Attention will be firmly on the U.S. on Wednesday ahead of the Thanksgiving bank holiday, as we get a broad range of important economic indicators that should offer crucial insight into the health of the U.S. economy.

When considering whether the Federal Reserve will raise interest rates next month, there is naturally a lot of emphasis on the U.S. jobs report as we saw earlier this month and will see again next week. However, there are a number of indicators that the Fed is looking at that can and will influence its decision to either raise rates or hold off until early next year and a number of these will be released today.

While it is difficult to pick the most important among these, the personal consumption expenditure price index surely stands out, given that it is the Fed’s preferred inflation measure. The labour market is looking more than healthy enough to warrant a rate hike, which means all focus in the next few weeks will be on the outlook for inflation. The core reading is expected to show prices rising by 1.3% compared to October last year which is unchanged from September but probably good enough for the Fed to push ahead as planned. Another decline here would worry investors and once again call into question whether the Fed will act.

While current levels of inflation are of course important, the temporary deflationary pressures have forced the Fed to focus more on the outlook and its ability to keep a lid on inflation when it does start rising again, hence the desire to raise even when it’s still well below its target. This makes personal income and spending figures very interesting, both of which are expected to have picked up in October from 0.1% to 0.4% and 0.3%, respectively. Income is particularly important as higher wages tend to be passed on to the end consumer, creating the inflationary pressures the Fed craves.

There are a number of other notable releases today, all of which could influence the Fed decision and therefore could create some volatility in the markets, especially as many of them are released simultaneously. Given how much information that investors have to absorb, we could well see large amounts of volatility initially before markets stabilise and find their levels. Durable goods orders will be among these reports and are expected to bounce back a little following two negative reports, although core orders are expected to remain somewhat subdued which acts as another reminder that this recovery is facing strong headwinds and is likely to continue to stall in the year ahead.

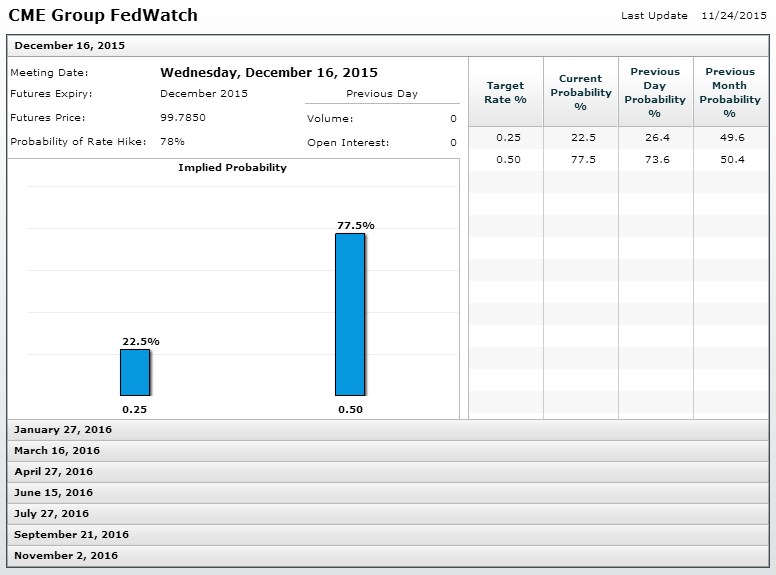

It is worth noting that Fed Funds futures are now pricing in a 78% chance of a rate hike in December, which is extremely high considering that the decision is far from guaranteed and the data has certainly not been perfect.

While I do believe that the rate hike will come in December, the market can be quite fickle and if we see a few disappointing numbers today – which is likely given the inconsistency in the data all year – the question of whether the Fed will/should hike will start all over again.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.