The Japanese yen is almost unchanged on Thursday. Early in the North American session, USD/JPY is trading just shy of the 118 line. On the release front, Japanese Retail Sales posted a weak gain of 0.2%, well short of expectations. Later in the day, Japan will release Tokyo Core CPI as well as consumer spending and manufacturing reports. In the US, Unemployment Claims sparkled, dropping to 265 thousand.

US employment numbers have improved as the economy chugs along. This was underscored by Unemployment Claims, which plunged to 265 thousand, down from 307 thousand a week earlier. This marked the indicator’s lowest level since April 2000. On Wednesday, the Federal Reserve reiterated that it would be “patient” regarding the timeline for a raise in interest rates, which have been close to zero since 2008. However, the Fed gave a vote of confidence to the US economy, noting that the economy was expanding at a “solid pace”. The markets expect the Fed to raise rates sometime during the year, so the “Fed rate watch” is sure to continue, as the markets look for clues as to when the Fed will make a move.

Japanese Retail Sales, the primary gauge of retail sales, disappointed in December. The indicator posted a small gain of 0.2%, well below the forecast of 1.1%. This is also marked a 6-month low, underscoring weak economic activity. Tokyo Core CPI is expected to continue to lose ground, with the estimate standing at 2.2%.

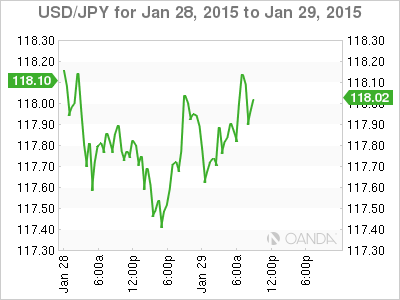

USD/JPY 117.97 H: 118.19 L: 117.56

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY holds rebound near 156.00 after probable Japan's intervention-led crash

USD/JPY consolidates the rebound near 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.