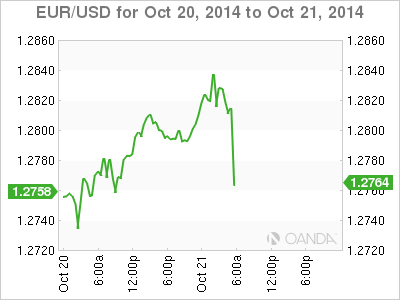

EUR/USD has posted slight losses on Tuesday, as the pair pushed into 1.28 territory but was unable to consolidate. It’s a very quiet day on the release front, with no Eurozone events. In the US, today’s sole release is Existing Home Sales. The markets are expecting the indicator to improve in the September release.

The markets were greeted with lukewarm Eurozone data on Monday morning. Inflation remains anemic, as German PPI came in at a flat 0.0%, shy of the estimate of 0.1%. The indicator has not produced a gain since December, as Germany continues to struggle with a lack of inflation. Eurozone Current Account, which is closely linked to currency demand, posted a surplus of EUR 18.9 billion, little changed from the previous release of EUR 18.7 billion. This reading disappointed the markets, as the estimate stood at EUR 21.3 billion.

The Deutsche Bundesbank issued its monthly report on Monday. The German central bank said that the economy showed little growth in Q3 as manufacturing production fell and business confidence weakened. At the same time, employment numbers and consumer spending were higher, so GDP was likely to remain unchanged. As for Q4, the report stated that the outlook is “moderate”. The report underscores weakness in the German economy, long considered the locomotive of Europe. Weak German data could hurt the shaky euro.

US releases wrapped up the week on a high note, as UoM Consumer Sentiment climbed to 86.4 points, its highest reading since July 2007. The markets had expected a reading of 84.3 points. This indicates that the US consumer remains optimistic about the economy and is not overly concerned about warnings of a global slowdown. On the housing front, Building Permits and Housing Starts met expectations. Strong US employment numbers continue to drive the US recovery, as US job claims dropped to 264 thousand, marking a 14 -year low. The estimate stood at 286 thousand.

EUR/USD 1.2762 H: 1.2840 L: 1.2758

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.