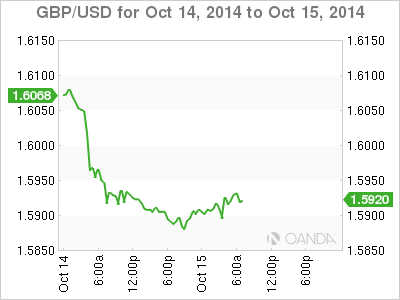

The British pound has stabilized after Tuesday’s sharp losses, trading in the low-1.59 range on Wednesday. On the release front, the Average Earnings Index improved to 0.7%. Employment numbers were a mix, as Claimant Count Change missed expectations, while the unemployment rate surprised with a drop to 6.0%. In the US, we’ll get a look at US releases after a quiet start to the week. There are three key events on the calendar – Retail Sales, Core Retail Sales and PPI.

In the UK, the Average Earnings Index edged up to 0.7%, matching the estimate. This was a four-month high for the indicator, which is an important indicator of consumer inflation. On the employment front, Claimant Count Change continues to drop, but the reading of -18.6 thousand was well of the forecast of -34.2 thousand. Meanwhile, the unemployment rate dropped from 6.2% to 6.0%, its lowest level since November 2008. Strong employment numbers is a sign of a healthy economy and could give a boost to the wobbly British pound.

British CPI, the primary gauge of consumer inflation, continues to lose ground. The index dropped to 1.2%, a five-year low and short of the estimate of 1.4%. Core CPI and PPI Input also missed their estimates, as inflation indicators continue to point downwards. The weak CPI reading gives Governor Mark Carney more breathing room to maintain current interest rate levels, and investors responded to the news by dumping their pound holdings on Tuesday. There is growing sentiment that the BoE could delay a rate hike until the second half of 2014, with inflationary pressures continuing to recede.

The US dollar has run roughshod over the pound, gaining almost 7 cents in the past six weeks. The dollar rally was halted briefly thanks to last week’s FOMC minutes, which were unexpectedly dovish. In the minutes, the Fed poured some cold water on rising expectations of a rate hike, as a number of policymakers said that the Federal Reserve should take a more data-dependent approach regarding a rate hike. The Fed also voiced concern about the rising strength of the US dollar which could weigh on the recovery. On the weekend, FOMC member Stanley Fischer said that the Fed could slow tightening if global growth is weaker than expected. Strong US numbers have raised expectations about a rate hike, but the Fed appears to be taking a cautious approach towards the timing of a rate hike. Still, with QE set to wind up by the end of the month, rising speculation about higher rates bodes well for the US dollar.

GBP/USD 1.5921 H: 1.5938 L: 1.5878

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD weakens further as US Treasury yields boost US Dollar

The Australian Dollar extended its losses against the US Dollar for the second straight day, as higher US Treasury bond yields underpinned the Greenback. On Wednesday, the AUD/USD lost 0.26% as market participants turned risk-averse. As the Asian session begins, the pair trades around 0.6577.

USD/JPY holds positive ground above 155.50 following the BoJ Summary of Opinions

The USD/JPY pair trades in positive territory for the fourth consecutive day around 155.60 during the early Asian trading hours on Thursday. However, the fear of further intervention from the Bank of Japan is likely to cap the downside of the Japanese Yen for the time being.

Gold price drops amid higher US yields awaiting next week's US inflation

Gold remained at familiar levels on Wednesday, trading near $2,312 amid rising US Treasury yields and a strong US dollar. Traders await unemployment claims on Thursday, followed by Friday's University of Michigan Consumer Sentiment survey.

President Biden threatens crypto with possible veto of Bitcoin custody among trusted custodians

Joe Biden could veto legislation that would allow regulated financial institutions to custody Bitcoin and crypto. Biden administration’s stance would disrupt US SEC’s work to protect crypto market investors and efforts to safeguard broader financial system.

US inflation data in the market purview

With next week's pivotal US inflation data looming, we're witnessing a stall in stock market momentum and an uptick in US Treasury yields. This shift comes amid murmurs of hawkish sentiment from Fed speak. Indeed the mind games intensify even further as investors cling to their rate cut hopes.