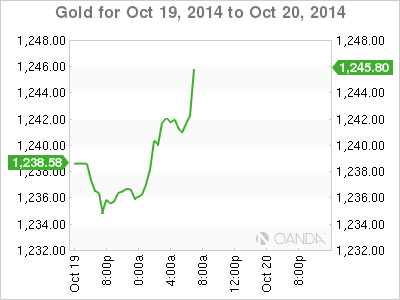

Gold has posted modest gains on Monday, as the spot price is $1243.36 per ounce in the European session. Gold has recovered nicely in the past two weeks, when it was trading below $1190. In economic news, it’s a quiet start to the week, with no US data releases on Monday.

The US dollar posted strong gains against gold in September and early October, pushing the metal below the $1200 level. However, gold prices have since rebounded back to the $1240 level. Why the renewed appetite for gold on the part of investors? A key reason is that the Federal Reserve has put out signals that it may delay changing its monetary stance and raising interest rates. The Fed has noted that there is still slack in the economy and global economic conditions remain weak. A rate hike is still expected in 2015, but the Fed is unlikely to pull the trigger early in the year. With continuing uncertainty about the timing of a rate hike, gold remains an attractive alternative to the greenback.

US releases wrapped up the week on a high note, as UoM Consumer Sentiment climbed to 86.4 points, its highest reading since July 2007. The markets had expected a reading of 84.3 points. This indicates that the US consumer remains optimistic about the economy and is not overly concerned about warnings of a global slowdown. On the housing front, Building Permits and Housing Starts met expectations. Strong US employment numbers continue to drive the US recovery, as US job claims dropped to 264 thousand, marking a 14-year low. The estimate stood at 286 thousand.

XAU/USD 1241.61 H: 1243.36 L: 1234.61

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.