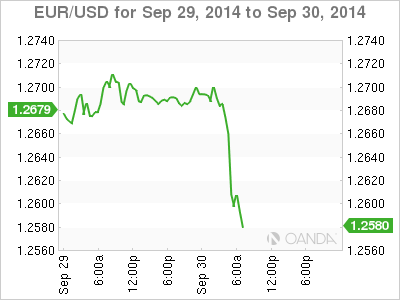

EUR/USD is trading in the high 1.27 range, its lowest level since September 2012. The euro sagged after the release of Eurozone CPI, which dipped 0.3% in September. German news was mixed, as Retail Sales jumped 2.5%, but Unemployment Change was up sharply. The Eurozone unemployment rate was unchanged at 11.5%. In the US, today’s key event is CB Consumer Confidence, with the markets expecting another strong reading above the 90-point level.

The euro has lost over 100 points on Tuesday, as the common currency shows no signs of halting its sharp descent. It’s been a disastrous September for the euro, which has shed over 500 points against the US dollar. The euro reacted sharply to the Eurozone CPI reading of 0.3%, which matched the forecast but was weaker than the 0.4% in August. The inflation rate has now been under 1% for twelve straight months, way off the ECB’s target of just below 2%. On Monday, German Preliminary CPI posted a flat reading of 0.0% for the second straight month. The ECB is feeling the pressure to act, but as Mario Draghi knows all too well, there isn’t any magic formula to creating inflation and improving economic growth.

Over in the US, Pending Home Sales posted a decline of 1.0%, compared to last month’s gain of 3.3%. The important housing indicator has shown strong movement, resulting in readings that have been well off market estimates. US housing indicators continue to paint a mixed picture, as New Home Sales jumped last month, while Existing Home Sales softened and was well short of expectations.

EUR/USD 1.2579 H: 1.2702 L: 1.2571

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.