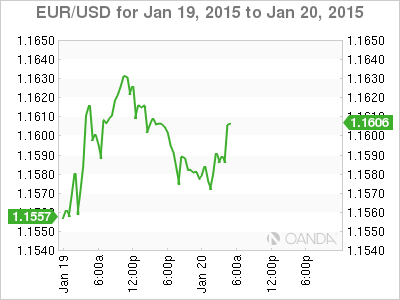

EUR/USD continues to show little movement this week, as the pair trades at the 1.16 line on Tuesday. On the release front, German ZEW Economic Sentiment jumped to 48.4 points, well above expectations. However, German PPI disappointed with a decline of 0.7%. There are no major releases out of the US on Tuesday.

There was excellent news out of Germany, as ZEW Economic Sentiment climbed to 48.4 points, crushing the estimate of 40.1 points. This marked the indicator’s highest level in 11 months, pointing to strong optimism among German investors and analysts. Eurozone Economic Sentiment, improving to 45.2 points. This easily surpassed the forecast of 37.6 points. The news was not as positive on the inflation front, as German PPI dropped 0.7%, its worst showing since April 2009. With the Eurozone struggling with deflation, there is growing expectation that the ECB will announce a QE package at its policy meeting on Thursday.

It’s been less than a week since the SNB stunned the markets by suddenly removing the cap with the euro. This resulted in the euro recording sharp losses against the Swiss franc and the US dollar. However, the markets have had to quickly change focus, as there is growing anticipation that the ECB will announce a QE package on Thursday, when the ECB meets for a crucial policy meeting. The Eurozone has been plagued by deflation and weak growth, and the SNB shocker only reinforces the belief that the ECB will finally make a move. Even if QE has been priced in, there’s no way to know the size of such a scheme, so traders could be in for plenty of volatility from EUR/USD later in the week.

EUR/USD 1.1592 H: 1.1614 L: 1.1568

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.