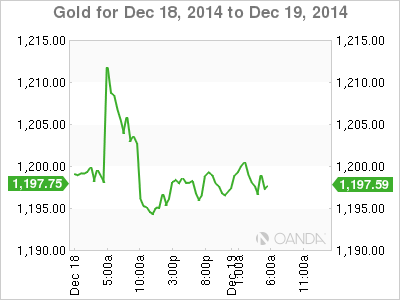

Gold is showing little movement on Friday, continuing the lack of activity we have seen for most of the week. In the European session, the spot price stands at $1197.48. There are no US releases on Friday, so traders can expect a quiet day from XAU/USD as we head into the weekend.

In the US, employment numbers continued to impress, as unemployment claims dropped to 289 thousand, the lowest level in six weeks. The easily beat the estimate of 297 thousand. The news was not as good on the manufacturing front, as the Philly Fed Manufacturing Index slid to 24.5 points, down from 40.6 points in November. The November reading was unusually high, and the markets had expected a sharp downturn, with the estimate standing at 26.3 points.

Previous Fed policy statements have usually stated that the Fed would maintain low rates for a “considerable time”, but the December statement changed terminology, saying the Fed would be “patient” before raising rates. In a follow-press conference, Federal Reserve chair Janet Yellen was less ambiguous, saying that the Fed was unlikely to raise rates for the “next couple of meetings”. The markets took this to mean that a rate hike is in the works, but not before April. Gold prices remained steady after the Fed statement, but as an interest rate hike by mid-2015 seems likely, there is room for the dollar to make gains against gold.

XAU/USD 1197.48 H: 1201.30 L: 1193.84

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold price struggles for a firm intraday direction, hover above $2,300

Gold price fails to lure buyers amid a fresh leg up in the US bond yields, modest USD uptick. A positive risk tone also contributes to capping the upside for the safe-haven precious metal. Traders, however, might prefer to wait for the US NFP report before placing aggressive bets.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.