The euro is flat on Friday, as EUR/USD trades in the low-1.13 range in the European session. On the release front, Eurozone releases were a disappointment. German Retail Sales posted a gain of 0.2%, while Eurozone CPI Estimate posted a sharp decline of 0.6%. In the US, today’s major events are Advance GDP and UoM Consumer Sentiment.

German Retail Sales posted a weak gain of 0.2%, marking a 3-month low. The estimate stood at 0.4%. Eurozone inflation remains anemic, as the CPI Estimate came in at -0.6%, its second straight decline. In Spain, CPI followed suit with a decline of -1.4%, although there was good news from GDP, which improved to 0.7% in Q4.

US key numbers were a mix on Thursday. This was underscored by Unemployment Claims, which plunged to 265 thousand, down from 307 thousand a week earlier. This marked the indicator’s lowest level since April 2000. The news was not as positive from Pending Home Sales, which declined 3.7%, its worst reading in a year.

The Federal Reserve reiterated in its policy statement on Wednesday that it would be ‘”patient'” regarding the timeline for a raise in interest rates, which have been close to zero since 2008. However, the Fed also noted that the US economy was expanding at a ‘”solid pace'” thanks to the robust labor market. This vote of confidence helped the dollar post sharp gains against the euro. The Fed is widely expected to raise rates sometime during the year, so the ‘”Fed rate watch'”is sure to continue as the markets look for clues as to when the Fed will make a move.

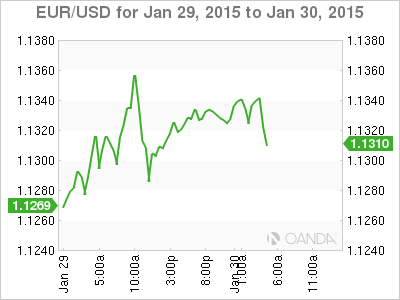

EUR/USD 1.1329 H: 1.1353 L: 1.1304

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.