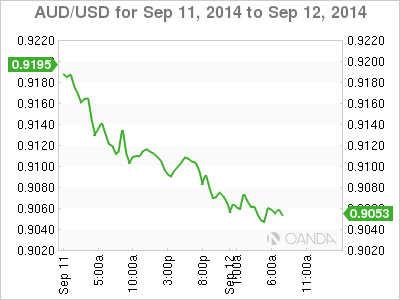

The Australian dollar's miseries continue, as AUD/USD has lost more ground on Friday. In the European session, the pair is trading in the mid-0.90 range, its lower level since March. The Aussie has had a dismal week, surrendering over 300 points. There are no Australian releases on Friday. In the US, it's a busy day with the release of three major events - Retail Sales, Core Retail Sales and UoM Consumer Sentiment.

US employment data continues to disappoint, as concerns increase regarding the health of the US job market. Unemployment Claims rose to 315 thousand, the largest number of claims in 10 weeks. The reading was much higher than the estimate of 306 thousand. This follows soft numbers from JOLTS Job Openings and a dismal Nonfarm Payrolls last week. The troubling job numbers are unlikely to affect the Fed's plan to continue trimming QE next week, but a weak labor market could postpone plans to raise interest rates by mid-2015.

Australian employment numbers made headlines on Thursday, as Employment Change posted an incredible gain of 121,000 last month, crushing the estimate of 15,000. The markets are having some difficulty accepting these stratospheric figures at face value, with one Australian analyst noting that the numbers are "somewhat difficult to interpret". The Australian statistics bureau claimed that a rotation in its survey group affected the August figures, and we're likely to hear more about the authenticity of these numbers in the next few days. There were no doubts about the veracity of the unemployment rate, which dipped to 6.1%, beating the estimate of 6.3%. The Aussie posted gains after the employment releases but then retracted and continued to head southward.

Confidence in the Australian economy appears to be waning, according to the latest business and consumer confidence data. Westpac Consumer Sentiment had been steadily improving, but the upswing came to a crashing halt as the indicator slipped by 4.6% in August. This marked a 4-month low. Earlier this week, NAB Business Confidence, a key indicator, slipped to 8 points in August, compared to 11 points a month earlier. Weak business and consumer confidence in Australia's economy could translate into decreased spending by consumers and businesses, which would be grim news for the weak economy.

The Australian dollar is sensitive to key Chinese releases, as China is Australia's biggest trading partner. Chinese Trade Balance hit a record high in August, as the surplus climbed to $49.8 billion, easily beating the estimate of $40.8 billion. Stronger Chinese exports should translate into increased demand for Australian raw materials, which bodes well for the Australian export sector and the Aussie. On Thursday, Chinese CPI came in at 2.0%, as the index fell to a 4-month low.

AUD/USD 0.9054 H: 0.9099 L: 0.9043

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.