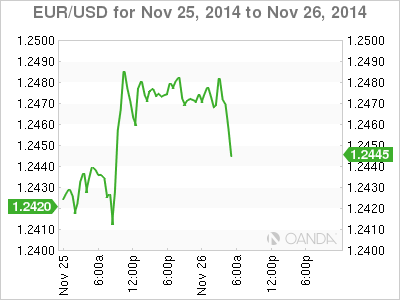

EUR/USD is showing little movement on Wednesday, as the pair trades in the mid-1.24 range in the European session. On the release front, German Import Prices declined 0.3%. In the US, there are a host of key events ahead of the Thanksgiving holiday on Thursday. These include Core Durable Goods Orders, Unemployment Claims, UoM Consumer Sentiment and New Homes Sales.

US economic growth continues to rack up impressive numbers, posting an excellent gain of 3.9% in Q3, well above the estimate of 3.3%. This followed a gain in Q2 of 4.2%, which also beat the estimate. The other key release, Consumer Confidence, was unexpectedly soft, dropping to 88.7 points. This was well off the estimate of 95.9 points.

German confidence indicators continue to point upwards. Ifo Business Climate rose to 104.7 points in November. Importantly, this reading snapped a streak of six straight declines. ZEW Economic Sentiment jumped 11.5 points, crushing the estimate of 0.9 points. This strong optimism is somewhat puzzling, given that inflation and growth levels in the Eurozone’s largest economy remain weak. At the same time, increasing confidence in the German economy could translate into stronger German numbers, which would help boost the ailing Eurozone.

EUR/USD 1.2447 H: 1.2495 L: 1.2444

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.