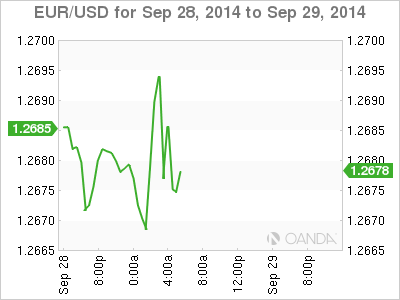

EUR/USD is steady on Monday, as the pair tries to find its footing following last week’s slide of about 170 points. EUR/USD is trading in the high 1.27 range, its lowest level since September 2002. On the release front, Germany releases Preliminary CPI, a key release. The markets are keeping their expectations low, with an estimate of -0.1%. In the US, today’s highlight is Pending Home Sales. After a sharp gain of 3.3% in July, the markets are braced for a sharp downturn, with an estimate of -0.4%.

Friday’s German releases underscored that the Eurozone’s largest economy is in trouble. GfK Consumer Climate dipped to 8,3 points, its lowest level in 2014. Import Prices posted a second straight decline, coming in at -0.1%. This followed Ifo German Business Climate, which weakened for a fifth straight month. The sputtering Eurozone is dependent on the German locomotive to pull the region’s economy back on track, and the shaky euro will have difficulty stabilizing if German data does not improve.

On Thursday, the euro lost ground after ECB head Mario Draghi spoke in Lithuania. Draghi reiterated that the ECB stood prepared to implement additional unconventional steps if prolonged low inflation levels did not rise. Draghi acknowledged that summer economic data was weaker than expected, but said the central bank forecast modest growth in Q3 and Q4. Lithuania is set to join the Eurozone in January and will become the 19th member of the Euro region.

In the US, Core Durable Goods Orders posted a strong gain of +0.7%, bouncing back from the previous reading of -0.8%. Durable Goods Orders continues to take its riders on a roller coaster ride, plunging 18.2% in August, compared to a huge gain of 22.6% a month earlier. Unemployment Claims rose to 293 thousand, within expectations.

EUR/USD 1.2675 H: 1.2698 L: 1.2664

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD loses ground due to the absence of a hawkish RBA

The Australian Dollar has plunged following the Reserve Bank of Australia's decision to maintain its interest rate at 4.35% on Tuesday. Investors sentiment leaned toward a potentially more hawkish stance from the RBA, particularly after last week's inflation data surpassed expectations.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold price recovers its recent losses, despite a firmer US Dollar

Gold price attracts some buyers during the Asian trading hours on Wednesday. Safe-haven demand, fueled by geopolitical tensions and uncertainty, as well as ongoing central bank purchases, might contribute to a rally in gold.

Ethereum resume sideways move as Grayscale files to withdraw Ethereum futures ETF application with the SEC

Ethereum is hinting at a resumption of a sideways movement on Tuesday after seeing inflows for the first time in seven weeks. Grayscale withdrew its application for an Ethereum futures ETF, and the SEC’s Chair Gary Gensler has also called most crypto assets securities.

No obvious macro catalysts to steer the bus

The US data calendar remains relatively light, with initial jobless claims and the University of Michigan survey being the key focus. However, these releases may not provide a significant catalyst for the next directional move in the US Dollar.