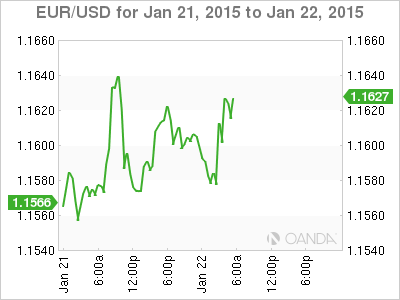

EUR/USD is showing little movement on Thursday, as the pair slightly above the 1.16 line in the European session. The markets are anxiously awaiting the ECB policy meeting later today, with the ECB widely expected to announce a QE program. There is also concern about the Greek elections on Sunday, as the Syriza party, which has promised to tear up Greece’s bailout agreement, leads in the polls. In the US, today’s highlight is Unemployment Claims, with the indicator expected to dip to 301 thousand.

As the markets nervously eye the ECB policy meeting later on Thursday, is the euro’s inactivity the calm before the storm? It appears that the ECB will flash its trump card and implement a QE program. However, now that a QE is likely priced in, the question remains what will be the size of the program? The markets are anticipating QE of between EUR 500-600 billion, but some market players are saying that the ECB could go as high as EUR 800 billion. There’s a strong chance that the euro could take a hit after the ECB statement, unless the ECB surprises with a “QE lite”, such as EUR 300 billion, which would be well below expectations.

There was excellent news out of Germany on Wednesday, as ZEW Economic Sentiment climbed to 48.4 points, crushing the estimate of 40.1 points. This marked the indicator’s highest level in 11 months, pointing to strong optimism among German investors and analysts. Eurozone Economic Sentiment, improving to 45.2 points. This easily surpassed the forecast of 37.6 points. The news was not as positive on the inflation front, as German PPI dropped 0.7%, its worst showing since April 2009. With the Eurozone struggling with deflation, there is growing expectation that the ECB will announce a QE package at its policy meeting later on Thursday.

EUR/USD 1.1631 H: 1.1638 L: 1.1576

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY crashes nearly 450 pips to 155.50 on likely Japanese intervention

Having briefly recaptured 160.00, USD/JPY came under intense selling to test 155.00 on what seems like a Japanese FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.