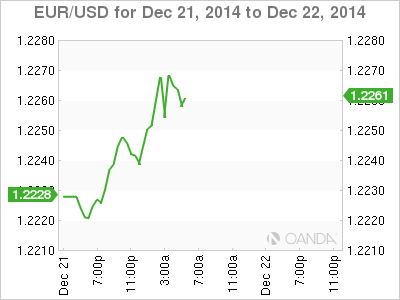

EUR/USD has started the week with slight gains, as the pair trades in the mid-1.22 range in Monday’s European session. The euro had awful week, losing about 200 points. EUR/USD is trading at its lowest level since July 2012. On the release front, German Import Prices posted a decline of 0.8%. Later in the day, Eurozone Consumer Confidence will be released. In the US, today’s only event is Existing Homes. The markets are expecting the indicator to soften in November, with an estimate of 5.21 million.

Recent releases out of Germany, the Eurozone’s largest economy, have been cause for optimism. The January forecast for German Consumer Climate came in at 9.0 points, a notch above the estimate of 8.9 points. This marked the fourth straight rise for the indicator, pointing to stronger optimism from consumers as we head into the New Year. These strong numbers come on the heels of German Business Climate, which improved to 105.5 points, up from 104.4 a month earlier. This edged above the forecast of 105.4 points. On the inflation front, German PPI, which tracks manufacturing inflation, improved to 0.0% in November, up from -0.2% a month earlier. Like the consumer confidence indicator, this release is on an upward trend. Strong German consumer and business confidence numbers are welcome news, as the Eurozone economy continues to struggle.

The shaky euro took a tumble last week, reacting sharply to the Federal Reserve policy statement. Previous Fed policy statements have usually stated that the Fed would maintain low rates for a “considerable time”, but the December statement changed terminology, saying the Fed would be “patient” before raising rates. In a follow-press conference, Federal Reserve chair Janet Yellen was less ambiguous, saying that the Fed was unlikely to raise rates for the “next couple of meetings”. The markets took this to mean that a rate hike is in the works, although most likely not before April. The news of a likely US rate hike in 2015 sent the euro sprawling, as the currency lost about 170 points on Wednesday and finds itself at 2.5 year lows against the surging US dollar.

EUR/USD 1.2264 H: 1.2274 L: 1.2222

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.