U.S. futures are little changed as we approach the open on Friday, as investors adopt a more cautious approach ahead of the penultimate jobs report before December’s highly anticipated FOMC meeting. The Federal Reserve has consistently stated that it intends to raise interest rates this year as long as the economy continues to recover in line with its expectations, which was clearly the case up until its October meeting when it once again reaffirmed its position, despite a weakening in the data and growing headwinds from abroad.

Moreover, recent comments from Fed officials have been uncharacteristically on message. Chair Janet Yellen claimed on Wednesday that a December rate hike is a “live possibility”, vice Chair Stanley Fischer claimed that the 2% target may be met quickly once temporary deflationary pressures pass and other policy makers have made similarly supportive comments. Given that the Fed seems content with the data despite poor third quarter growth and softer jobs reports in the last couple of months, it seems we’ll have to see a significant deterioration in the data over the next six weeks for the Fed to reconsider.

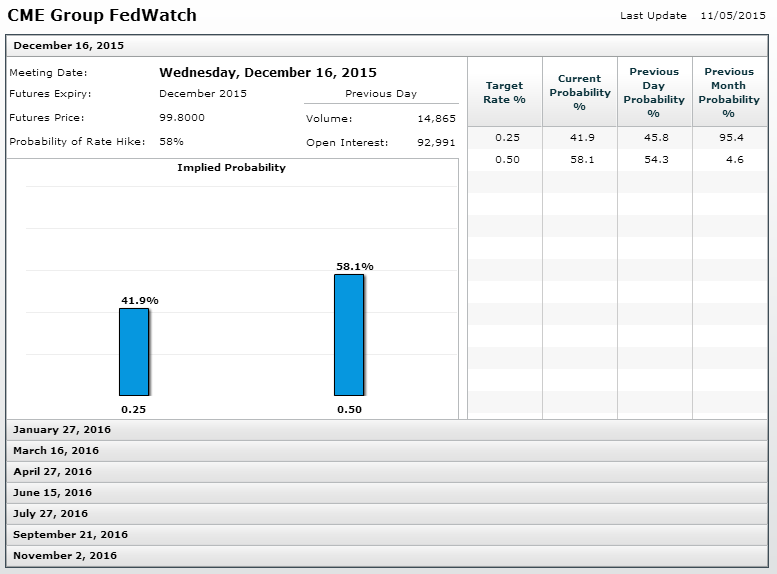

Today’s jobs report is one of only two to come before the December meeting and if the numbers are in line with market expectations – 180,000 jobs created, unemployment at 5.1% and hourly earnings up 0.2% – I think this will more than satisfy the Fed’s rate hike requirements. It will also take some pressure off the November report if October can meet or exceed expectations. Fed Funds futures are currently pricing in a 58% chance of a Fed hike in December and if we get a good jobs report today, that number will only increase. This is quite a difference from the 35% we were seeing prior to the October meeting.

EURUSD

We’ve seen a substantial decline in this pair as markets price in the increasingly diverging monetary policies of the Fed and ECB. The pair found some stability just above 1.08 yesterday which has been a key level of support since it broke above here back in April. We’re seeing consolidation in the pair again today, with traders adopting some caution ahead of the meeting. If we see a good jobs report today, we could see this support come under significant pressure, with a break opening up a move back towards this year’s lows around 1.0450. Under this scenario parity by year end would be a very real possibility, especially if we also see additional stimulus from the ECB. It’s been suggested that a U.S. rate hike may not be a big driver in the pair going forward but I strongly disagree. At only 58%, this hike is far from fully priced in and as long as that’s the case, there remains plenty of scope for the dollar to appreciate more.

Gold

Gold has been one of the victims of the sudden repricing of a Fed rate hike in the markets. Having traded at close to $1,200 less than a month ago, it is now trading back near $1,100 and further losses may follow today. Increasing odds of a rate hike is generally bearish for Gold and if we see a good jobs report today, $1,100 could break which would bring July lows of $1,071.80 into focus in the short term but beyond that, $1,000 could come under serious pressure by year end, the first time it will have traded here since October 2009.

The S&P is expected to open 2 points higher, the Dow 28 points lower and the Nasdaq 1 points lower.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.