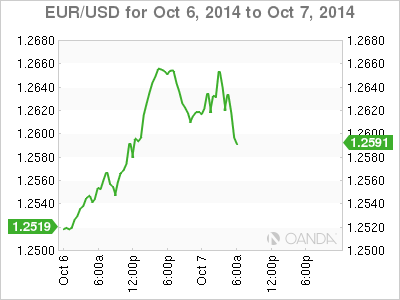

EUR/USD is stable on Tuesday, as the pair trades in the mid-1.26 line. The pair is showing some volatility, as Friday’s sharp losses were recovered on Monday. In today’s releases, German data posted losses for the second day running as German Industrial Production came in at -4.0%. In the US, today’s highlight is JOLTS Job Openings, an important employment indicator. The markets are expecting a slight improvement in the September reading.

It’s been a rough week for German numbers, as the Eurozone’s locomotive is having trouble. Industrial Production declined by 4.0% last month, its sharpest drop since January 2009. This was well off the estimate of -1.4%. German Factory Orders had an awful September, coming in at -5.7%. This was the indicator’s third decline in four releases. This week’s Eurozone data has not impressed, with weak readings from Retail PMI and the Eurozone Sentix Investor Confidence. With the Eurozone economy continuing to sputter, growth and confidence levels remain at weak levels.

US employment data sparkled on Friday, helping the US dollar post gains against the wobbly euro. Nonfarm Employment change rebounded in September, climbing to 248 thousand. This exceeded expectations of 216 thousand. The unemployment rate dipped to 5.9%, the first time it’s been below the 6% threshold in over six years. With QE slated to end later this month, the focus will shift to the timetable for an interest rake hike. Strong job numbers such as these could put pressure on the Fed to make an interest rate move sooner rather than later in 2015, and increased speculation about a rate move will likely boost the dollar even further.

At its October policy meeting last week, the ECB made no changes to interest rates. The central bank did announce it would start buying covered bonds in October and begin asset-backed purchases (ABS) purchases in Q4. However, there were no specifics and no mention of any purchase of government bonds. This left the markets underwhelmed by the ECB announcement and kept the euro remains at low levels. Given that the ECB shows no signs of introducing a full-blown QE, it’s questionable whether ABS will help boost the anemic Eurozone economy.

EUR/USD 1.2585 H: 1.2665 L: 1.2584c

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.