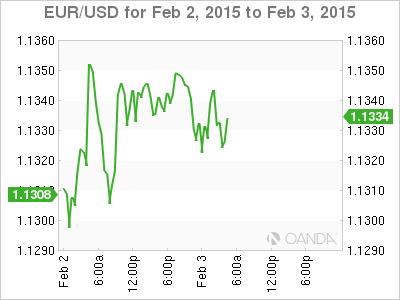

The euro has been listless for the past week, and the trend continues on Tuesday, as EUR/USD trades quietly in the low-1.13 range. On the release front, it’s a quiet day. Spanish Unemployment Change came in at 78.0 thousand, beating expectations. In the US, today’s highlight is Factory Orders. The markets are bracing for a sharp decline of 1.8%.

With the new Greek government looking to renegotiate its debt, Greece and its international creditors will have to reach some accommodation over Greece’s EUR 320 billion bailout program. European Commission President Jean-Claude Juncker has offered an olive branch to Athens, saying he is willing to scrap the troika mission, which represents the European Commission, ECB and the IMF and governs the bailout. However, he ruled out writing off any part of Greece’s debt. The new Greek government has stated it wishes to remain in the Eurozone but does not want to accept more bailout funds under the present agreement. Germany, which essentially calls the shots with regard to the bailout, has taken a hard line as it doesn’t want the Greek situation to set a precedent for other Eurozone members who have received bailouts. It is early going in this newest Greek saga, and the plot is sure to thicken.

US Advance GDP for Q4 disappointed, posting a gain of 2.6%. The markets had anticipated a gain of 3.0%. Still, market sentiment towards the US economy remains positive, underscored by the Federal Reserve statement last week, where the Fed noted solid growth in the economy. The Fed remains on track to raise rates later in 2015, and the dollar will likely benefit as speculation continues over the timing of a rate hike.

Spanish releases continue to impress. Unemployment Change rose by 78.0 thousand, well below the estimate of 83.4 thousand. On Monday, Spanish Manufacturing PMI improved to 54.7 points in January, up from 53.8 points a month earlier. Last week GDP for Q4 posted a respectable gain of 0.7% in Q4. At the same time, deflation remains a serious concern, as CPI fell 1.4%. in January.

EUR/USD 1.1331 H: 1.1354 L: 1.1292

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

AUD/USD drops below 0.6600 after RBA policy announcements

AUD/USD stays under bearish pressure and trades deep in negative territory slightly below 0.6600. The RBA left the policy settings unchanged as expected but Governor Bullock said that there was no necessity to further tighten the policy.

Gold price turns red amid the renewed US dollar demand

Gold price trades in negative territory on Tuesday amid the renewed USD demand. A downbeat US jobs data for April prompted speculation of potential rate cuts by the Fed in the coming months.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.