The Japanese yen is stable on Wednesday, as USD/JPY trades just above the 107 line in the European session. The yen has rebounded strongly in the past week, gaining about 250 points against the US dollar. In economic news, Japanese Revised Industrial Production slumped in August, posting a decline of 1.9%. In the US, we’ll get a look at US releases after a quiet start to the week. There are three key events on the calendar – Retail Sales, Core Retail Sales and PPI.

US markets were off on Monday for a holiday, so there’s been little action on the release front so far this week. That could change later on Wednesday, as the US releases key consumer spending and inflation data. The markets are keeping low expectations, so traders should be prepared for some movement from the pair if there are some unexpected readings from Wednesday’s releases.

The US dollar has looked sharp recently, and pushed above the 110 line earlier this month. However, the impressive rally was interrupted by last week’s FOMC minutes, which were unexpectedly dovish. In the minutes, the Fed poured some cold water on rising expectations of a rate hike, as a number of policymakers said that the Federal Reserve should take a more data-dependent approach regarding a rate hike. The Fed also voiced concern about the rising strength of the US dollar which could weigh on the recovery. On the weekend, FOMC member Stanley Fischer said that the Fed could slow tightening if global growth is weaker than expected. Strong US numbers have raised expectations about a rate hike, but clearly the Fed is taking a cautious approach regarding the timing of a rate hike. Still, with QE set to wind up by the end of the month, rising speculation about higher rates bodes well for the US dollar.

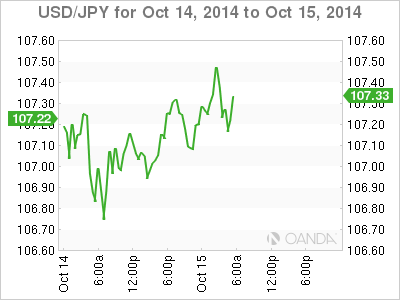

USD/JPY 107.11 H: 107.49 L: 107.05

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.