releases below the 50-point level, which separates expansion from contraction. It is also the sixth consecutive month that the PMI has softened. As well, ISM Manufacturing Prices dipped to 33.5 points, well below expectations.

AUD/USD Fundamentals

Tuesday (Jan. 5)

All Day – US Total Vehicle Sales. Estimate 18.1M

22:30 Australian AIG Services Index.

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.6931 | 0.7063 | 0.71 | 0.7213 | 0.7349 | 0.744 |

AUD/USD posted slight gains in the Asian session, but lost these gains in European trade and continues to move lower

0.7213 is a weak resistance line The round number of 0.7100 is providing support

Current range: 0.7100 to 0.7213

Further levels in both directions:

Below: 0.7100, 0.7063 and 0.6931

Above: 0.7213, 0.7349, 0.7440 and 0.7526

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.