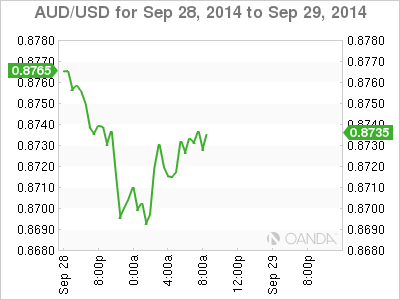

The Australian dollar remains under pressure on Monday, as AUD/USD trades at in the mid-0.87 range. The Aussie is currently trading at 9-month lows. On the release front, today’s highlight is Pending Home Sales. After a sharp gain of 3.3% in July, the markets are braced for a sharp downturn, with an estimate of -0.4%. The only Australian release is Private Sector Credit, a minor event.

The Aussie continues to flounder, and had an awful week, shedding about 180 points against the sharp US dollar. For the month of September, the currency has plunged a remarkable 600 points. Will the downward spiral continue this week? The RBA should be pleased at the Aussie’s vanishing act, as the central bank has often expressed its unease at the currency’s high value, which has weighed on economic growth.

In the US, Core Durable Goods Orders posted a strong gain of +0.7%, bouncing back from the previous reading of -0.8%. Durable Goods Orders continues to take its riders on a roller coaster ride, plunging 18.2% in August, compared to a huge gain of 22.6% a month earlier. Unemployment Claims rose to 293 thousand, within expectations.

AUD/USD 0.8731 H: 0.8747 L: 0.8684

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.